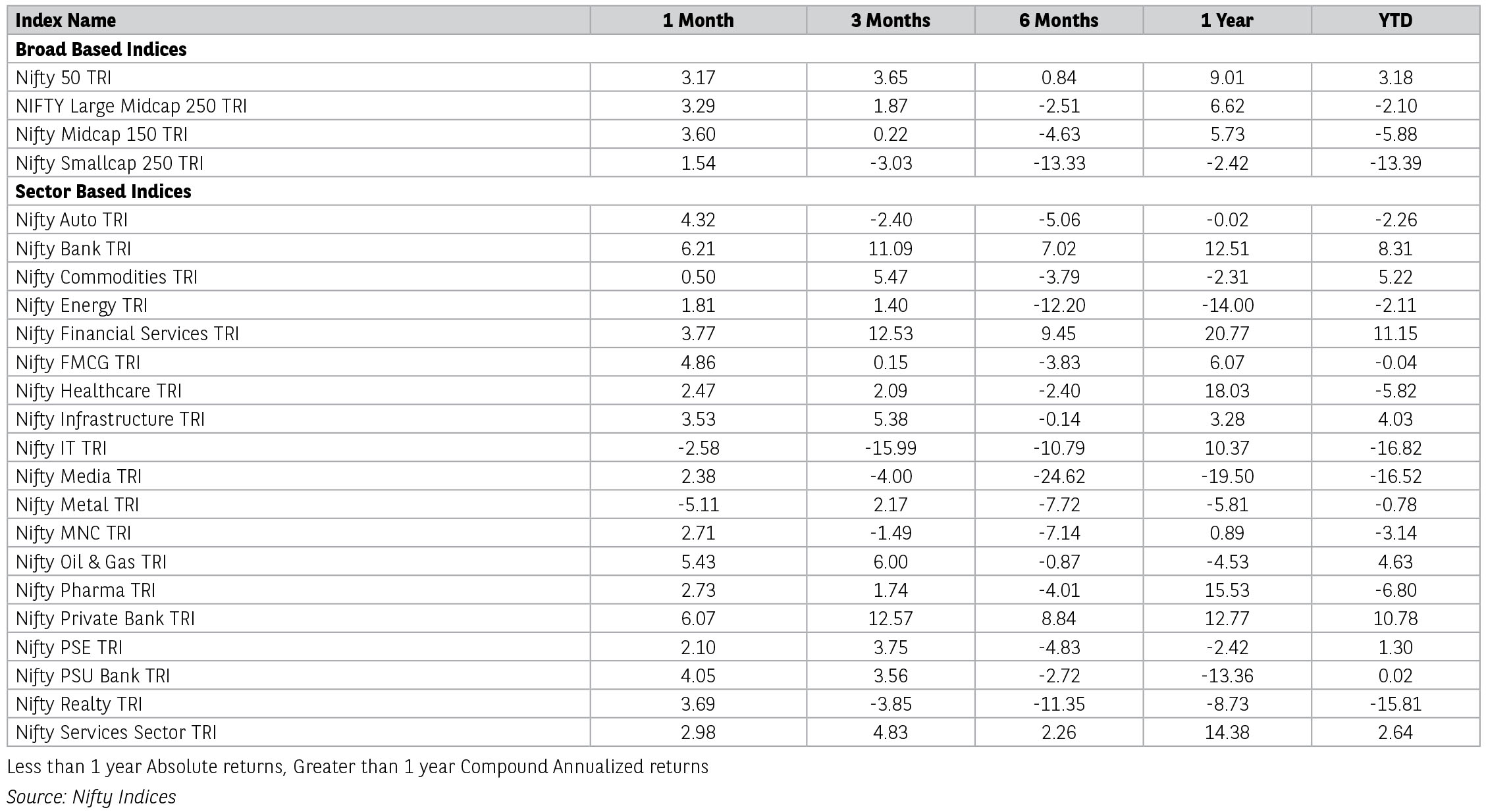

Nifty Small Cap 250 Index rose by 1.7% and Nifty Midcap 150 Index by 3.9% over the month. Sector-wise global facing sectors viz. IT (-3%) and metals (-5.8%) were down. Most sectors ended in the green. Consumer durables sector saw rally of 5.7%, followed by Oil & Gas (+5.4%), Bankex and FMCG (+5.2), Auto (4.7%), Realty (+4%), Pharma (+1.9%).

A key talking point through the month was the spike in US yields, raising concerns about appeal of US treasury assets for long term investors. US yields on 10-yr Treasuries hit high of 4.49% in mid-April 2025 from lows of 3.87%.; it ended at 4.18% in April 2025.

DXY Index (Dollar Index) has depreciated by 4.6% in April 2025 despite rise in US bond yields moving higher on investor concerns on tariffs and slowdown in US economy. The US manufacturing sector continued to contract in April 2025 with Purchasing Managers Index (PMI) lowering to 48.7 in April 2025 from 49.0 in March 2025. A depreciating DXY should be positive for Emerging Markets (EM) flows in general and in particular to India.

On currency side, while most currencies appreciated against the dollar, Indian currency was relatively stable (+0.5%) as against EUR (+5.1%), JPY (+5.2%), GBP (+3.6).

After turning positive in March 2025, FPI flows continued its trajectory in April 2025 with buying of USD 1.3bn up from USD0.23bn in March 2025. This can be attributed to weakening US dollar, softening crude oil prices and relative attractive valuations post fall over the last few months. Some of the emerging markets saw outflows in April 2025, with South Korea and Indonesia witnessing highest outflow of USD 7bn and USD 1.2bn respectively. Thailand, Vietnam, and Brazil experienced outflows, each of around USD 500mn in April 2025.

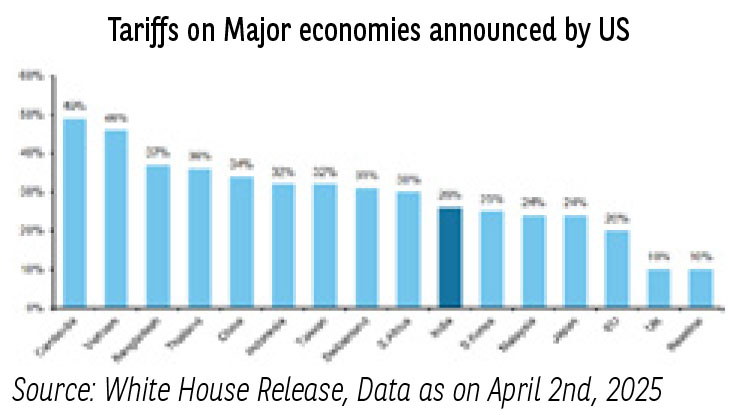

On 2nd April 2025 President Trump announced its much-awaited tariffs with 10% minimum tariffs on all US imports and reciprocal tariffs on 57 countries. While US imposed 34% tariffs in China, it escalated to 145% with China also announcing retaliatory tariffs of 125% on US goods. China has also put restrictions on exports of rare earth minerals to the US which can likely impact defence production. While the global markets reacted negatively to tariffs news, US on 10th April 2025 has put tariffs on hold for 90 days, except for China. Overall, India seems to be relatively well placed with US exports contributing low single digit to GDP vs higher number for other developing economies.

In China, manufacturing activity contracted in April 2025 as the official purchasing managers' index (PMI) came in at 49 from 50.5 in March 2025, while the non-manufacturing PMI, which includes services and construction, declined to 50.4 from 50.8 respectively. The data indicates concerns of tariffs on China.

With President Trump completing first 100 days in the office, US economy declined for the first time in three years with GDP declining 0.3% in the first quarter of FY 25. This can be attributed to increase in import by business to avoid higher cost from tariffs, deceleration in consumer spending, and a downturn in government spending.

In India, March 2025 Industrial production (IIP) growth was moderate 3% as against 2.9% in February 2025 on account of sluggish growth in mining and manufacturing. Capital goods growth slowed down from 8.2% to 2.4% sequentially, infra growth was 8.8%, consumer durable grew by 6.7%, while non-durables contracted 4.7%.

For FY25 IIP grew by 4% with consumer durables as the best performing segment, growing 7.9%, while non-durables recording the weakest performance declining by 1.6%. March CPI inflation moderated to 3.3%, with food inflation falling to 2.7%.

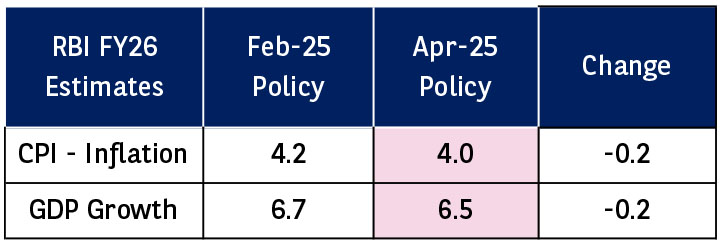

After reducing repo rate in March 2025, RBI in April 2025 announced another rate of 25bps to 6% while changing the stance to "accommodative" from "neutral". The RBI’s focus remains on addressing growth concerns while inflation remains comfortable. It also cut GDP growth forecast by 20bps to 6.5%. Growth to be led by rural demand, revival in urban consumption, improving capex, while exports are likely to see some impact led by tariff war.

We are amid 4Q earnings, earnings expectations are muted for 4Q. Nifty EPS growth estimated at 2-3%. Some sectors such as telecom, healthcare and cement can report strong growth. Overall FY25 growth is now likely to be muted. Expectations are for growth revival in FY26e led by pickup in capital expenditure, revival in urban consumption led by tax cuts and pick up in rural spend led by normal monsoon. Valuations for Nifty is now in line with 10-year averages. We remain cautiously optimistic on markets.

Source:_Bloomberg. Data as of 30th April 2025. Kindly refer to the last page of the factsheet of Baroda BNP Paribas Mutual fund for the month ending March 2025 for disclaimers.

The global economic landscape took a much-awaited turn in April-2025 with US announcing a 10% base tariff and reciprocal tariffs on approximately 60 countries, taking average US tariffs to their highest levels in over a century. Few days later, a 90 day pause was announced for countries who resorted to negotiations and not retaliatory measures. China being one off, of the lot, levied retaliatory tariffs on US. The impact of trade tensions between US and China are expected to reflect in the global merchandise trade volumes. According to World Trade Organisation (WTO), the immediate impact of the tariffs on world trade is expected to be significant with merchandise trade volumes expected to contract by 1% in 2025.

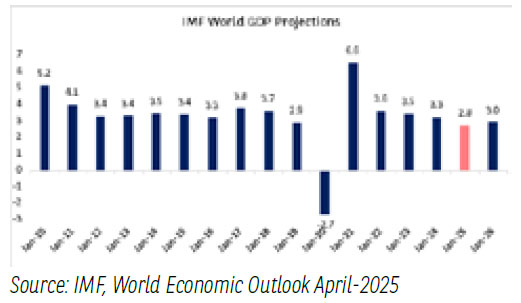

The uncertainty of trade tariffs may further hinder both short-term and long-term growth prospects. International Monetary Fund(IMF) in its April-2025 world economic outlook, has projected global growth to drop to 2.8% in 2025 and 3% in 2026—down from 3.3% for both years estimated in January 2025. This marks a cumulative downgrade of 0.8% and much below the historical (2000–19) average of 3.7%.

The trade war is expected to have implications not only on world growth but also on the US economy. The tariffs are inflationary for the US economy with its negative implications for growth. In its baseline projections in the March monetary policy meeting, FED has revised down US GDP growth projections to 1.7% in 2025, from earlier projected 2.1% in the December-2024 FED policy. The revisions were made even before the announcement of the trade tariffs.

World markets have remained volatile in recent months, with the repricing of various asset classes. With the dollar index losing steam, currencies like JPY, INR etc. have recovered the lost ground. The ultimate winner of worldly uncertainties has been Gold. The gold prices crossed $3400 in April-2025, marking a new all-time high. Contrary to gold, crude prices have witnessed the utmost bashing, falling below 60 $/bl.

Domestic Economy-

Amidst the challenges of a volatile external environment, India’s economic activity continues to remain stable. High frequency indicators suggest that aggregate demand picked up after the slump in Q2 FY25. Also, certain interest sensitive sectors still witness moderate growth. On the consumption front, indicators such as E-way bills and toll collections recorded robust y-o-y growth in double digits in March 2025. Tractor sales also registered a double-digit growth for the fourth consecutive month. As per the IMD’s first stage long-range forecast, the rainfall during southwest monsoon season (June September 2025) is most likely to be above normal at 105% of the long period average., this augurs well for rural outlook.

Overall, RBI remains supportive of domestic growth. RBI in its April-2025 monetary policy meeting decided to reduce repo rate by 25bps and changed the stance to ‘accommodative’ from ‘neutral’. The tone of the policy signaled more rate cuts given the change in stance. RBI has revised down its domestic growth estimates to 6.5% for FY26 from earlier estimates of 6.7%. Concerns stem from the current tariff war, having implications on both global and domestic growth. Outlook for inflation remains optimistic with falling crude prices and robust kharif sowing. Inflation remains supportive of RBI’s tilt towards a growth-oriented policy.Government Borrowing- H1 FY26 –

Domestic Inflation-

- India CPI inflation eased to 3.3% y/y in March-2025 from 3.6% y/y in Feb-2025. CPI inflation is currently at its 67-month low.

- Inflation for FY25 has averaged at 4.6% y/y. The softening in vegetable prices reversed the shocks to food inflation.

- Secondly, a weak global outlook, caps crude prices to limited volatility. Inflation at 3.3% continues to provide the space for more cuts and remain growth supportive.

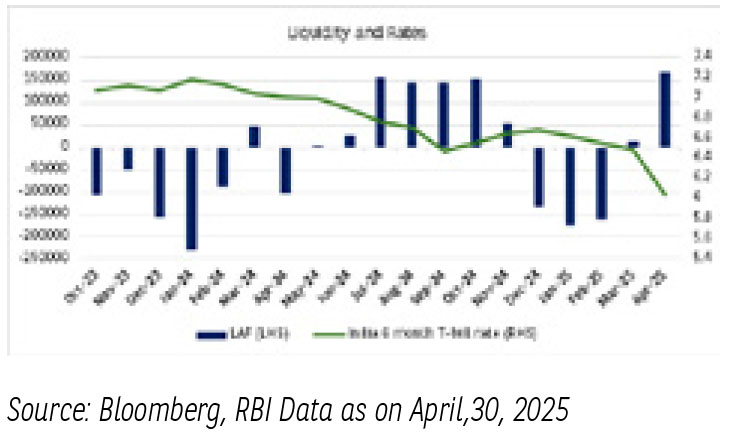

Domestic Liquidity and Rates –

- Liquidity conditions turned into a surplus zone by end of March-25 and April-2025 led by aggressive government spending, Open Market Operations (OMO) purchases and CRR drawdown.

- Accordingly domestic rates followed the liquidity conditions and softened.

- RBI announced OMO purchases to the tune of Rs800 bn in the month of April-25 (in four tranches of Rs 200 bn each), which is expected to be supportive of liquidity conditions.

- With RBI’s proactive approach on liquidity and surplus liquidity conditions, we expect system liquidity to remain in surplus in the coming months.

- Global growth remains a key concern in the evolving economic landscape.

- Central bankers globally are expected to balance the risks between inflation and growth.

- The decline in the dollar index and US growth will be a key watch.

- Trumps tariff threats and spillovers on currencies is the existing risk that is driving the markets volatile.

- On the domestic front, evolving growth dynamics have taken center stage.

- RBI’s forward guidance and the rate cut gives us confidence on growth supported future policy expectations.

- Recent softening in domestic inflations paves the way for RBI to take calibrated policy decisions.

- RBI has been and is expected to continue infusing liquidity through OMO, FX swap in essence of the monetary policy stance

- Irrespective of the tools, liquidity measures are expected to have a positive ramifications on the short end of the curve.

- The spreads on the short end are already elevated and attractive and a rate cut going forward may compress the current spreads.

- Recent moves by RBI give us confidence that liquidity will be managed in spirit of the stance.

- Having said that, the fundamentals of India’s fiscal demand supply remain balanced and that is expected to maintain a downside bias on entire segment of the curve.

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) (formerly BNP Paribas Asset Management India Private Limited), makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.

Disclaimers for Market Outlook - Equity: The views and investment tips expressed by experts are their own and are meant for informational purposes only and should not be

construed as investment advice. Investors should check with their financial advisors before taking any investment decisions.

The material contained herein has been obtained from publicly available information, internally developed data and other sources believed to be reliable, but Baroda BNP

Paribas Asset Management India Private Limited (BBNPP), makes no representation that it is accurate or complete. BBNPP has no obligation to tell the recipient when opinions

or information given herein change. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This information is

meant for general reading purposes only and is not meant to serve as a professional guide for the readers. Except for the historical information contained herein, statements in

this publication, which contain words or phrases such as ‘will’, ‘would’, etc., and similar expressions or variations of such expressions may constitute forward-looking statements.

These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the

forward-looking statements. BBNPP undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date thereof. Words like believe/

belief are independent perception of the Fund Manager and do not construe as opinion or advice. This information is not intended to be an offer to see or a solicitation for the

purchase or sale of any financial product or instrument. The investment strategy stated above is for illustration purposes only and may or may not be suitable for all investors.