Indian markets continued to face headwinds on account of geopolitical tension with the US as India was unable to negotiate favourable trade deal leading to 50% tariffs. Moderate growth in corporate earnings led to FII selling in the month of August 2025, keeping the markets volatile. On the positive side, proposed GST reforms, softening inflation and strong GDP growth gave support to the markets.

The mid and small cap index underperformed the broader market with Nifty Small Cap 250 Index declining by 3.7% and Nifty Midcap 150 Index by 2.9% for the month. Sector-wise majority of the sectors ended in red with BSE OIL down by 4.7%, followed by Real Estate (-4.5%), Cap Goods (-4.1%), Healthcare (-3.9%) and BSE Bank (-3.3%). BSE Discretionary index was up by 2.5% followed by Durables (+2%).

FPIs were once again net sellers on account of tariffs and weak earnings, with net selling of USD 12.96bn for CY2025 and USD 1.9bn for the month of August 2025. Amongst Asian economies, South Korea (-USD 756mn) and Taiwan (-USD 1.5) saw negative flows after three months of positive inflows. After a blip in July 2025 (-USD 1.1bn outflows), Brazil continued to see positive FPI flows of USD 27mn in August 2025 and USD 3.6bn for CY2025.

Chances of a rate cut in USA during the FOMC meeting in September 2025 has increased post the recent speech by Fed Chair at Jackson Hole. This is on account of slack labour market and slowing growth. US business activity gained momentum in the month of August 2025 with Manufacturing PMI surging to 53.3 (49.8 in July 2025), highest since May 2022. However, Services PMI moderated to 55.4 from 55.7. On the tariff side, US, EU finalized on a trade deal with US imposing 15% tariffs on most EU imports. US has agreed to lower the tariffs once EU cuts tariffs on American goods.

Geopolitical tensions kept global currencies under check for the month, with most currencies declining. Indian currency was down by 1.3%, while some of the emerging economy currencies like Turkey was down by 1.5%, Vietnam by 0.9%, South Korea by 0.8%, China by 0.2% as against the USD.

Locally, corporate India reported its quarterly results. Nifty 50 companies delivered 8% PAT growth for the quarter which is the fifth consecutive quarter of single digit growth since the pandemic. With regards to Nifty 500, EBITDA growth was 11% YoY and PAT growth of 10% YoY (as against 8% and 9% for previous quarters. Of the 10% PAT growth, 1/3rd came from oil & gas sector. Other sectors which contributed to growth were NBFC, Metals and PSBs.

Recently, one of the biggest announcements came through with Prime minister announcing a major GST overhaul on August 15th, 2025. This includes reduction of slabs, addressing the input duty structure issues. As per the new reforms, government is planning on reducing the number of GST slabs from four to only two slabs at 5% and 18% and introducing a new slab of 40% for select items. This should boost consumption and benefit sectors such as consumer durables, autos, cement, staples/ FMCG and retail.

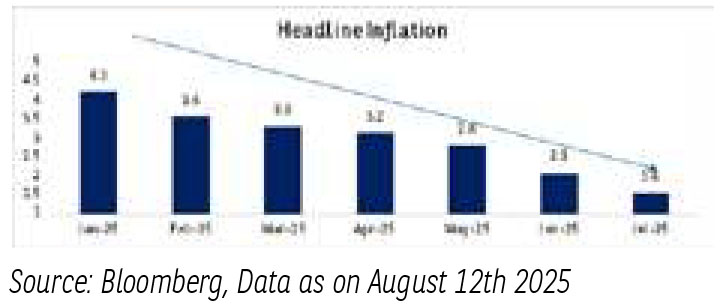

CPI inflation continues to decelerate at 1.6% in July 2025 as against 2.1% in June 2025, as food prices moderate. India Manufacturing PMI (Purchasing Managers Index) came in at 59.1 in July 2025 up from 58.4 in June 2025. This was at 16 month high for the Indian manufacturing sector, which benefitted from strong growth in new orders and output. Services PMI further inched up to 60.5 in July 2025 as against 60.4 in June 2025, led by pick-up in new export orders.

India saw positive surprise in Q1DY26 GDP growth number which came in at 7.8% as against consensus estimate of 6.7%. The surprise was led by manufacturing, construction and service sectors. While the central bank maintained its status quo in the August 2025 policy, there are indications that it may cut rates once again in the second half if growth slows down.

Indian markets have underperformed global peers over the last 3 months and one year basis. RBI and Government of India has announced key monetary and fiscal policies which should drive growth over the next few months. Key to watch would be earnings, where base is now favourable. Sectoral we are positioned in consumption, financials, industrials in our portfolio. Index is trading at 20x FY27E which is in line with ten-year averages. We turn constructive on equity markets.

Source: Bloomberg, B&K Securities. Data as of August 31, 2025. Kindly refer to the last page of the factsheet of Baroda BNP Paribas Mutual fund for the month ending August 2025 for disclaimers.

Nations across the globe are running the race to lock in tariff deals with US. European Union, Japan, South Korea have been the front runners in securing trade deals with US, where as China and India struggle to secure a balance burner. This is happening parallelly while wars continue to happen. The global markets continue to move in every direction with every data point.

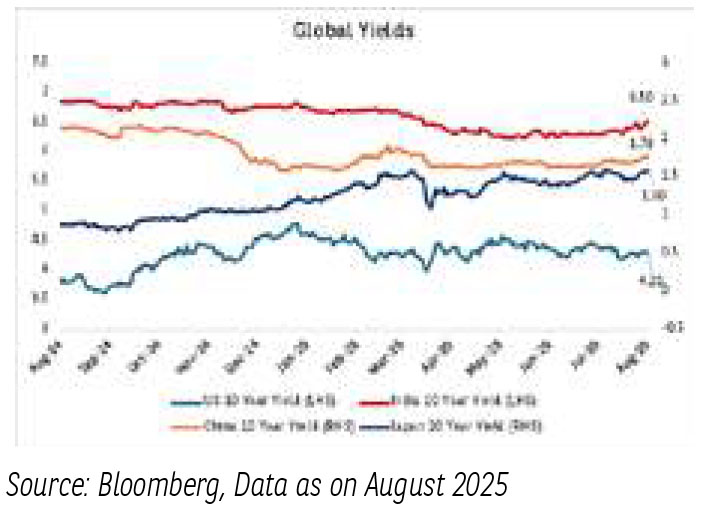

Global monetary dynamics are attuned to their respective domestic developments. US FOMC continued with a pause as uncertainty remains over inflation going forward. Indicators like producer price index and consumer inflationary expectations have started showing concerns regarding tariff transfers. The unusual political pressures on US FOMC have been building up for lower interest rates. This is expected to have implications on US bond market as the autonomy of a central bank gets threatened.

Bank of Japan continued with a pause in their July-Aug-25 monetary policy meeting. The minutes of the meeting highlighted members concerns over core inflation in Japan which is above 3%. Also, positive surprise on growth numbers added to the worry on inflation.

Key global commodities remained range bound in Aug-2025. Brent prices remained sub-70$/bl, whereas gold prices remained closer to 3400$/oz. Uncertainty around tariffs and continuation of wars have kept gold prices elevated.

Currency markets remained range bound with dollar index hovering around 98. However, INR has depreciated sharply this month reflecting concerns over tariff threats being larger than peer countries. US FOMC decision on interest rate trajectory will be one of the key factor in shaping the global currency and bond markets in the visible future.

Domestic Economy-

August-25 has been a key month for domestic economy with various developments starting with S&P’s upgrade of India’s sovereign rating from BBB- to BBB. In addition, , Centre has renewed their reform mandate to continue to support India’s growth and hence announced GST reforms following up the rationalization of tax brackets announced in Budget 2025 earlier. The tax brackets are expected to come down to 2 from the current 4 slabs.

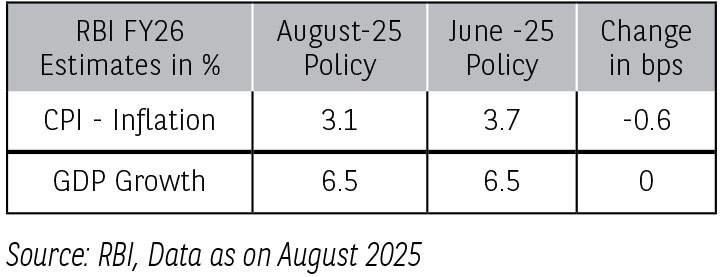

Along with this, RBI’s August 2025 monetary policy was another key event. RBI kept the repo rate unchanged. The policy reflected a cautious approach regarding ongoing tariff negotiations, geopolitical tensions and volatile global financial markets. Expect Monetary Policy Committee(MPC) to have a data dependent policy response, post monitoring global trade and domestic growth developments. RBI also reduced its inflation projection to 3.1% from earlier 3.7% whereas growth estimates remain the same.

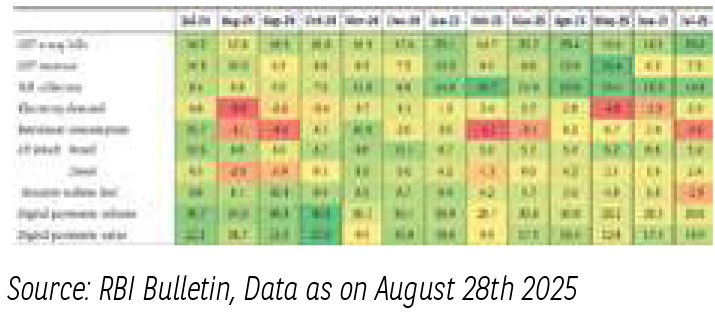

The high-frequency indicators for overall economic activity showed a mixed picture in July-Aug-2025. Urban demand moderated with indicators like domestic air passenger traffic weakening, retail sales of passenger vehicles also declined etc. Rural demand remained resilient supported by an uptick in real wages. Retail tractor sales posted robust growth, aided by a favourable monsoon. India’s Q1 FY26 GDP registered a strong print of 7.8% y/y, a much stronger print than the 7.4% y/y number in Q1 FY25. GVA growth too registered a growth print of 7.6% y/y, keeping the gap between GDP and GVA growth broadly intact. GDP internals show broad-based improvement, mostly driven by lower input costs and strong services economy.

Key Growth Indicators -

Domestic Inflation-

- Headline CPI hits 8-year low at 1.6% y/y in July-25, second instance of sub-2% print since the base change in 2011.

- The domestic inflation trajectory remains favorable, driven by moderating food prices.

- High-frequency food price data for Aug-25 showed easing in prices of pulses and eggs, while vegetable and fruit prices continue to inch higher but at a slower sequential pace than in July-25

- Core inflation moderates to 4.2% y/y in July-25 v/s 4.5% y/y in June-25.

- Going forward headline inflation is expected to be supported by monsoons, benign commodity prices.

- On the upside, the favorable base effects are expected to fade in Q4 FY26.

Domestic Liquidity -

- System liquidity surplus improved higher than our expectations, driven by month-end government spending despite outflows related to FX buy/sell swap maturity and CRR product build-up.

- Going forward, we expect liquidity surplus to improve further driven by continued government spending. The liquidity surplus is expected to be supported by CRR rate cuts coming into effect, which will help offset the seasonally higher currency in circulation.

- Bond market have nervously sold off in August 2025 where the 10year benchmark yields have gone up by ~20 bps and long end g-sec as well as State Development Loan (SDL) yields have gone up even more.

- The main reasons assigned to this sell off is a) GST rate revision is expected to be fiscal negative and hence may increase supply of sovereign securities b) RBI’s neutral stance indicates that there are no more rate cuts in near future c) Long gsec plus long SDL supply as a percentage of total annual supply between April-2025 and Aug 2025 is heavier than as seen in the past few years, d) Demand from long term investors like Insurance and Pension funds is lower than expected due to lower inflow of AUM or due to availability of alternate investment options (like extra allocation allowed towards equity) e) Lower run rate of corporate tax in this financial year till date coupled with upfront capex executed by Government has resulted in slightly heavier cumulative run rate on fiscal deficit till date f) INR has depreciated sharply in this month compared to some peers given larger than expected tariff impact.

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.

Disclaimers for Market Outlook - Equity: The views and investment tips expressed by experts are their own and are meant for informational purposes only and should not be

construed as investment advice. Investors should check with their financial advisors before taking any investment decisions.

The material contained herein has been obtained from publicly available information, internally developed data and other sources believed to be reliable, but Baroda BNP

Paribas Asset Management India Private Limited (BBNPP), makes no representation that it is accurate or complete. BBNPP has no obligation to tell the recipient when opinions

or information given herein change. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This information is

meant for general reading purposes only and is not meant to serve as a professional guide for the readers. Except for the historical information contained herein, statements in

this publication, which contain words or phrases such as ‘will’, ‘would’, etc., and similar expressions or variations of such expressions may constitute forward-looking statements.

These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the

forward-looking statements. BBNPP undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date thereof. Words like believe/

belief are independent perception of the Fund Manager and do not construe as opinion or advice. This information is not intended to be an offer to see or a solicitation for the

purchase or sale of any financial product or instrument. The investment strategy stated above is for illustration purposes only and may or may not be suitable for all investors.