CY2025 was a challenging year led by adverse geopolitical events. The start of CY2025 was impacted by news of President Trump imposing tariffs, increase in crude prices and weak corporate earnings. The news of India-Pakistan war, Iran-Israel war in the 2nd half of 2025 was negated by slew of positive news such as GST rate rationalization, RBI rate cut of 125bps and US Fed rate cut of 75bps. Consequently Nifty 50 rallied by ~18% from the bottom of April.

Locally, policy changes such as increase in slab rate for individual income tax and GST rationalization are witnessing early signs of pick-up in consumption. Domestic passenger vehicle volume grew by 27% YoY for the month of December 2025, while 2-wheeler retail domestic sales were up by 38% YoY during the same period. Commercial vehicle domestic sales volumes were up by 28% YoY in December 2025and tractor domestic sales were up by 37% YoY.

Banking credit growth has improved to 11.2% vs average of 10% for the year and is set to further increase. In November, India’s Industrial Production (IIP) registered a robust growth of 6.7%YoY, a sharp increase from 0.6% in October 2025, driven primarily by manufacturing sector and from basic metals, pharma and autos. GST net collection for financial year till date (April 25-November 25) stood at INR 12.79tn, up 7.3% YoY. CPI inflation in November inched up to 0.71% from 0.25% in October 2025 on account of increase in food prices.

Globally, the sentiments in 1HCY25 were marred by geo-political tensions and President Trump threatening to impose high tariffs. Barring some of the economies like India, China most of the countries have negotiated a lower tariff rate of 10-20%. Most markets have fared better than India and had an element of AI driving the outperformance. South Korean market was up by 75.6%, highest globally during CY25 primarily led by rally in AI and defence stocks. This was followed by Brazil (+34%), Hong Kong (+27.8%), Japan (+26.2%) and Taiwan (+25.7%). Amongst the developed economies, Germany was up 23% in CY2025 followed by UK (+21.5%), US S&P 500 (+17.3%), China (+18.4%) and US Dow Jones (13.7%).

On the currency front, INR has been the worst performing currency in CY25, down by 4.9%, followed by Indonesia (-3.2%), Philippines (-1.7%) while South Korea has appreciated by 1.8%, followed by Japan by 0.4%. While uncertainty on tariff and geo-political instability impacted the rupee, outflow by FPIs also led to depreciation in INR. For CY2025, FPIs withdrew most emerging markets. Amongst some of the Asian economies Taiwan saw outflow of USD 7.8bn, followed by Malaysia (USD-5.1bn), Vietnam (USD-4.8bn), South Korea (USD-4.5bn). Amongst Emerging Markets (EM), only Brazil saw inflows of USD 4.9bn during CY2025.

Although there are multiple headwinds globally, India continues to remain the fastest growing economy registering GDP growth of 8.2% during Q2FY26. With favourable policy announcements by the government, India’s GDP is expected to remain healthy, with Fitch Ratings revising India’s GDP forecast to 7.4% for FY26 up from 6.9% projected earlier.

Going ahead, revival in earning will be key to watch out for and crucial for FPIs to turn positive on India. Earnings growth improved during 2Q FY26 and it may grow in double digits during FY27 and FY28. With index underperforming emerging markets, FPI ownership at all time low and with some reversal of AI trades we can expect activity to pick up in Indian markets. Wish you all a Happy and Prosperous New Year.

Happy investing!

Source: BnK/360One, Kotak Securities, Prabhudas Lilladher. Data as of December 31, 2025. Kindly refer to the last page of the factsheet of Baroda BNP Paribas Mutual fund for the month ending December 2025 for disclaimers.

As we progressed towards the end of 2025, global uncertainty though present but retreated from its elevated levels post US tariff shock. With countries closing negotiations and deals with the US, the impact of the tariffs becomes clearer. Although there are countries still behind the wagon to close any deal and are currently facing the brunt of the tariffs.

In the month of December, there was a clear divergence in the monetary policy of some central banks. While the US and the UK delivered a rate cut emphasising the soft labour market conditions, Japan increased its policy rate to a 30-year high as inflation remained above target. US Treasury yields declined amidst increasing rate cut expectations. Yields, thereafter, firmed up to a 16-year high in early December following hawkish comments from the Bank of Japan. Though yields moderated post the Fed policy in December, the fall was capped by uncertainty on Fed rate outlook for 2026.

Global commodity prices remained largely stable. Divergent movements were also observed across commodity markets, with a continued uptick in gold prices and a softening bias in crude oil prices. Copper prices too picked up sharply led by supply concerns.

Domestic Economy-

The Indian economy, supported by resilient domestic demand, grew by 8.2% y/y in Q2 FY26.High-frequency indicators suggest that overall economic activity held up in November-2025. The increase in e-way bill generation indicates a rise in goods movement and freight activity supported by the GST reforms. The increase in petroleum consumption was driven by a pick-up in construction and agricultural operations. Electricity demand declined for the second consecutive month due to the early onset of winter season.

Indicators of urban demand strengthened further, building up on the festival season pick-up. Retail passenger vehicle sales grew at their highest pace in over a year, aided by GST benefits, marriage season demand, and improved supply. Retail tractor sales growth, buoyed by positive rabi season prospects, reduction in GST rates and hike in minimum support prices of rabi crops, registered a significant pickup. Other high frequency indicators of rural demand, namely, retail automobiles sales, however, witnessed a sharp deceleration in the post festive season coupled with adverse base effects

India’s external sector exhibited resilience despite a challenging global environment. Current account deficit narrowed in Q2 FY26 with a moderation in merchandise trade deficit, robust services exports and resilient remittances. Capital flows, however, were tempered by persistent global uncertainties. Foreign exchange reserves remain sufficient to comfortably meet India’s external financing requirements.

Domestic Economy-

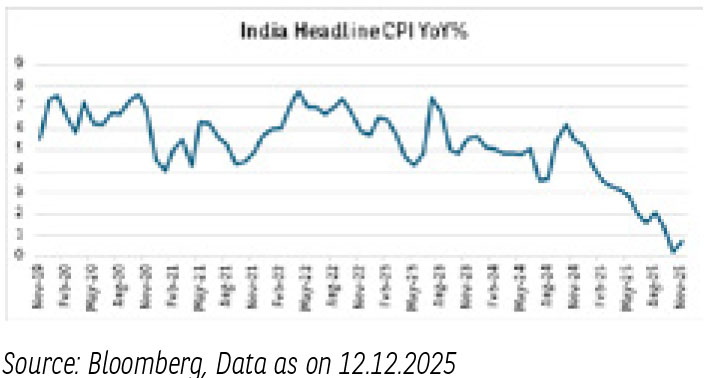

- CPI inflation picked up tad bit at 0.7% in November-2025 v/s 0.25% YoY in October-2025. The marginal pick-up was due to less supportive base effect.

- Food and beverages inflation remained negative at -2.8%YoY in November v/s -3.7% in October. The deflation in food prices remains broad-based, spanning vegetables, pulses, and spices.

- Preliminary estimates for December CPI inflation is tracking at 1.7%, reflecting adverse base-effect. The pass-through of GST cuts is likely completed in October and November.

- Core inflation is estimated at 4.8%, reflecting further surge in gold prices. There is also a possibility of higher telecom tariffs in December.

- FY26 CPI inflation is tracking at 2.0% in line with RBI’s estimate.

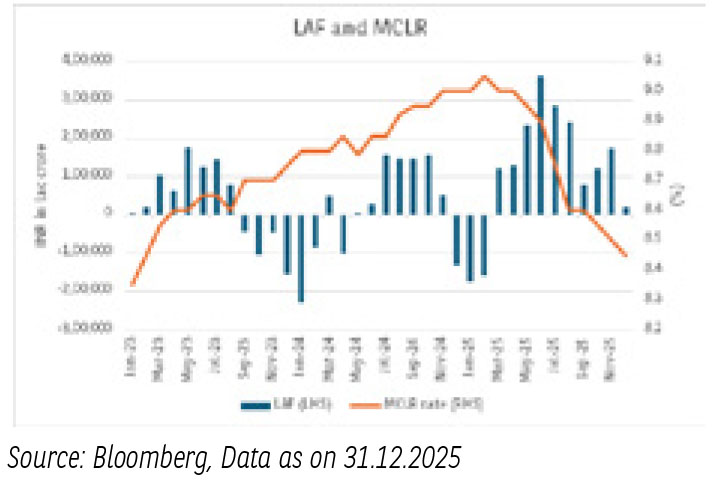

Domestic Liquidity -

- Banking system liquidity became deficit post advance tax payments on December 15th, 2025.

- RBIs commitment to provide sufficient liquidity has led to further announcement of liquidity measures.

- RBI continues to infuse liquidity at an accelerated pace, it has undertaken INR3tn Open Market Operations(OMO)purchase and INR2.6tn via CRR cut until Jan 2026.

- RBI has also conducted two buy-sell swaps during this period of US$15bn in December and January, thereby reinstating core liquidity of more than INR 4 trillion.

- RBIs action also addresses the tepid money supply (M3) growth in the economy.

- The announcement of OMOs for liquidity gives additional 3 tn INR in the economy which may circle back to accretion of deposits in the banking sector.

- Deposit growth is an important factor to bring down the Credit-Deposit (CD) ratio of the scheduled commercial banks. Thus, supporting short- term rates as this may lead to lesser issuances of CDs in the coming quarter.

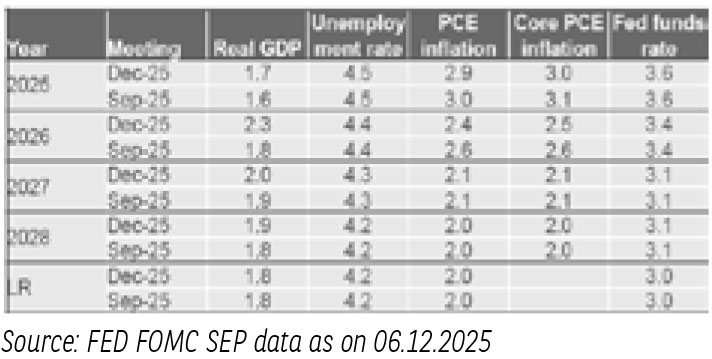

- US Monetary Shift – FED in December-25 policy delivered a rate

cut and also mentioned to start quantitative easing.

Even though the economic projections reflect one cut in 2026 and 2027, we believe the FED will continue to remain data dependent and the SEP (summary of economic projections) to align accordingly.

The key triggers on Fed’s rate trajectory depend further clarity on US labor market conditions post government shutdown, US tariffs and its actual impact on inflation and tightness in US money markets.

We expect one more cut by March-2026 given weakness in labour market conditions.

- Changing Policy Dynamics from August to December -25 -. RBI

Monetary policy reduced the repo rate by 25bps to 5.25% in line

with our expectations. The dynamics of RBI’s future monetary policy

decisions will depend on

a)Firstly, the direction of FED policy monetary, where we expect fed to deliver at least 1 rate cuts by March 2026 led by labor market concerns and tightness in US money markets, b)Secondly, domestic growth is currently supported by multiple reforms and policies pushes, the actual momentum of the economy will be visible in Q4 FY26 post effects of GST cuts. However, the current run rate of less than double digit nominal GDP also provides an impetus to remain on expansionary mode on monetary policy front especially when fiscal expansion potential remains limited c)Thirdly, inflation expectations in Q1 and Q2 FY27 are lower than 4% and real rates remain ‘substantially high’ as per RBI’s Governor. Therefore, RBI may acknowledge scope for either reducing rates further/continue infusion of durable liquidity or remain on long pause with liquidity infusion mode till the time double digit nominal gdp or inflation more than 4% on sustainable basis is achieved.

- Elevated spreads and yields - We believe the recent sell off started since August-25 has created another opportunity for investors as it has resulted in valuation of securities to a reasonably attractive point wherein spreads of 10-year benchmark vs the overnight rate and SDLs/Long gsec versus the 10yr benchmark have reached the higher end of the trading range. The investors could benefit from further easing of rates in months ahead.

- Fiscal concerns added to the woes But! – Fiscal concerns aided further rise in yields, but we do not expect GST rate cuts to be fiscally negative as we expect Government to benefit from higher volumes at lower GST rates along with other avenues to manage the deficit, if any.

- INR took the hit - INR depreciation has resulted in INR valuation being closer to fair level and provides an attractive entry point from foreign investors in fixed income markets.

- At last, the opportunity - Positive real rates of ~200 bps (1yr T-bill vs FY26 inflation), post RBI rate cut of 100 bps provides a fundamentally attractive case for remaining invested in fixed income assets. Benign inflation forecast of 2.6%, below RBI threshold of 4% for FY 26 and maintaining GDP forecast at 6.8% indicates a continuity of pro-growth-oriented policy mindset. Multiyear high spread between benchmarks and long end G-sec is expected to provide ample opportunity, with stable to lower rate view and comfortable macros.

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.

Disclaimers for Market Outlook - Equity: The views and investment tips expressed by experts are their own and are meant for informational purposes only and should not be

construed as investment advice. Investors should check with their financial advisors before taking any investment decisions.

The material contained herein has been obtained from publicly available information, internally developed data and other sources believed to be reliable, but Baroda BNP

Paribas Asset Management India Private Limited (BBNPP), makes no representation that it is accurate or complete. BBNPP has no obligation to tell the recipient when opinions

or information given herein change. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This information is

meant for general reading purposes only and is not meant to serve as a professional guide for the readers. Except for the historical information contained herein, statements in

this publication, which contain words or phrases such as ‘will’, ‘would’, etc., and similar expressions or variations of such expressions may constitute forward-looking statements.

These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the

forward-looking statements. BBNPP undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date thereof. Words like believe/

belief are independent perception of the Fund Manager and do not construe as opinion or advice. This information is not intended to be an offer to see or a solicitation for the

purchase or sale of any financial product or instrument. The investment strategy stated above is for illustration purposes only and may or may not be suitable for all investors.