Nifty 50 was down by 3.1% for the month of January 2026. Amongst Asian markets, South Korean market (KOSPI) was up by 24%, followed by Taiwan Index (+10.7%), Hang Seng Index (+6.9%), Japan (NIKKEI 225) (+5.9%) and SSE Composite (Shanghai Stock Exchange) (+3.8%). In Europe, FTSE 100 Index (UK) was up by 2.9%, while DAX (Germany) was largely flat at 0.2% and CAC 40 (France) was marginally down by 0.3%. In the US both S&P 500 and Dow Jones were up by 1.3%.

In January 2026, Nifty Midcap 150 Index was down by 3.5% and Nifty Small Cap 250 Index by 5.5%. Sector wise majority of the sectors were in red with BSE Realty down the most by 10.3%, followed by BSE FMCG (-7.9%), BSE Consumer Durables (-7.8%), BSE Healthcare (-5.6%), BSE Auto (-5.2%), BSE Oil & Gas (-2.1%), BSE IT (-1.4%), while BSE Bankex was marginally up by 0.5% followed by BSE PSU (+4.5%) and BSE Metals (+5.5).

FPIs entered 2026 with selling USD 3.5bn in Indian markets in January 2026, as global uncertainties and revival of corporate earnings to double digit growth remains a major overhang. With regards to certain emerging economies, Brazil saw the highest inflows to the tune of USD 4.3bn, followed by Taiwan (+USD 1.8bn), while Malaysia, South Korea and Thailand saw lower inflows of USD 150-400mn in January 2026. Indonesia saw outflows of USD 589mn and Vietnam by USD 211mn.

The US Federal Reserve in its latest meeting has kept the interest rate unchanged at 3.5-3.75% range, cut rates by 25bps to the 3.75- 4% range. The pause on rate cut was on account of persistent inflation and resilient growth. Geo-political tensions are keeping crude oil prices under check at USD 60/bb to USD 70/bb on account of US intervention in Venezuela and threats of attack on Iran. The US has also threatened European Union with high tariffs if EU countries oppose to US control over Greenland.

On 27th January 2026 India and the European Nation concluded a landmark deal, after nearly 18 years of negotiations and is expected to become effective from CY2027. This will give a big boost to Indian exports particularly in the labour-intensive sectors which contribute ~28% of total India’s exports to EU (USD 76bn in FY25) such as textiles, gems and jewellery, agriculture, seafood, leather. Tariffs on labour intensive exports will reduce to 0%, certain marine products, processed foods and defence goods are to be reduced over 3-5 years, select Agri-products are to be reduced to preferential rates.

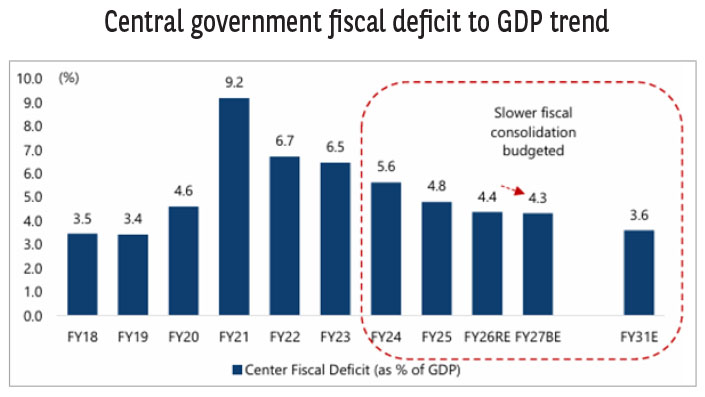

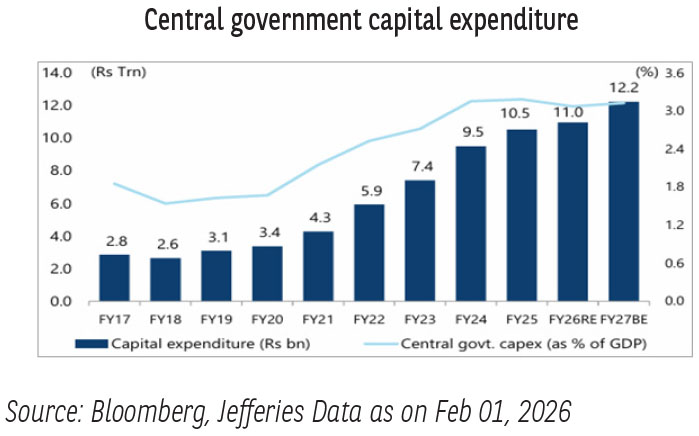

Locally, government presented the budget for FY27 with higher focus on capex which is expected to grow 11.5% in FY27 to INR 12.2t, while revenue expenditure growing by 6.6%. The government in the budget has prioritized macro stability, with projected fiscal deficit of 4.3% in FY27 and also indicated a gradual improvement in debt dynamics, with the debt-to-GDP ratio expected to decline to 55.6% in FY27 from around 56% in FY26 (RE).

One of the key highlights of the budget was government’s push to manufacturing, which will be key drivers for job creation, domestic value addition and long-term industrial competitiveness. Keeping this in mind government has focused on seven sectors which include, biopharmaceutical, semiconductors, electronic components, rare earth magnets, chemicals, capital goods and textiles.

Corporate India started reporting its quarterly numbers. During Q3FY26 Nifty 500 saw double digit revenue growth after a gap of five quarters while Earnings Growth marked third-consecutive quarter of double-digit growth, up 14.7% YoY for the 128 companies which reported results. Banking sector has seen improvement in credit growth and witnessing pick-up in corporate lending. Asset quality continues to improve with pain in unsecured segments normalising and collection efficiency improving as well as gross slippages coming down

Indian market valuations trade at its long-term average of 21x and with expectations of accelerated growth from 2HFY26 onwards, valuations can see re-rating. While Indian markets have been underperforming global peers over one year period on weak earnings growth, recent favourable government policies and improvement in earnings, risk reward seems favourable.

Source: B&K/ 360One, Kotak Securities; dated 31st January 2026

The tariff shock triggered by the US on other economies had a structured effect on global growth and trade dynamics. The impact is huge but cannot be seen on a standalone basis. The comparative trade advantage is fading, and a more insulated trade economy Is taking shape. New trade blocks are being formed whereas old ones are becoming obsolete. The dominance of dollar has faced subtle disinterest via increased use of local currencies in trade and diversification of reserves; gold became the center of it.

What we witnessed is switch from the influence and dominance of one currency and country to a more fragmented and multipolar economic system. Unsettling trade shocks have underlined a new reality in which geopolitics rather than pure economics is setting the stage for a new world order, driving growth, inflation and capital flows. The standing point of changing world order is visible in asset classes.

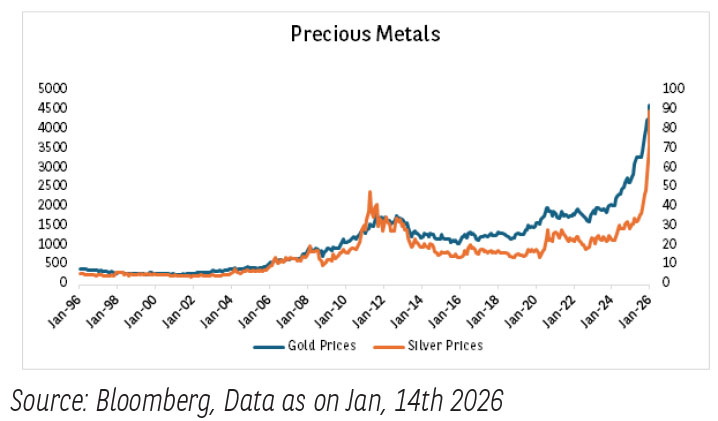

Commodities that were meant to hedge each other moved in tandem, safe havens behaved like risk assets, therefore forcing investors and policy makers to adapt in real time. Gold prices remained volatile, rising above $5400 in January-26 and declining sharply back to ~$4800 levels starting Feb-26. Silver too followed similar volatility.

Meanwhile, global fixed income markets have also witnessed sideway movements led by uncertainty and divergence between central bankers positioning on rate cycles especially in advanced economies. Recent divergence was visible between US and Japan, where US in December-2025 policy reduced federal fund rate and started with Quantitative easing, whereas Japan delivered a rate hike.

Domestic Economy-

Amidst these uneasy global dynamics, India has not been completely insulated. Domestic growth and currency faced headwinds from US tariffs, with secondhand effects on domestic liquidity conditions. But with the recent announcement of lowering of US trade tariffs on India from 50% to 18% it has led to appreciation of Indian rupee against dollar. India has also concluded major FTAs with UK, New Zealand and European Union. The most significant of the deals is India-EU FTA, with a combined market estimated at ~USD 24 trillion. The EU’s average tariff rate on Indian goods will drop from 3.8% to 0.1%, which could boost India’s exports and imports from EU which have been stagnant of late. EU-India FTA is a comprehensive agreement that spans both goods and services. More importantly, there is a comprehensive agreement on mobility of skilled and semi-skilled professionals.

Union budget was another key event shaping market expectations. Budget FY27 was focused on India’s commitment to fiscal discipline and sovereign credibility while choosing temporary repricing rather than structural damage. Centre has targeted fiscal deficit at 4.3% for FY27, which broadly aligns with its fiscal consolidation road map, while continuing its thrust on capital expenditure, considering a 11% y/y growth from FY26 revised estimates.

Overall, the tax assumptions as usual have been realistic. A 10% nominal gdp growth in our view is conservative and can surprise on the upside going forward. The borrowing trajectory was largely predictable with a few surprises. Also, the budget avoided any disruptive policy changes amidst an already volatile global environment.

On the growth front high-frequency indicators suggest continued buoyancy in growth impulses. Demand conditions remained upbeat, underpinned by a resurgence in rural demand and a gradual recovery in urban demand.

Domestic Liquidity -

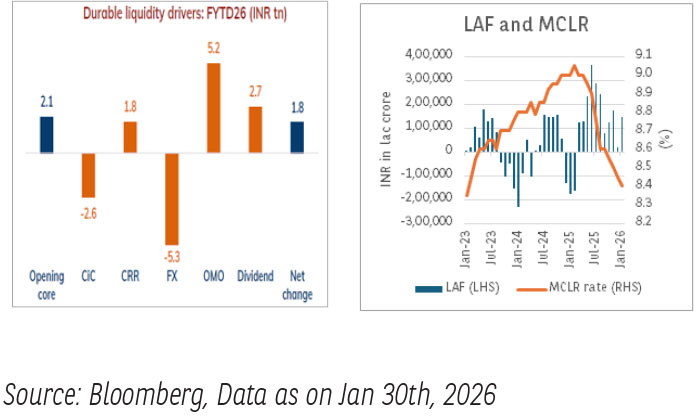

- System liquidity was under pressure on account of GST and foreign capital outflows.

- This led to increase in domestic yields.

- Post the announcement of further liquidity support (INR 1trn. Open Market Operations(OMO) purchase + USD 10bn FX swap) and month-end government spending, domestic yield curve flattened.

- Overall pressure on yields, especially short end remains, as CD ratio remains high (currently above 80).

- Also, the supply remains limited to the belly of the curve.

- We expect short-term rates to be supported with expectation of issuances of CDs in the coming quarter from commercial banks.

Domestic Inflation -

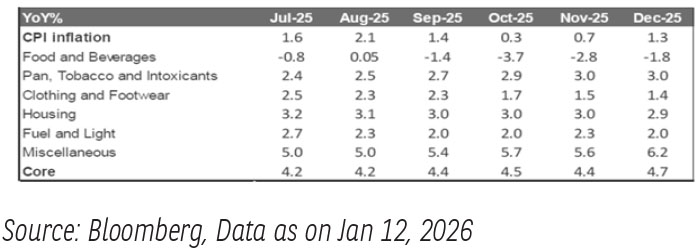

- India CPI inflation came at 1.33% y/y in December-2025 marking the eleventh consecutive print below the 4% inflation target.

- While headline inflation edged up in Dec-2025 from 0.7% in Nov-2025 it was driven by unfavorable base effects.

- Food inflation continued to remain in deflation. Food and beverage inflation declined by 1.8% y/y in Dec-2025 v/s a decline of 2.8% y/y in Nov-25. The decline was visible in key food items like vegetables, pulses, spices and cereals.

- High frequency daily food price indicators for first two weeks of January-26 indicated a month-on-month decline in vegetable, pulses and cereal prices.

- On the contrary, core inflation inched up to 4.7% y/y in Dec-25 vs 4.3% in Nov-25. However, core ex gold and silver where core inflation was ranging at 2.3% y/y.

- With India set to transition to a new CPI series in Feb 2026, with the base year revised to 2024 using the household consumption expenditure survey, the weights of food and core inflation will change.

- The new CPI series will give a better picture on core inflation with inclusion of modern services such as quick commerce in the index.

- Looking at the current inflation trajectory and RBI’s dovish tone last policy, we still see space for another cut. The timing will depend on timelines of US tariffs and growth indicators in Q4 FY26. The space is available, but the key is timing.

Fixed Income Outlook-

Global Monetary Dynamics –

- Fed and Bank of Japan continue with contrary monetary policy outlook.

- The pressure of the above can keep high uncertainty in the global rates market.

- We expect FED to remain accommodative on rates front amidst political pressure and soft labour market.

Domestic Growth & Inflation –

- Shift in base year for GDP and inflation looks fundamentally positive for the economy.

- Growth and inflation projections will change as the base year changes.

- The new index for inflation has reduced weights for food cpi and higher weights for core CPI.

- This will give a better picture of actual inflation in the economy.

- Overall, RBI’s language on growth is supportive and comfortable on inflation.

Currency –

- Recent announcement of US trade deal is expected to support INR and FII sentiments.

- Latest FTA deals are sentiment boosting and also opens different market access to India for both goods and services.

- Therefore, at current levels we see INR valuations being closer to fair level.

- This provides an entry point opportunity for foreign investors in domestic fixed income markets.

Spreads and Rates –

- RBI has been very proactive on liquidity and rates front. Even though the spreads are elevated due to higher CD ratio.

- We believe RBI’s concerns on growth will be visible on rates through liquidity measures.

- Also, next quarter we expect some normalization of CD ratio.

- With expectations of further RBI liquidity measures we expect yield curve steepening.

- Going ahead, spreads and accrual would be a major source of alpha as compared to duration in the portfolio.

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.

Disclaimers for Market Outlook - Equity: The views and investment tips expressed by experts are their own and are meant for informational purposes only and should not be

construed as investment advice. Investors should check with their financial advisors before taking any investment decisions.

The material contained herein has been obtained from publicly available information, internally developed data and other sources believed to be reliable, but Baroda BNP

Paribas Asset Management India Private Limited (BBNPP), makes no representation that it is accurate or complete. BBNPP has no obligation to tell the recipient when opinions

or information given herein change. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This information is

meant for general reading purposes only and is not meant to serve as a professional guide for the readers. Except for the historical information contained herein, statements in

this publication, which contain words or phrases such as ‘will’, ‘would’, etc., and similar expressions or variations of such expressions may constitute forward-looking statements.

These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the

forward-looking statements. BBNPP undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date thereof. Words like believe/

belief are independent perception of the Fund Manager and do not construe as opinion or advice. This information is not intended to be an offer to see or a solicitation for the

purchase or sale of any financial product or instrument. The investment strategy stated above is for illustration purposes only and may or may not be suitable for all investors.