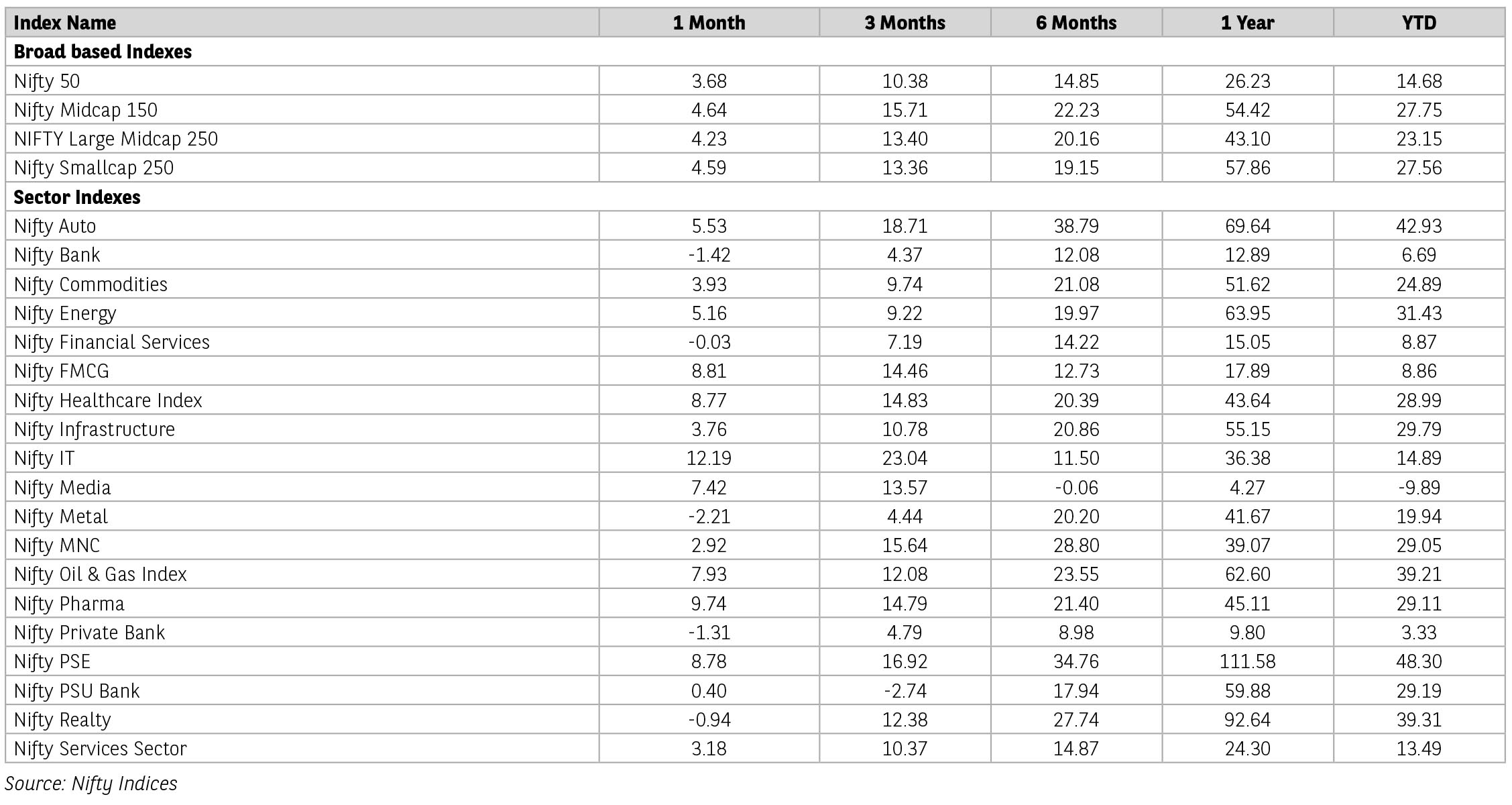

The benchmark indices, Nifty/Sensex, continue to be on a strong uptrend. Despite major events such as the general elections and Union Budget bringing in some negative news

flow, the markets have climbed all the walls of worries to scale to new peaks. Globally, Indian markets were among the best-performing markets, along with US Dow Jones (+4.4%)

and Australia (+4.2%). Hang Seng and Shanghai Composite declined 2.1% and 1% amid the weakness in the economy. For the month of July 2024, Nifty 100 Index was up by 4.1%.

Mid-cap and small-cap indices were up 4.9% and 4.9% in the month, respectively. Sector-wise, IT, oil & gas, FMCG were up by 13%, 11% and 10%. Banks, metals and realty indices

ended with a minor loss of around 1% each. FPIs bought USD 3.7 bn of Indian equities in the secondary market, whereas DIIs bought USD2.8 bn.

The US Fed kept key interest rates unchanged, but markets are now expecting rate cut to start by September. Europe's and the UK's growth is still modest, but the future is cast in doubt by persistent geopolitical threats, tighter financial regulations, and decreased consumer confidence. Stimulus expectations from China post the Plenum meet were downplayed with no major announcements.

Indian high frequency data showed mix trend. IIP growth elevated to 5.9% in May-24 after the moderation of 5% in April 24; the growth attributed to manufacturing. GST (Goods and Services Tax) collection rose to its third-highest level of Rs.82tn; growth improved to 10.3% YoY (8.1% in Jun). Manufacturing PMI softened to 58.1(58.3 in June). Indian CPI (Consumer price index) inflation elevated to 5.1% in June-24 as compared to 4.8% in the previous month due to higher inflation in specific food categories. Rainfall is currently 2% above the LPA (Long period Average) as per recent data. Supported by higher-than-normal rainfall, an improvement has been observed in the sowed area, with higher acreage of pulses, oilseeds, and coarse cereals compared with last year. This augurs well for rural consumption.

FY25 budget policies address the demands of middle-class income earners, job seekers & coalition political partners. But still, it improves fiscal discipline. Short-term capital allocation challenges from a rise in capital gains tax for equities and real estate may weigh on markets. Budget has retained the capex amount of 11 lakh crs an increase of 17% on YoY basis with 11% growth in defence spend. Railways and Road spends are lower at 4% and 3% respectively.

The government has pegged the fiscal deficit target at 4.9% of GDP, and an additional expenditure in the key areas of agriculture & allied sectors; skilling & employment creation, tax relief to middle class and providing a much higher allocation for development of Bihar and Andhra Pradesh. There is also continuity on the existing policy to boost the manufacturing, housing and energy sectors.

LTCG tax rate hiked to 12.5% from 10% and STCG hiked to 20% from 15 % are sentimentally negative. For real estate, Capital gains tax on property sales is changed from 20% with indexation benefits to 12.5% without any indexation benefits; There is minor tweaks to tax slabs and Standard deduction increase. This will drive an additional INR17500 tax savings for someone with taxable income of 15 lakhs. Incrementally positive for consumption. FM proposed to fully exempt customs duties on 25 critical minerals some of which are used in EV batteries.

While budget is a key event, and markets tend to be volatile during budget day, the focus does shift to fundamentals later. In terms of earnings announced- IT sector has done better than expected. Auto 2W co reported healthy double-digit growth and improvement in margins as well. Cement topline growth is muted led by lower realisation which led to drag in margins. Oil marketing companies earnings have been weak due to under recoveries.

Nifty 50 index is trading at 25x on 12 M trailing basis Q1FY25 results. Given macroeconomic stability, political continuity, deleveraged corporate balance sheets and continued focus on government capex, India has shown remarkable progress in current year. Even as consumption demand remains sluggish, efforts to boost employment and tax changes in the new tax regime should gradually aid private consumption. Elections in the US are the key event to watch out for.

Source: Kotak; Motilal Oswal and Ambit

The US Fed kept key interest rates unchanged, but markets are now expecting rate cut to start by September. Europe's and the UK's growth is still modest, but the future is cast in doubt by persistent geopolitical threats, tighter financial regulations, and decreased consumer confidence. Stimulus expectations from China post the Plenum meet were downplayed with no major announcements.

Indian high frequency data showed mix trend. IIP growth elevated to 5.9% in May-24 after the moderation of 5% in April 24; the growth attributed to manufacturing. GST (Goods and Services Tax) collection rose to its third-highest level of Rs.82tn; growth improved to 10.3% YoY (8.1% in Jun). Manufacturing PMI softened to 58.1(58.3 in June). Indian CPI (Consumer price index) inflation elevated to 5.1% in June-24 as compared to 4.8% in the previous month due to higher inflation in specific food categories. Rainfall is currently 2% above the LPA (Long period Average) as per recent data. Supported by higher-than-normal rainfall, an improvement has been observed in the sowed area, with higher acreage of pulses, oilseeds, and coarse cereals compared with last year. This augurs well for rural consumption.

FY25 budget policies address the demands of middle-class income earners, job seekers & coalition political partners. But still, it improves fiscal discipline. Short-term capital allocation challenges from a rise in capital gains tax for equities and real estate may weigh on markets. Budget has retained the capex amount of 11 lakh crs an increase of 17% on YoY basis with 11% growth in defence spend. Railways and Road spends are lower at 4% and 3% respectively.

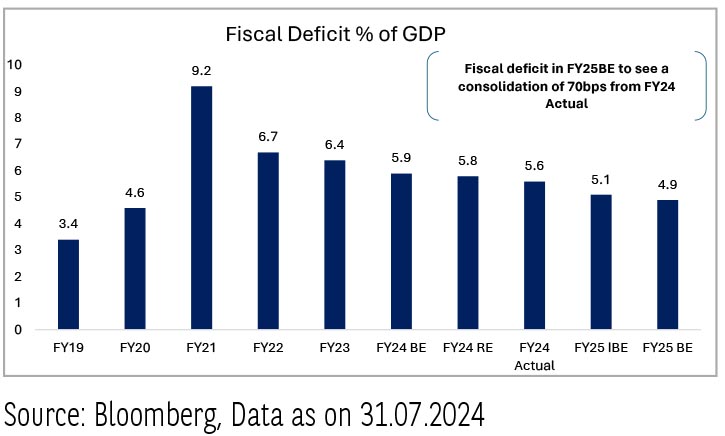

The government has pegged the fiscal deficit target at 4.9% of GDP, and an additional expenditure in the key areas of agriculture & allied sectors; skilling & employment creation, tax relief to middle class and providing a much higher allocation for development of Bihar and Andhra Pradesh. There is also continuity on the existing policy to boost the manufacturing, housing and energy sectors.

LTCG tax rate hiked to 12.5% from 10% and STCG hiked to 20% from 15 % are sentimentally negative. For real estate, Capital gains tax on property sales is changed from 20% with indexation benefits to 12.5% without any indexation benefits; There is minor tweaks to tax slabs and Standard deduction increase. This will drive an additional INR17500 tax savings for someone with taxable income of 15 lakhs. Incrementally positive for consumption. FM proposed to fully exempt customs duties on 25 critical minerals some of which are used in EV batteries.

While budget is a key event, and markets tend to be volatile during budget day, the focus does shift to fundamentals later. In terms of earnings announced- IT sector has done better than expected. Auto 2W co reported healthy double-digit growth and improvement in margins as well. Cement topline growth is muted led by lower realisation which led to drag in margins. Oil marketing companies earnings have been weak due to under recoveries.

Nifty 50 index is trading at 25x on 12 M trailing basis Q1FY25 results. Given macroeconomic stability, political continuity, deleveraged corporate balance sheets and continued focus on government capex, India has shown remarkable progress in current year. Even as consumption demand remains sluggish, efforts to boost employment and tax changes in the new tax regime should gradually aid private consumption. Elections in the US are the key event to watch out for.

Source: Kotak; Motilal Oswal and Ambit

Global Economy-

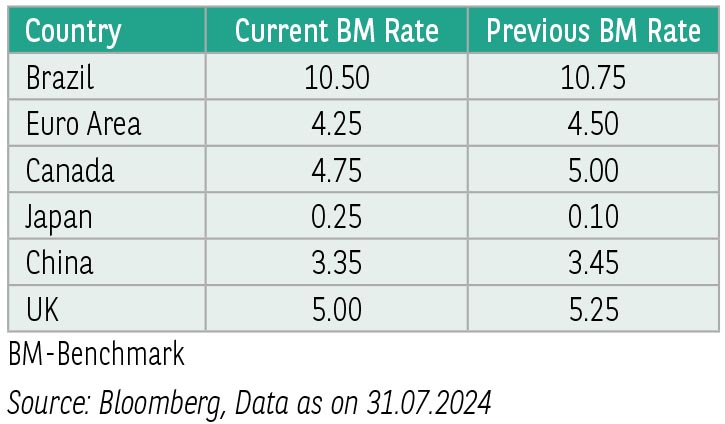

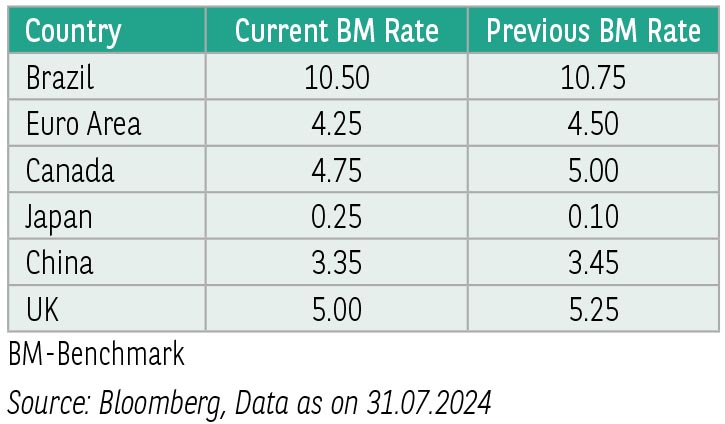

FED in its July-2024 FOMC meeting continued with a pause. Whereas People Bank of China, Bank of England and European Central Bank unleashed rate cuts. The divergence in global monetary policy dynamics sets the tone of the underlying economic developments globally and the differential in growth outlook. On one hand, US economic activity remained robust whereas on the other UK, Eurozone and China continue to see slower growth. China’s growth outlook continues to remain worrisome.

Global manufacturing PMI experienced a growth setback at the start of the second half of 2024, with July-2024 seeing output expand at the weakest rate in the last seven-months. Euro area remained the main source of weakness – with output falling across the currency bloc for the sixteenth month in a row – sharp growth slowdowns in China and the US alongside renewed contraction in Japan also contributed to the slowdown at the global level.

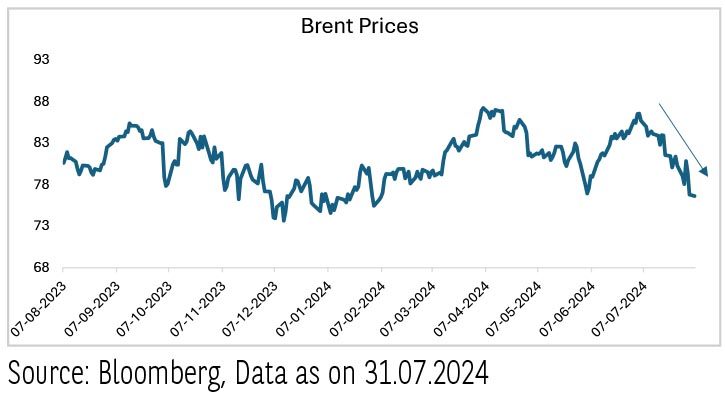

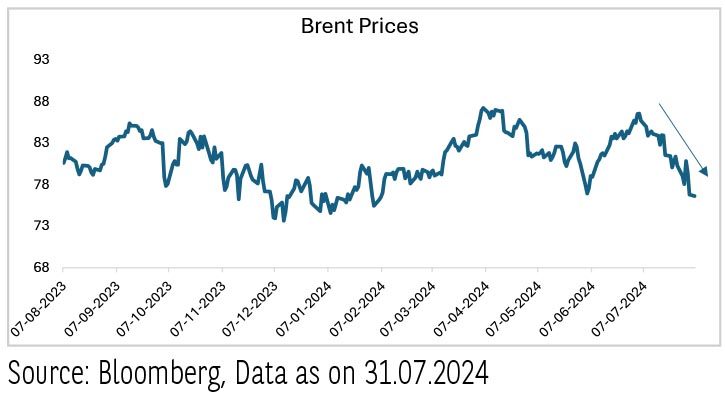

Global commodity prices have started reflecting the global demand supply dynamics, irrespective of extension of supply cuts from OPEC+, brent continues to remain below 80$/bl as China, the biggest importer of crude oil faces economic uncertainty and weakness.

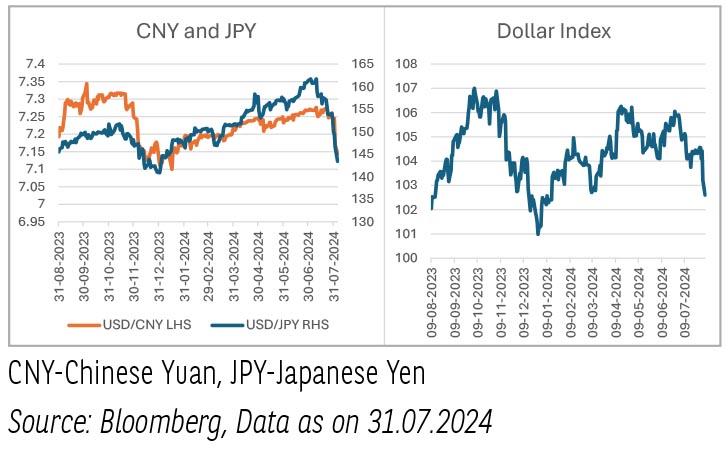

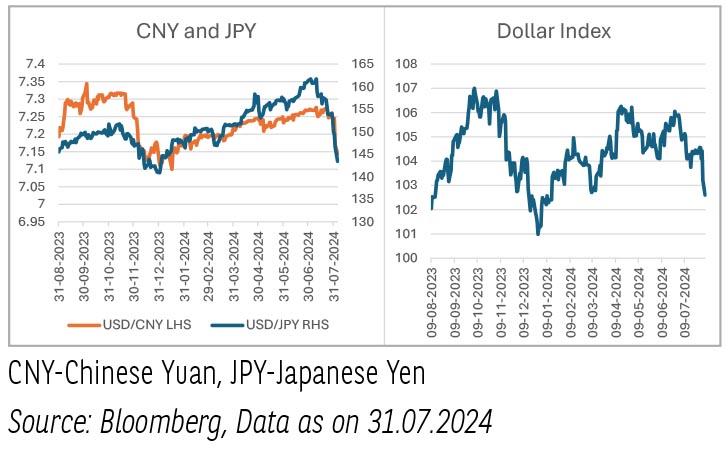

Interest rate differential with US and domestic inflation issues has weighed down on Asian currencies especially China and Japan. With Bank of Japan’s recent move to hike its benchmark rate, it has been supportive of its currency. Japan’s inflation problem and changing monetary dynamics is expected to trigger some shift in the global flows.

Domestic Economy-

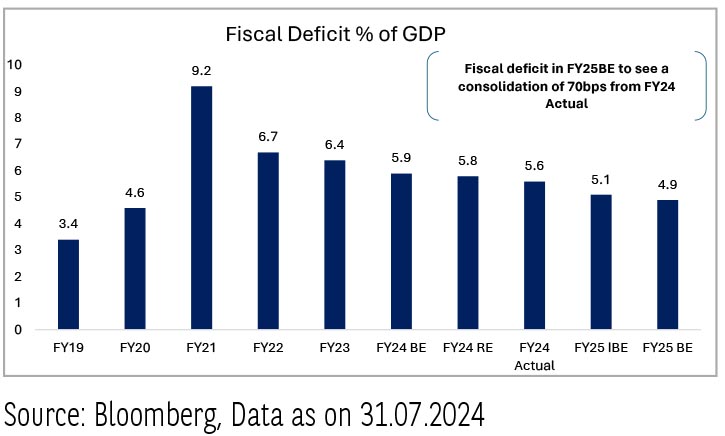

Union budget was the key event in the month of July-2024 which triggered a positive bias for India’s fixed income markets. The Union Budget judiciously used the fiscal space created by the RBI dividend, to boost revenue expenditure and further enhanced fiscal consolidation (fiscal deficit target 4.9% of GDP v/s 5.1% in interim budget). The budget was non-inflationary with revenue expenditure (as % of GDP) moderating to 11.4% in FY25 from 11.8% in FY24. The Budget remains supportive to the capex cycle, with capital expenditure maintained at 3.4% of GDP.

In line with the budget estimations, the actual run rate for direct tax collection remained robust as on FYTD basis. Indirect tax collections too showed robust growth irrespective of a higher allocation to states.

On the growth front, high frequency indicators in July-2024 reflected softer expansion in economic activity. India’s manufacturing PMI showed a marginal decline in the pace of expansion in July-2024. The continuous increase in the output price index, driven by input and labour cost pressure, remains a concern.

Domestic Inflation-

Liquidity –

INR movement was dictated by two key variables:

Fixed Income outlook -

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) (formerly BNP Paribas Asset Management India Private Limited), makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future.

FED in its July-2024 FOMC meeting continued with a pause. Whereas People Bank of China, Bank of England and European Central Bank unleashed rate cuts. The divergence in global monetary policy dynamics sets the tone of the underlying economic developments globally and the differential in growth outlook. On one hand, US economic activity remained robust whereas on the other UK, Eurozone and China continue to see slower growth. China’s growth outlook continues to remain worrisome.

Global manufacturing PMI experienced a growth setback at the start of the second half of 2024, with July-2024 seeing output expand at the weakest rate in the last seven-months. Euro area remained the main source of weakness – with output falling across the currency bloc for the sixteenth month in a row – sharp growth slowdowns in China and the US alongside renewed contraction in Japan also contributed to the slowdown at the global level.

Global commodity prices have started reflecting the global demand supply dynamics, irrespective of extension of supply cuts from OPEC+, brent continues to remain below 80$/bl as China, the biggest importer of crude oil faces economic uncertainty and weakness.

Interest rate differential with US and domestic inflation issues has weighed down on Asian currencies especially China and Japan. With Bank of Japan’s recent move to hike its benchmark rate, it has been supportive of its currency. Japan’s inflation problem and changing monetary dynamics is expected to trigger some shift in the global flows.

Domestic Economy-

Union budget was the key event in the month of July-2024 which triggered a positive bias for India’s fixed income markets. The Union Budget judiciously used the fiscal space created by the RBI dividend, to boost revenue expenditure and further enhanced fiscal consolidation (fiscal deficit target 4.9% of GDP v/s 5.1% in interim budget). The budget was non-inflationary with revenue expenditure (as % of GDP) moderating to 11.4% in FY25 from 11.8% in FY24. The Budget remains supportive to the capex cycle, with capital expenditure maintained at 3.4% of GDP.

In line with the budget estimations, the actual run rate for direct tax collection remained robust as on FYTD basis. Indirect tax collections too showed robust growth irrespective of a higher allocation to states.

On the growth front, high frequency indicators in July-2024 reflected softer expansion in economic activity. India’s manufacturing PMI showed a marginal decline in the pace of expansion in July-2024. The continuous increase in the output price index, driven by input and labour cost pressure, remains a concern.

Domestic Inflation-

- CPI inflation in June-24 rose to 5.08% y/y from 4.75% y/y in May-24.

- Food and Beverage inflation rose to 8.4% y/y in June-24 from 7.9% y/y in May-24. Sequentially food and beverage inflation increased by 2.7% m/m in June-24.

- The pickup in food prices was led by a sharp increase in vegetable prices (14.2% m/m), pulses (2.5% m/m) meat and fish (2% m/m), and eggs (2% m/m).

- Core (ex-food fuel) CPI stood at 3.13% y/y in June-24. Sequentially core inflation increased by 0.1% m/m in June-24.

- Headline inflation picked up above 5% in June-24 led by a sharp pickup in food prices. Whereas core inflation remained closer to historical lows. Going forward, in July- 24 and Aug-24, headline inflation numbers are expected-to remain supported by favourable base.

- Although July inflation is expected to see another pass through of higher vegetable prices and tariffs hikes, the headline is expected to track sub 4%.

Liquidity –

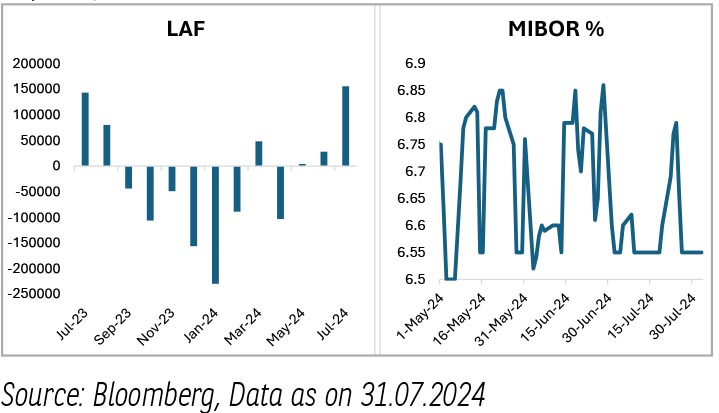

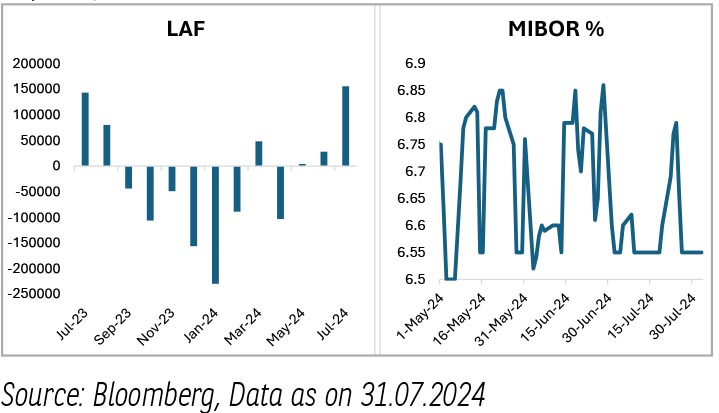

- System liquidity conditions remained comfortable and in surplus zone in July-2024. Barring the GST-led outflow days, most of July has witnessed the overnight rates trading below the Repo rate, even as the RBI continues to conduct Variable Reverse Repo Rate (VRRRs).

- Liquidity conditions are expected to improve further led by month-end government spending.

- This quarter, we expect continued government spending, minimal currency leakage and FX intervention to keep liquidity conditions very comfortably in surplus zone, thereby providing room for further easing in the money market rates.

INR movement was dictated by two key variables:

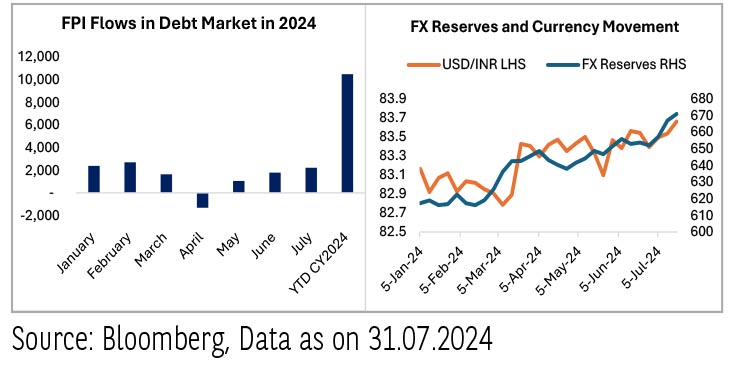

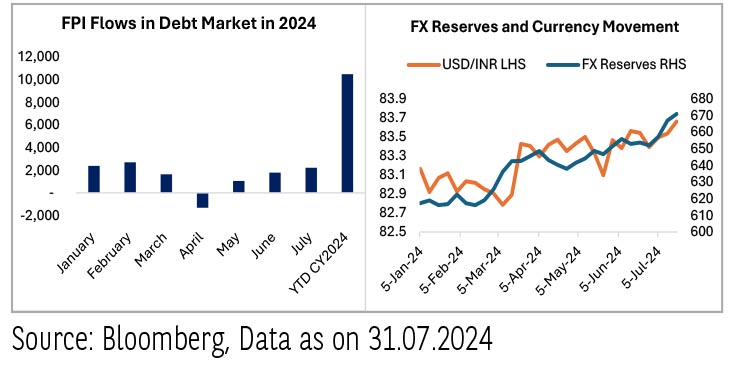

- FPI flows – FPI flows remained robust in July-2024 at $5.8 bn., this was further reflected in dual approach by RBI to increase FX reserves and support rupee.

- Pressures from Asian Currency – Spillovers from pressure on Asian currency was reflected in rupee depreciation to 83.7 levels.

- Despite volatility triggered by spillovers over market expectations relating to the future course of monetary policy and a fluctuating US dollar (DXY), the rupee is trading in a tight range.

Fixed Income outlook -

- Global growth has started showing signs of elevated interest rate scenario, with US economy showing signs of normalization and China growth still finding it difficult to find stability.

- Global yields have started pricing in changing monetary policy dynamics with China’s 10-year benchmark yield softening to its lowest.

- India’s position continues to show robust growth and stable yield currency movement.

- Recent announcement in FY25 Union budget saw positive pulses for India’s fixed income market with government thrust on qualitative expenditure along with confidence on fiscal consolidation.

- Net borrowing numbers decline by ~17,000 crores and we expect some more downside to the same.

- The fiscal deficit at 4.9% and next year’s fiscal deficit vision of 4.5% by the government instills faith in government’s seriousness towards debt management and its outlook on sovereign ratings.

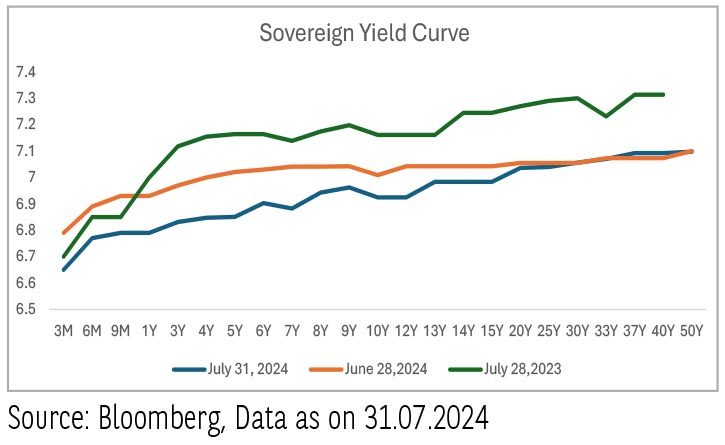

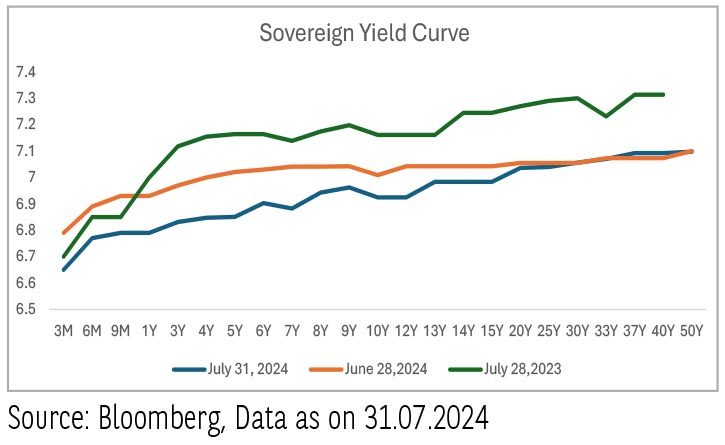

- In last one month yield curve steepened due to comfortable liquidity situation and robust inflows from FPI which is evident from the graph

- We expect the current yield curve to see an intercept shift across the curve with tailwinds from JP morgan index inclusion.

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) (formerly BNP Paribas Asset Management India Private Limited), makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future.