Nifty took a breather in July as weak corporate earnings, uncertainty around a potential trade deal with the US weighed on markets. On 30th July President Trump announced 25% tariffs on India along with additional penalty which further impacted markets. On the positive side, India signed the ‘Free Trade Agreement’ (FTA) with the UK. This deal will boost some key sectors such as textiles, leather, footwear, sports goods and toys, marine products, gems and jewellery, engineering goods, auto parts and engines, and organic chemicals.

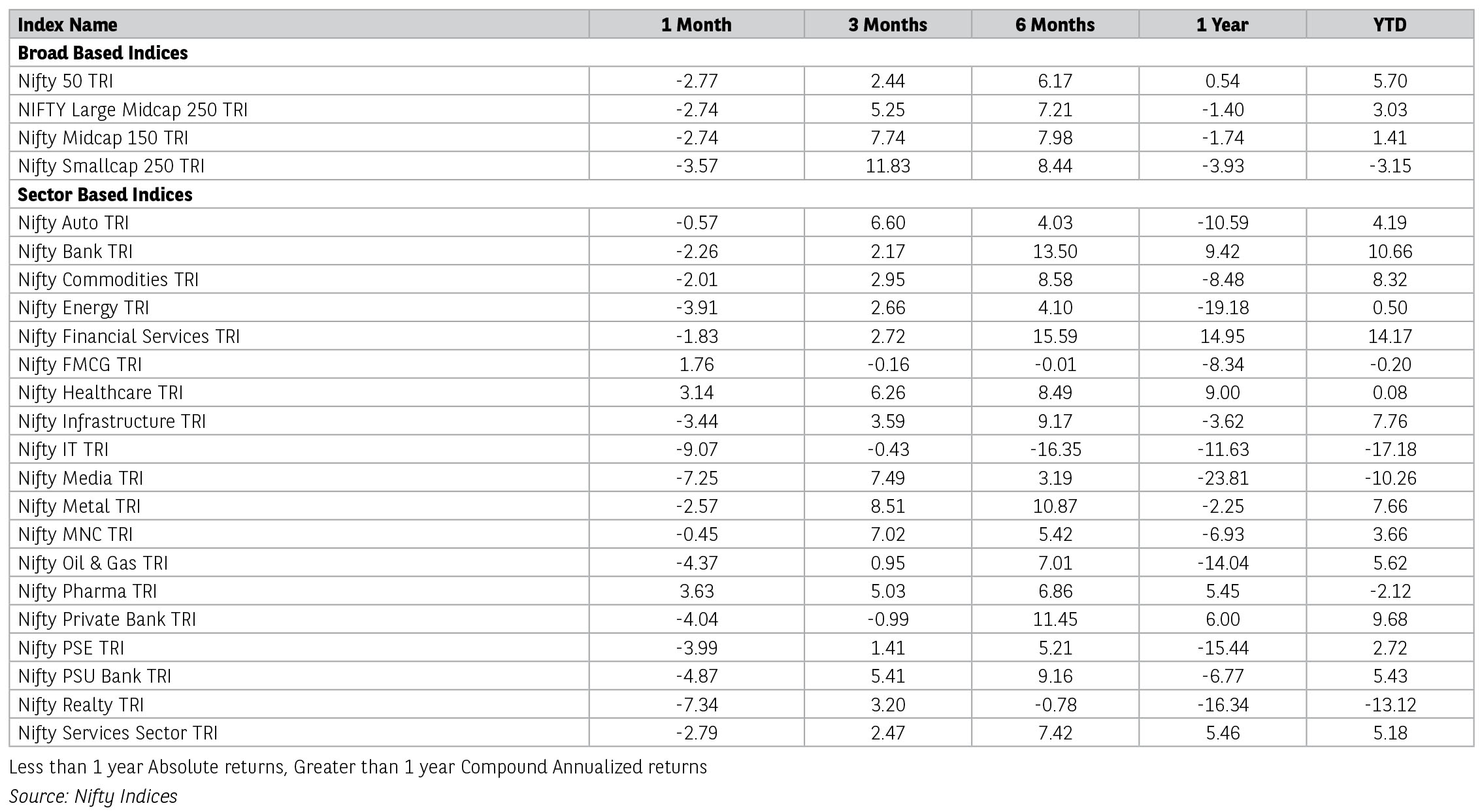

The mid and small cap index underperformed the broader market with Nifty Small Cap 250 Index declining by 3.7% and Nifty Midcap 150 Index by 2.9% for the month. Sector-wise most sectors ended in red barring BSE Healthcare (+2.5%) and BSE FMCG (+1.6%), with BSE IT declining 8.7% followed by BSE CAP (-5.7), OIL (-3.8%), Metals (-2.6%), Banks (-3.2%), Consumer Discretionary (-1.5%) and Consumer Durables (-0.5%).

Given the uncertainty on tariffs and weak earnings, FPIs have turned net sellers after positive flows for the past 4 months. FPIs sold to the tune of USD 2.1bn in July, and overall net selling of USD 10.3bn for calendar year 2025. Some of the emerging market like South Korea (+USD 4.5bn) and Taiwan (+USD 7.8bn) continued to see positive flows for third consecutive months. Brazil saw outflow of USD 1bn, followed by Indonesia (-USD 435mn) and Malaysia (-USD 201mn).

The Federal Open Market Committee (FOMC) maintained its range for interest rate at 4.25-4.5% and indicating that it still expects two rate cuts this year, though the outlook is more uncertain. The Fed also expects inflation to pick slightly this year to 2.7% from the current level of 2.5%. For Q2CY25 US GDP grew better than expected at 3% which was aided by increased consumer spending. With threats of tariffs on countries buying Russian oil by President Trump, Brent increased by ~6% in the last week of July to $72.55.

Domestically, corporate India has started reporting its quarterly results. Companies have reported lower than expected sales and EBITDA (Earnings before interest, taxes, depreciation and amortization). Earnings continue to grow at mid-single digits on YoY basis. While sales for IT companies have been in line, they are facing challenges on the EBITDA margin. In the BFSI space, while Net Interest Margin (NIM) compression was expected, most companies reported higher slippages, i.e. rise in non-performing assets, led by MSME and Microfinance (MFI) sector, indicating stress in credit quality in this segment. Capital market companies continue to perform well. Consumer companies reported inline results with pick up in rural spend and some traction in urban consumer spends.

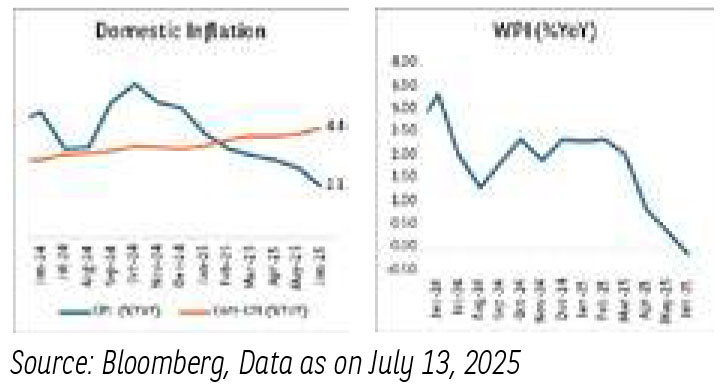

CPI inflation continues to decelerate at 2.1% in June as against 2.8% in May, as food prices moderate. India Services Purchasing Managers’ Index (PMI) inched up to 10 months high at 60.4 in June as against 58.8 in May. Continued strength in domestic market aided service companies, along with increase in export business. Manufacturing PMI rose to 14 months high of 58.4 in June (57.6 in May), led by intermediate goods makers, with slowdown in the consumer and capital goods segment. June also saw quicker upturn in new order inflow.

Monsoons continue to be above normal with good rainfall in the last week of July leading to cumulative rainfall surplus of 7% above normal. For the season till July end, cumulative rainfall was 467.8mm against normal of 437.2mm. A healthy monsoon and pick-up in sowing will be key for rural demand pick-up.

After rallying almost 7% in the 1HCY25, Indian markets have taken a pause in the month of July with overall Nifty 50 rally for CY2025 coming down to 3%. Key to watch would be increase in consumption given favourable monetary policy by RBI, Personal tax cuts announced in Budget and better than expected monsoons. Key challenge though is US tariffs where uncertainty remains, though impact could be lower given exports to US forms only 18% of overall exports for India. Valuations are now reasonable, and earnings are expected to pick up in 2nd half led by favourable base and early and well spread out of festivals in 2HFY2025-26.

Source: Bloomberg, Kotak Securities, B&K Securities. Data as of July 31, 2025. Kindly refer to the last page of the factsheet of Baroda BNP Paribas Mutual fund for the month ending July 2025 for disclaimers.

Global Economy –

Global economic activity remained fluid in July-2025, while awaiting clarity on trade tariffs. While some countries like Japan, EU, Vietnam, Indonesia have entered trade deals with US but the impact of the new trade negotiations are yet to play out. The volatility and uncertainty regarding the trade tariffs have reduced since the effective tariff rates have been lower than announced in April-2025. International Monetary Fund (IMF) in its latest world economic projections, have revised the global growth projections on the upside to 3% from earlier estimated 2.8% led by stronger-than-expected front-loading in anticipation of higher tariffs; lower average effective US tariff rates than announced in April-2025 and an improvement in financial conditions. Global currencies markets have witnessed a depreciating dollar in June-25, but saw the reversal in July with dollar index back to 99 levels.

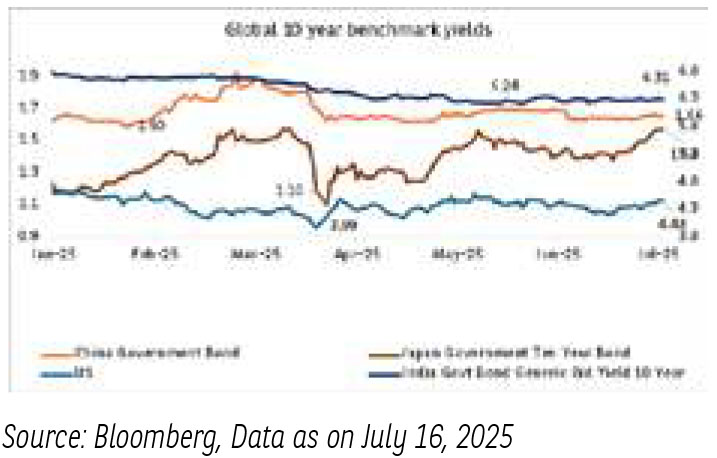

FED in its July FOMC meeting delivered another pause keeping the Federal fund rate at 4.25-4.50%. The overall tone of the policy was slightly hawkish as concerns on tariff related inflation risks continued to cloud Fed’s decision. The FED highlighted some pass through of tariff related hikes to be visible in inflation data but the key question is whether the pass through will affect inflation in the medium term.

Global Inflation has started to moderate, now averaging 4.2%. It remains elevated in the U.S., and consumer prices are beginning to be affected by the recent tariffs and dollar depreciation, particularly in goods that are sensitive to imports. In contrast, Europe and China have experienced more subdued price pressures due to slower consumption and fiscal support. Also, energy markets have been relatively less volatile this month.

However, geopolitical tensions do still remain high this month. In particular, the Iran-Israel conflict and ongoing conflicts in Ukraine continue to pose serious risks, with any escalation potentially disrupting shipping routes and supply chains and triggering fresh inflationary shocks. Due to these tensions, major economies are treading carefully.

Domestic Economy-

Domestic economic activity held up in June-July-2025, with highfrequency indicators pointing to improving prospects of rural outlook with positive kharif agricultural season. On the urban front continuation of strong momentum in the services sector supports overall outlook. High-frequency indicators displayed a mixed picture showing a clear divide between urban and rural economic activity.

Auto sales saw a sluggish month with respect to sales in June- 2025. Looking deeper, passenger vehicle sales contracted by 7.4% y/y in June-2025, followed by two wheelers contracting by 3.4% y/y. Auto sales reflect a sluggish urban demand whereas rural demand continues to remain robust with tractor sales clocking in a 10.5% y/y growth in June-2025. Credit growth too witnessed a slowdown. Credit growth has slowed to a 3-year low. RBI’s support and government’s fiscal push is expected to reflect with a lag with transmission of rate cuts.

India received ‘above normal’ rainfall during the first half of the current monsoon season at 106% of long period average. This has allowed crop sowing operations to expand by 4% over last year.

External sector continues to remain volatile, latest tariffs on India remained around 25%, similar to what was announced in April-25. US has about 20% of total weightage in India’s export basket. Overall expectations are the current tariffs can lower India’s GDP by 0.2 bps as India’s exposure to US tariffs remains relatively moderate with exports to US accounting for 2% of GDP.

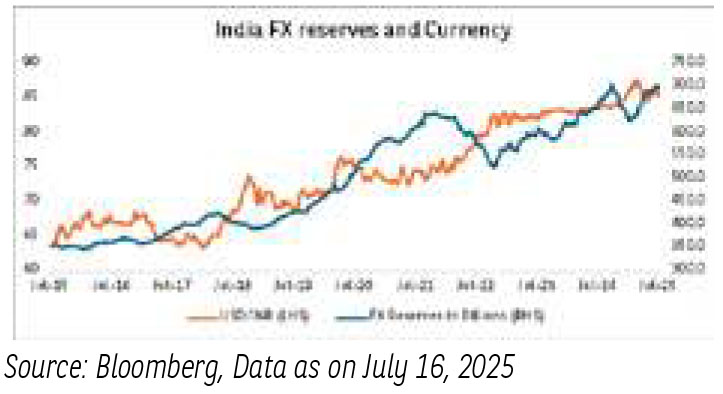

Against these external headwinds, RBI has been adding to the forex (FX) buffer. India’s FX reserves increased to $700 bn. in July-25 as INR stabilized and domestic liquidity concerns faded.

Despite global uncertainties, the Indian economy remains largely resilient, supported by strong macroeconomic fundamentals. The front-loading of government expenditure, healthy fiscal indicators and lower inflation and faster transmission of rate reductions are expected to support economic growth in FY 2026.

Domestic Inflation-

- Headline CPI slowed further in June-25, to 2.1% y/y from 2.8% y/y in May-25, lowest since Feb-19. The decline in headline inflation is led by lack of seasonal pickup in food prices and a favorable base.

- The domestic inflation trajectory remains favorable, driven by moderating food price, timely monsoons and a healthy crop output, as well as benign commodity prices.

- We expect FY26 inflation to undershoot RBI’s target of 3.7%.

- The favorable base effects are expected to fade in Q4 FY26, irrespective of that, we see space for one more rate cut with the presence of a negative output gap and benign inflation expectation.

Domestic Liquidity -

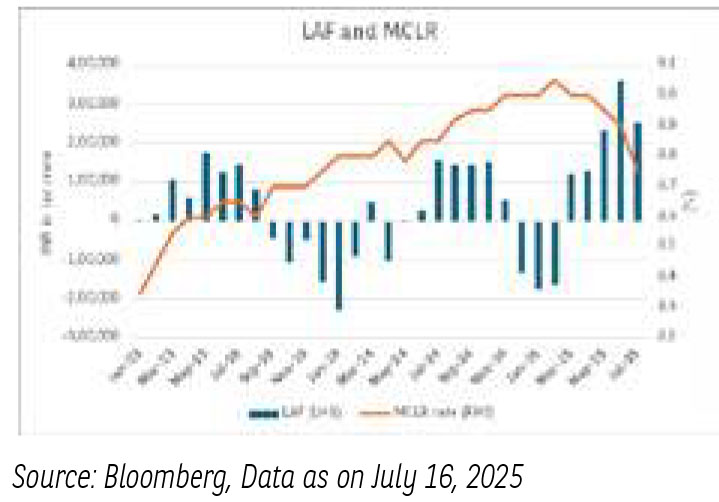

- Banking and durable liquidity are currently comfortable, and financial conditions have significantly improved.

- Banking MCLR tracking the benchmark rates and liquidity reduced to 8.75%, reflecting transmission of rate cuts in the economy.

- Geopolitical tensions have again begun to cloud the global economy.

- Trumps tariff threats and spillovers on currencies is the existing risk that is driving the markets volatile.

- The impact of uncertainty on US inflation and growth will be a key watch on global front.

- The recent softening of employment data in US and downward revision of the same for last two months do indicate softening of growth levels in US. The probability of rate cuts by FED has increased post this data and may be a key monitorable going forward as we get into later part of 2025

- On the domestic front, evolving growth dynamics have taken center stage.

- RBI’s forward guidance and the rate cut gives us the confidence on growth supported future policy expectations.

- Recent softening in domestic inflations paves the way for RBI to take calibrated policy decisions.

- Irrespective of the tools, liquidity measures are expected to have an impact on the short end of the curve.

- The spreads on the short end are elevated and current liquidity expectations make them attractive.

- Recent moves by RBI give us confidence that liquidity will be managed in spirit of the stance.

- RBI had injected INR 5tn through Open Market Operations (OMOs) recently and also cut CRR by 100 bps to aid transmission of rates.

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.

Disclaimers for Market Outlook - Equity: The views and investment tips expressed by experts are their own and are meant for informational purposes only and should not be

construed as investment advice. Investors should check with their financial advisors before taking any investment decisions.

The material contained herein has been obtained from publicly available information, internally developed data and other sources believed to be reliable, but Baroda BNP

Paribas Asset Management India Private Limited (BBNPP), makes no representation that it is accurate or complete. BBNPP has no obligation to tell the recipient when opinions

or information given herein change. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This information is

meant for general reading purposes only and is not meant to serve as a professional guide for the readers. Except for the historical information contained herein, statements in

this publication, which contain words or phrases such as ‘will’, ‘would’, etc., and similar expressions or variations of such expressions may constitute forward-looking statements.

These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the

forward-looking statements. BBNPP undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date thereof. Words like believe/

belief are independent perception of the Fund Manager and do not construe as opinion or advice. This information is not intended to be an offer to see or a solicitation for the

purchase or sale of any financial product or instrument. The investment strategy stated above is for illustration purposes only and may or may not be suitable for all investors.