Month of June 2025 saw heightened volatility, driven by concerns surrounding the Israel-Iran war. While the news of RBI reducing the repo rate by 50bps which was higher than street expectation, led to cheer in the markets, Iran-Israel war and US hinting at increasing tariffs on steel and aluminium imports erased the gains. Since then, US Fed, keeping the rate unchanged with expectation of two rate cuts this year, early ceasefire between Iran-Israel led to uptick in the market.

The mid and small cap index outperformed the broader market with Nifty Small Cap 250 Index rallying by 5.7% and Nifty Midcap 150 Index by 4.1% for the month. Sector-wise most sectors ended in green with BSE Healthcare rallying 3.9% followed by Realty (+3.8%), Consumer Discretionary (+3.5%), IT (+3.3%), Consumer Durables (+3.2%), Oil (+3.1%) and Metals (+3%).

While FPIs remain net sellers Year-to-Date (YTD), they have been net buyers over the past four months, with USD 400Mn of inflows in June 2025. Emerging market saw mixed flows with Taiwan continued to witness highest flows of USD 5bn followed by South Korea (+USD 2bn), Brazil (+USD 758mn).

The Federal Open Market Committee (FOMC) kept the Federal Funds rate steady at 4.25-4.5% for a fourth consecutive meeting in June 2025 while indicating two rate cuts. The Fed also projected increased stagflationary risk and expectation of slower GDP growth at 1.4% (as against 1.7% in March’25) and inflation at 3.1% (as against 2.8% in March’25). Geo-political uncertainty kept the US yields volatile at the start of the month, however with early ceasefire between Iran-Iseral led to softening of yields closing at 4.2%.

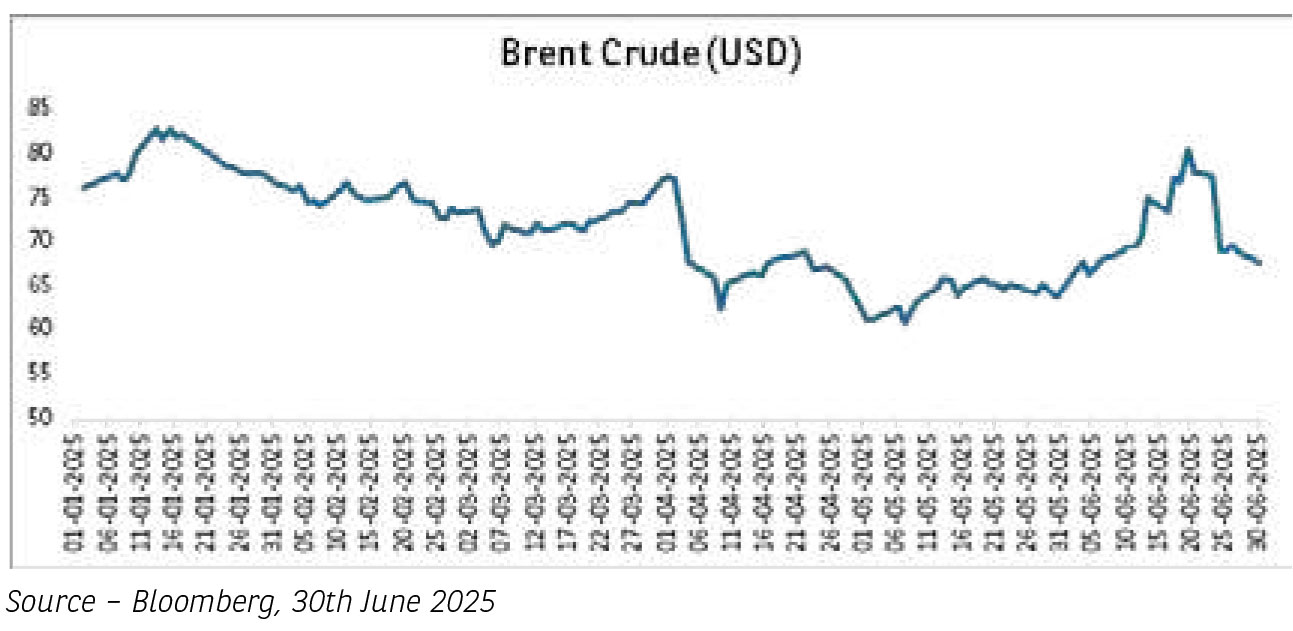

Brent futures rallied in June 2025 from $64 to $81 on rising perception of disruption of oil and product flow with escalation of Iran conflict in Middle East and eased back to $68 with easing of disruption risk after a strike by US and ceasefire announcements.

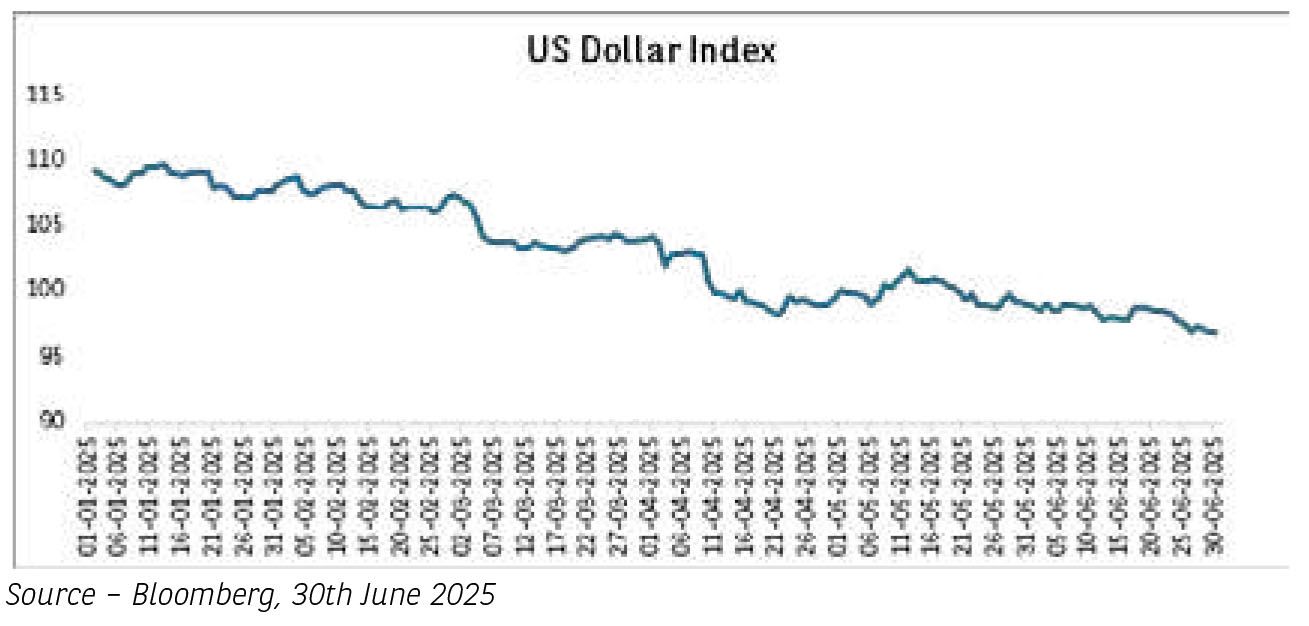

DXY Index (Dollar Index) continued to remain weak since President Trump took charge. While there is still uncertainty over tariffs, President Trump has also announced multi-trillion-dollar spending policy which may increase US debt by ~USD 3tn. These factors have led to DXY falling by 1.9% in the month of June 2025 after falling 3.4% in May 2025. Indian currency was volatile for the month of June 2025 remaining largely flat.

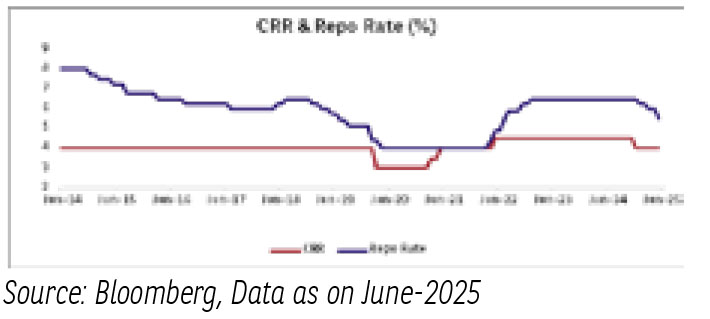

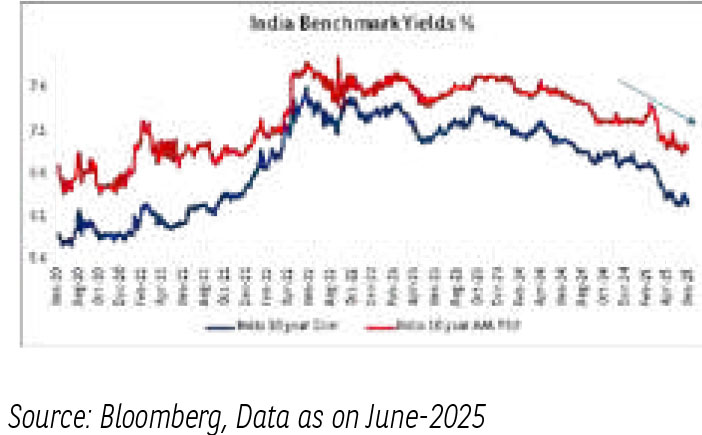

Locally, in the June 2025 policy meet, RBI has cut repo rate by 50bps to 5.5% and changing stance from accommodative to neutral, signalling central banks intent to stimulate credit growth and revive economic activity. RBI also cut the Cash Reserve Ratio (CRR) by 1% with staggered liquidity infusion of INR 2.5tn.

India’s Services Purchasing Managers Index (PMI) stood at 58.8 in May 2025, up from April’s 58.7, marking the fastest expansion since February 2025, as output and new orders continued to rise. Exports posted one of the strongest improvements in international demand in the 19.5 years of data collection. Output price inflation accelerated to a six-month high, as firms passed on rising expenses to clients. CPI inflation further came down to 2.8% in May 2025 as food prices continued to moderate.

India monsoons are picking up well. Till June 27th, 2025, cumulative rainfall was 10% above long-term average while weekly rainfall was 31% above long-term average. On a cumulative basis, rainfall was above normal in north, and west, central and south India while below normal in east India. This augurs well for sowing and pick up in rural activity.

Indian markets have rallied by 9% over the last three months and near all-time highs. Valuations based on one-year forward consensus earnings are currently aligned with their long-term averages. In the near term, however, market movements are expected to be influenced primarily by the first-quarter earnings season. Further appreciation will depend on corporate earnings performance in FY26E. A favourable monetary policy, tax cuts announced during Budget, pick up in capex and favourable monsoon should drive pickup in earnings. The outlook remains optimistic.

Source: Bloomberg. Data as of 30th June 2025. Kindly refer to the last page of the factsheet of Baroda BNP Paribas Mutual fund for the month ending June 2025 for disclaimers.

Global Economy –

Wars, geopolitics and clash of egos, has sent the global economy in a state of uncertainty and unearthing values in different asset classes. The outbreak of the Iran-Israel conflict offset the optimism from a temporary tariff freeze and trade deals bringing back the volatility. Rising trade barriers and restrictions amidst ongoing geopolitical tensions sets the tone for a marked deterioration in the medium-term global economic prospects.

Looking deeper in the month of June we saw shocks to crude oil prices. Brent prices increased ~10% from its slumber. Eventually the prices melted down to its demand supply fundamentals and is range bound around 66-68 $/bl. Gold continues to outshine at above $3300 levels. The volatility in gold prices continue as demand for safe haven assets increased.

Currencies too are now responding to clarity of information regarding the trade deals and tariff and the impact of the same on US economy. Euro and Yen have witnessed appreciation bias whereas dollar index continued the decline. Dollar index declined from 99 to 96 levels as US economic strength comes under scrutiny.

In June FOMC meeting, as widely expected, Fed kept its policy rate unchanged at 4.25-4.5%, with the dot plot suggesting lesser cuts going forward as uncertainty remains high. The key reason being tariffs driving higher inflation expectations despite lower growth expectations with a marginal rise in unemployment. Fed however feels that the economy is a solid shape to absorb tariff related growth shocks, but it is the inflation that keeps it from lowering rates. Contrary to the same, the open conversations by Trump on lower rates have built in rate cut expectations, keeping the bond markets jittery.

Domestic Economy-

Growth indicators exhibit a modest recovery led by domestic demand. Macro stability indicators have improved, increasing flexibility for policy makers. Uncertainty from external conditions continues to weigh on growth, even as India appears better placed on a relative basis.

High frequency indicators displayed a mixed picture of the economic activity in June. India’s manufacturing PMI rose to a 14-month high of 58.4 in June-2025, up from 57.6 in May-2025. The survey highlighted quicker upturn in new order inflows particularly from international markets. On the contrary, Passenger vehicles wholesale sales declined 9% YoY in June- 2025. Tractor sales remained stable. GST collections remained resilient at INR 1.85trn.

RBI in its June-2025 policy included a series of announcements starting from a rate cut of 50bps (market expected 25bps as consensus), to shift in stance from ‘accommodative’ to ‘neutral’ and then a surprise CRR rate cut of 100bps in four tranches of 25bps each. The change in stance also signals no further rate cuts. The CRR rate cut indicates that the liquidity conditions will remain encouraging for the transmission of rate cuts.

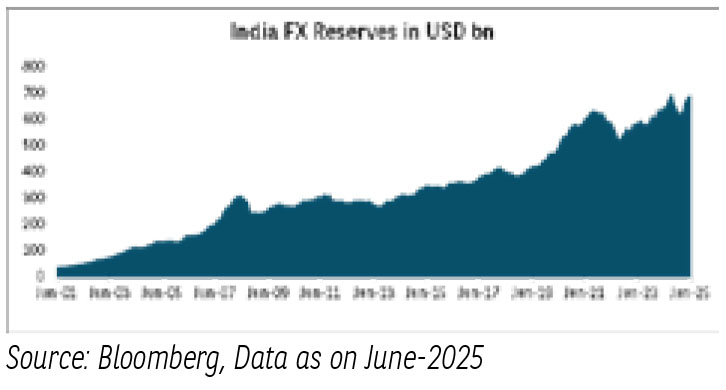

India’s foreign exchange reserves stood at US$699 billion, providing a cover for more than 11 months of goods imports, and for 97% of external debt outstanding at end December 2024.

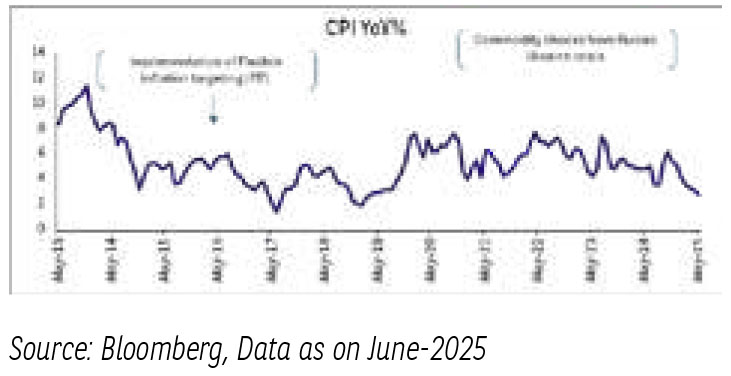

Domestic Inflation-

- Headline CPI slowed further to 2.8% YoY in May from 3.2% in April, the lowest since Mar-19.

- Food CPI hit a 43-month low of 1% YoY in May (vs. 1.8% in April), partly due to base effect and sharper-thananticipated moderation in food prices.

- While the trend in high-frequency food prices for June (MTD) remains mixed on a sequential basis, food prices remain benign at the aggregate level – especially compared to the previous year.

- We expect this trend of benign inflation readings to continue supported by favorable outlook for crop production and lack of upside pressures from nonfood inflation.

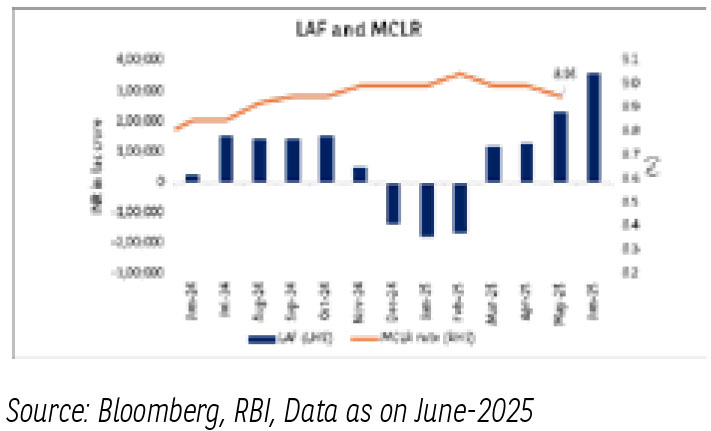

Domestic Liquidity -

- Banking and durable liquidity are currently comfortable, and financial conditions have significantly eased in past four months.

- RBI delivered a CRR rate cut of 100bps in four tranches of 25bps each, bringing the CRR rate to 3%.

- The move has been a liquidity bonanza with the CRR cut expected to provide a liquidity boost of ~2.5 lac crore by December-2025.

- Going into June policy the core banking system liquidity was in surplus to the tune of INR 5-6 trn., still RBI decided to infuse further liquidity by CRR cut of 100 bps adding another INR 2.5 trn to the banking system liquidity.

- We believe this is largely to offset FX forward maturities, currency leakages during the festive season and advance tax outflows in Q2 FY26.

- Changing the stance to neutral indicates the market that the operational overnight rate may remain closer to repo rate hence market factoring an operational rate to be around 5.40-5.50% instead of previously expected 5.25%.

- This has hardened the short end of the curve by 10-15bps compared to pre policy levels.

- However, due to flush of liquidity provided by RBI the spreads post correction may remain anchored going forward.

- Geopolitical tensions have again begun to cloud the global economy.

- Trumps tariff threats and spillovers on currencies is the existing risk that is driving the markets volatile.

- The impact of uncertainty on US inflation and growth will be a key watch on global front.

- On the domestic front, evolving growth dynamics have taken center stage.

- RBI’s forward guidance and the rate cut gives us the confidence on growth supported future policy expectations.

- Recent softening in domestic inflations paves the way for RBI to take calibrated policy decisions.

- Irrespective of the tools, liquidity measures are expected to have an impact on the short end of the curve.

- The spreads on the short end are elevated and current liquidity expectations make them attractive.

- Recent moves by RBI give us confidence that liquidity will be managed in spirit of the stance.

- RBI had injected INR 5tn through OMOs recently and also cut CRR by 100 bps to aid transmission of rates.

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.

Disclaimers for Market Outlook - Equity: The views and investment tips expressed by experts are their own and are meant for informational purposes only and should not be

construed as investment advice. Investors should check with their financial advisors before taking any investment decisions.

The material contained herein has been obtained from publicly available information, internally developed data and other sources believed to be reliable, but Baroda BNP

Paribas Asset Management India Private Limited (BBNPP), makes no representation that it is accurate or complete. BBNPP has no obligation to tell the recipient when opinions

or information given herein change. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This information is

meant for general reading purposes only and is not meant to serve as a professional guide for the readers. Except for the historical information contained herein, statements in

this publication, which contain words or phrases such as ‘will’, ‘would’, etc., and similar expressions or variations of such expressions may constitute forward-looking statements.

These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the

forward-looking statements. BBNPP undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date thereof. Words like believe/

belief are independent perception of the Fund Manager and do not construe as opinion or advice. This information is not intended to be an offer to see or a solicitation for the

purchase or sale of any financial product or instrument. The investment strategy stated above is for illustration purposes only and may or may not be suitable for all investors.