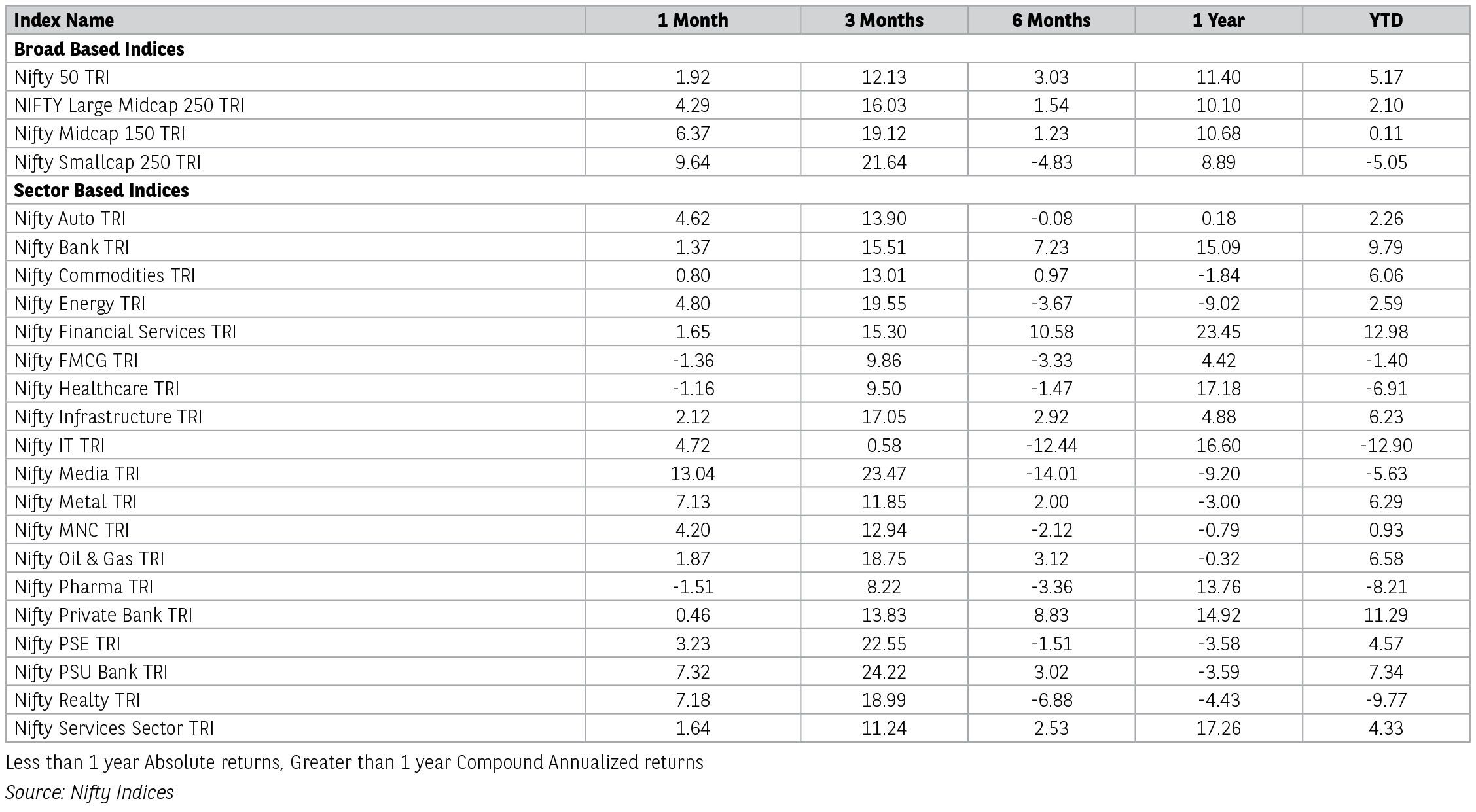

Indian markets after outperforming some of the developed and Asian markets for the past 2-3 months, have underperformed in the month of May 2025, with Nifty 50 seeing modest growth of 1.7%. S&P 500 rallied 6.2%, Nasdaq by 9.6% in May 2025. Some of the Asian markets also outperformed with Hang Seng and Nikkei 225 up by 5.3% each and SSE Composite (Shanghai Stock Exchange) by 2.1%.

The mid and small cap index outperformed the broader market with Nifty Small Cap 250 Index rallying by 9.6% and Nifty Midcap 150 Index by 6.3% for the month of May 2025. Sector-wise all sectors ended in green barring BSE FMCG (-0.7%). Capital goods saw the most rally up by ~13% for the month of May 2025, followed by Realty (7.2%), Metals (5.9%), Auto (4.7%), Healthcare and Consumer Durables each by 0.9%.

After pumping in USD 1.3bn in the Indian equity market, FPIs have continued its buying trajectory with net buying of USD 2.3bn in May 2025. This can be attributed to weakening US dollar, up-tick in corporate earnings, easing of tension between India-Pakistan. Some of the emerging markets which saw massive outflows in April 2025 have turned positive with Taiwan witnessing inflows of USD 7.6bn, followed by Brazil (+USD 2bn), South Korea (+0.9bn).

For the first time on over a century, Moody’s downgraded US government’s credit rating from AAA to AA1, citing government’s prolonged failure to manage its debt. This also kept the US yields volatile with 10-yr Treasuries hitting high of 4.61% and ended at 4.4%. Although the concerns of US imposing high tariffs on China have eased down, the fiscal situation in the US will be a risk for the US yields. Barring India and China, government bond yields of other economies have also risen in the last few months with concerns over inflation due to US tariffs. With the recent rise in yield’s, Japan is considering trimming issuance of super long bonds.

DXY Index (Dollar Index) has remained largely flat for the month of May 2025 as the US-China tariff was eased out, however it has depreciated almost 9% since January 2025. Federal reserve kept interest rates unchanged during its March FOMC meeting with dovish stance and signalling two rate cuts in 2025. On currency side, Indian currency was the most impacted amongst Asian countries, with rupee depreciating 1.3%, compared to South Korea (+3.3%), Indonesia (+1.7%), Japan (-0.6%), Vietnam (-0.2%) respectively.

US Consumer sentiment showed a positive rebound after five consecutive months of decline. The Consumer Confidence Index rose by 12.3% to 98, aided by temporary pause in trade war between US-China. However, business sentiment appeared more fragile. New orders for key US manufactured capital goods specifically, non-defence capital goods excluding aircraft plunged 1.3% in April 2025, marking the steepest drop in six months and reflecting growing economic uncertainty linked to tariffs. This followed a revised 0.3% gain in March 2025.

Japan’s headline inflation data remained steady at 3.4%, core Consumer Price Index (CPI) rose more than expected, reaching two year high of 3.6% YoY, up from 3.4% in April 2025. Japan’s Industrial production contracted by 0.9% MoM in April 2025— less than the forecasted 1.4% decline, yet reversing a 0.2% rise seen in the previous month. GDP contracted by 0.7% on back of weakening exports due to tariff related disruptions and sluggish private consumption

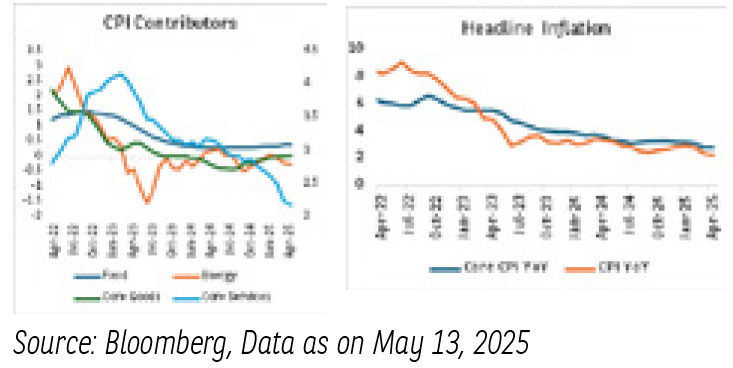

India’s headline CPI inflation stood at 3.16% as against 3.34% in March 2025. Vegetable prices declined leading to 2.14% YoY decline in food and beverage inflation. Fuel and light inflation increased by 2.9% YoY in April 2025, which can be attributed to increase in LPG prices.

India’s Q4FY25 GDP grew by 7.4% YoY, which was higher than expected, led by gross fixed capital formation and sharp contraction in imports. Growth in consumption was subdued with private consumption growing at 6% YoY and government consumption declining 1.8%. RBI has lowered its projection for CPI inflation to 4% from 4.2% for FY26. It has also lowered its GDP growth guidance to 6.5% for FY26 from 6.7% earlier due to tariff related tension and resultant global uncertainty. Recently RBI has also announced INR 2.69tn to the centre as dividend, higher than the budgeted level of INR 2.1tn.

On the recent earnings season, Q4FY25 PAT for Nifty-50 saw growth of ~3% YoY, which was above the street expectations. Nifty reported a single-digit profit growth for the fourth successive quarter since the pandemic (June 2020).

Amid uncertainty on tariffs, we continue to remain cautiously optimistic on markets as we expect rural consumption to pick up led by tax cuts and expectation of normal monsoon. Nifty valuations remain in-line with its long-term average.

Source: Bloomberg. Data as of 31st May 2025. Kindly refer to the last page of the factsheet of Baroda BNP Paribas Mutual fund for the month ending May 2025 for disclaimers.

Global Economy –

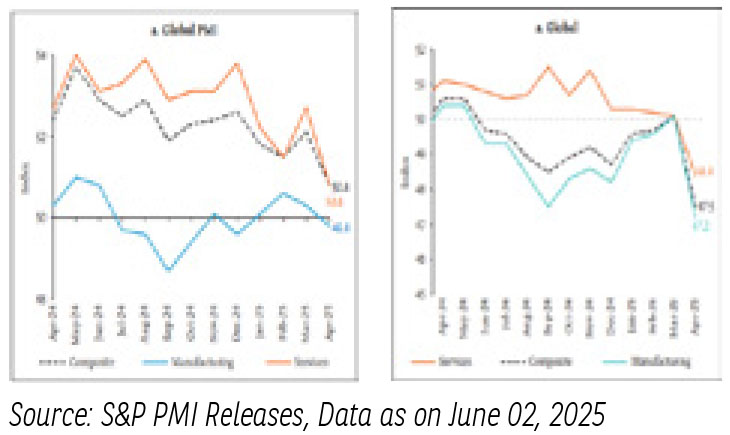

A precautious stance in global economic activity has started to build around the world. Persistent trade frictions and uncertainty regarding policy moves have been the key contributors for it. The first line of impact has been on global manufacturing and goods activity in April-2025 with S&P Global manufacturing PMI contracted in April-2025 from expansionary zone in March-2025, reflecting sluggishness in new orders and exports growth. Early indications for the major developed economies showed Eurozone, Japan and UK all reported slight falls in business activity.

Concerns on the actual impact of trade on US inflation and growth has led to heightened uncertainty and volatility across market US yields. The yield on the US 10-year Treasury note held above 4.4% in April-2025, led by global trade tensions. On the other hand, the US dollar faced depreciating pressures amidst rising trade policy uncertainty and ebbing investor confidence, with other AE currencies witnessing notable appreciation.

In an uncertain and volatile macro-financial environment, monetary policies have turned cautious with many central banks maintaining status quo or resorting to pre-emptive but measured easing of policy rates to cushion the impact of trade disruptions on growth.

Domestic Economy-

The Indian economy is exhibiting resilience despite the high trade and tariff-related uncertainty. The recent released FY25 and Q4 FY25 GDP growth numbers show India GDP growth in Q4 FY25 at 7.4% higher than consensus estimates of 6.8%, however, GVA growth registered a slightly lower print, at 6.8% y/y. The surprise was led by a sharp increase in net indirect taxes at 12.7% y/y likely on account of lower subsidy payouts, thus widening the gap between GDP and GVA. Nominal GDP growth stood at 10.8% y/y in Q4 FY25. On an annual basis, FY25 GDP grew by 6.5% y/y vs. 9.2% in FY24.

Q4 FY25 GDP numbers reflected a positive surprise with internals better than anticipated. Strong push on capex and lower drag from net exports reflected in the stronger print. Overall, the dip of Q2 FY25 is behind us, and overall recovery has been broad based, especially in the rural economy. A robust rabi season has been supportive of rural consumption.

Various high frequency indicators of industrial and services sectors sustained their momentum in April. Record goods and services tax (GST) collections in April-2025 also reflect the underlying resilience of the economy. A bumper rabi harvest and higher acreage for summer crops also augur well for agriculture sector.

Net investments by foreign portfolio investors (FPIs) also rebounded in the second half of the month on the back of improving domestic market sentiments. Reflecting these, the Indian rupee moved within a narrow range and exhibited lower volatility compared to peer economies.

Domestic Inflation-

- The softening of food basket is a welcome development for headline inflation.

- Looking forward, the inflation trajectory remains positive and aligns with RBI’s target range, we estimate inflation to average around 4-4.2% in FY26, with expectations of a normal monsoon based on Indian meteorological department (IMD’s) first projection.

- Secondly, there is a weak global outlook that caps crude prices to limited volatility. Current decline crude prices remain positive for India’s import inflation. Inflation at 3.16% builds an argument for deeper rate cuts.

Liquidity and Rates –

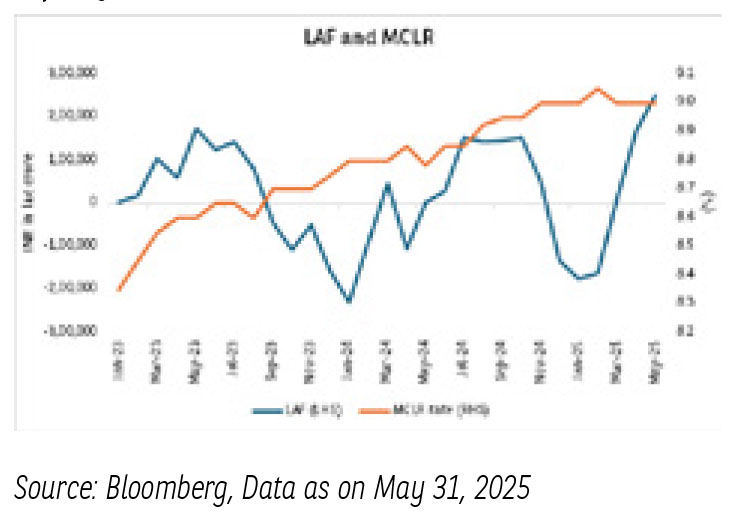

- Banking and durable liquidity are currently comfortable, and financial conditions have significantly improved in past four months.

- RBI announced Open Market operations (OMO) purchase of INR 1.25tn for the month of May-25, taking total OMO purchase in FY26 to INR2.45tn.

- RBI liquidity management is focused on faster and more effective transmission of rate cuts.

- Going forward, we expect liquidity to remain in surplus over the next few months, with the flow of funds to the banking system to increase led by RBI dividend transfer (2.6trillion).

- Global monetary policy dynamics have started witnessing bumps in their path to recalibrate the monetary rates.

- The decline in the dollar index and US growth will be a key watch.

- Trumps tariff threats and spillovers on currencies is the existing risk that is driving the markets volatile.

- On the domestic front, evolving growth dynamics have taken center stage.

- RBI’s forward guidance and the rate cut gives us the confidence on growth supported future policy expectations.

- Recent softening in domestic inflations paves the way for RBI to take calibrated policy decisions.

- Having said that external headwinds continue weigh on INR which will have spillovers over domestic liquidity.

- RBI has been and is expected to continue infusing liquidity through OMO, FX swap in essence of the monetary policy stance.

- RBI’s dividend is expected to keep the domestic liquidity in surplus.

- Irrespective of the tools, liquidity measures are expected to have an impact on the short end of the curve.

- The spreads on the short end are elevated and current liquidity expectations make them attractive.

- Recent moves by RBI give us confidence that liquidity will be managed in spirit of the stance.

- Having said that, the fundamentals of India’s fiscal demand supply remain balanced and that is expected to maintain a downside bias on yields.

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) (formerly BNP Paribas Asset Management India Private Limited), makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.

Disclaimers for Market Outlook - Equity: The views and investment tips expressed by experts are their own and are meant for informational purposes only and should not be

construed as investment advice. Investors should check with their financial advisors before taking any investment decisions.

The material contained herein has been obtained from publicly available information, internally developed data and other sources believed to be reliable, but Baroda BNP

Paribas Asset Management India Private Limited (BBNPP), makes no representation that it is accurate or complete. BBNPP has no obligation to tell the recipient when opinions

or information given herein change. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This information is

meant for general reading purposes only and is not meant to serve as a professional guide for the readers. Except for the historical information contained herein, statements in

this publication, which contain words or phrases such as ‘will’, ‘would’, etc., and similar expressions or variations of such expressions may constitute forward-looking statements.

These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the

forward-looking statements. BBNPP undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date thereof. Words like believe/

belief are independent perception of the Fund Manager and do not construe as opinion or advice. This information is not intended to be an offer to see or a solicitation for the

purchase or sale of any financial product or instrument. The investment strategy stated above is for illustration purposes only and may or may not be suitable for all investors.