FPI flows were positive to the tune of USD 500mn, 2nd consecutive month of positive flow. Domestic Institutional Investors (DII) flows continue to be positive with flows of USD 7.8bn. FPI ownership is now at all-time low of 16% -a 20-year low. FPI also withdrew money from other markets such as South Korea, Taiwan, Malaysia.

On the global side, the Federal Reserve delivered a second consecutive 25 bp rate cut, lowering the Fed Funds target range to 3.75–4%, and announced the end of Treasury runoffs starting December 1st. However, Chair Powell used the post-meeting press conference to indicate lower certainty of rate cuts in December meeting. Consequently, expectations for December rate cuts are lower and a key monitorable for global markets.

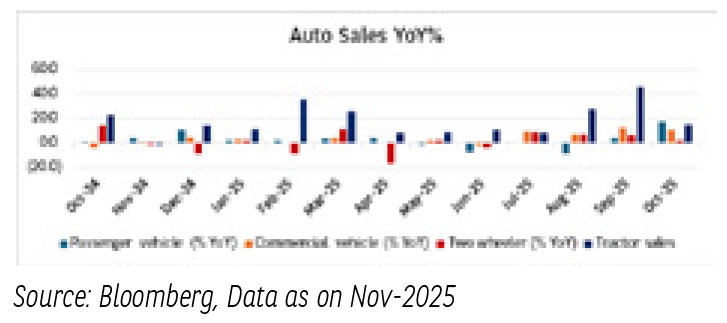

Domestically we had several events. Bihar election saw a clear majority mandate for NDA. Cash transfer schemes and fiscal measures such as tax cuts and GST cuts should boost consumption. With a few key elections due next year- Bengal and Tamil Nadu (2026), UP (2027), election spending may drive consumption in these states.

India’s GDP print of 8.2% for Q2 FY26 surprised on the upside with GVA (Gross Value Added) at 8.1%. Growth was driven primarily by Manufacturing and Services on the production side. On the expenditure front, private consumption and investments were the key contributors. Nominal GDP growth, in Q2, stood at 8.7%, just 0.5 percentage point above real GDP growth, highlighting the impact of soft inflation.

Credit growth accelerated to 11.3% yoy in October 2025, the highest in 10 months, signalling a positive inflection for bank earnings. Growth was driven by a robust 27% yoy increase in MSME loans (Micro, Small, and Mid Enterprises) and a 14% yoy rise in personal loans, the strongest in 15 months. Notably, unsecured personal loans increased to 12.4% yoy, reflecting banks’ increased risk appetite. Bank valuations are supported by declining delinquency rates in unsecured loans.

We are through the corporate earnings season. Sales of Nifty 500 companies grew by 6% yoy, EBIDTA grew by 17% yoy, while PAT growth was 15%. This was largely driven by the Nifty Next 50 and midcaps followed by Nifty 50 and the small caps. Overall result season was better than expected with consensus upgrading the Nifty 50 earnings by about 2.5%. Earnings seem to have stabilized and we are past the earnings cut cycle which we witnessed over the last few quarters.

Indian market valuations trade at its long-term average of 21x and with expectations of accelerated growth from 2HFY26 onwards, valuations can see re-rating. After Indian markets having underperformed significantly to Emerging markets, FPI ownership being at an all-time low, and with some reversal of AI trades and earnings likely to pick up; both fundamentals and technical factors are aligned for better performance of the Indian markets.

Source: Kotak Securities, Bloomberg. Data as of November 30, 2025. Kindly refer to the last page of the factsheet of Baroda BNP Paribas Mutual fund for the month ending November 2025 for disclaimers.

Global Economy –

Global market volatility took a breather in November-2025. The overall uncertainty regarding US tariffs came down. Dollar broadly strengthened till early November on increased safe-haven demand amidst the US government shutdown, and lower expectations of Fed rate cut in the December meeting. Currencies like Japanese yen remained volatile conditional on the evolving growth and inflation dynamics. Global commodity prices remained subdued on lower food and crude oil prices. Prices of industrial metals rose on fears of a supply shortage and higher imports by China. Gold prices saw a correction from a record high in mid-October in the second half due to reduced safe haven buying and a stronger dollar.

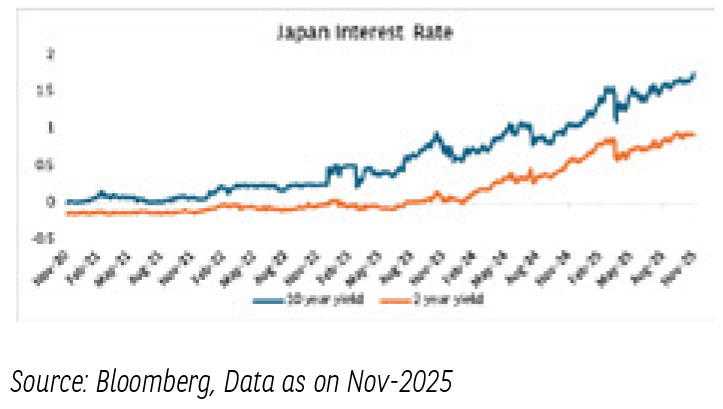

US Treasury yields declined until the third week of October on safe-haven demand, a prolonged government shutdown, and Fed rate cut expectations. US yields, however, edged higher from the end of October on Fed Chair’s comments tempering further rate cut expectations. Japan’s economy witnessed fresh pressures on currencies and rates as concerns on the new Prime Minister Sanae Takaichi’s stimulus package, which is expected to exceed 20 trillion-yen double of last year. The massive spending plan has raised concerns about Japan’s fiscal health, when they haven’t really come out of inflation problem.

Domestic Economy-

The Indian economy showed signs of a further pick up in momentum, despite lingering external sector headwinds. Demand conditions witnessed signs of improvement with the revival of urban demand and continued strength in rural demand.

Policy stimulus both fiscal and monetary (income tax cut and interest rate reductions), good monsoon and lower inflation likely drove momentum in economic activity. Strong corporate earnings momentum due to low commodity prices, the mid-quarter announcement of GST rate cuts also spurred production ahead of implementation. All these factors have contributed to a resilient growth number.

Therefore, India’s GDP growth stood at 8.2% in Q2 FY26 vs consensus at 7.4%, owing to a muted deflator (0.5%). Nominal GDP growth remained subpar at 8.7%. Real GDP surprised on the upside due to the continued outsized impact of the deflator. Lower prices captured as lower deflator likely boosted purchasing power. Private consumption growth at 7.9% y/y outpaced investment growth at 7.3% y/y, while government consumption growth contracted by 2.7% y/y. GVA, which we consider as a better proxy for growth, stood at 8.1% y/y vs consensus at 7.3% y/y. The upside surprise mainly came from services registering growth of 9% y/y in Q2 FY26.

On the trade front, a crucial variable amidst US trade tariffs, India’s merchandise trade deficit widened to an all-time high in October 2025. Exports contracted reflecting the adverse impact from global headwinds, imports surged on account of higher gold and silver imports, catering to the festive demand.

Pressure on INR has been clearly visible with USD/INR depreciating to a new low of 89.9. Lack of visibility on the trade deal is expected to weigh on INR, RBI’s intervention has been low key in fresh pressures.

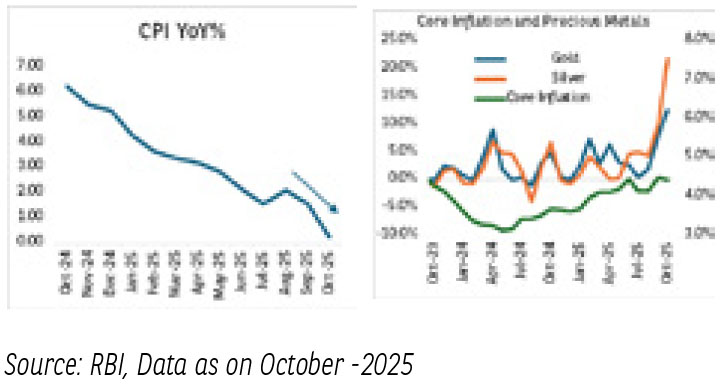

Domestic Inflation –

- Headline CPI fell to 0.25% y/y in October-2025, the series all-time low. The decline was on account of lower food prices, GST cuts past tthrough and favourable base effects.

- CPI inflation is expected to remain benign led by 1) Lower crude oil prices keeping input cost inflation under check 2) High-frequency food prices indicate a continued decline in food prices in Nov-25, Also, from Dec-2025 with the winter food crop arrival, food prices are expected to moderate further.

- With the impact of GST cut higher than anticipated in October itself, the inflation trajectory has softened further with FY26 inflation expected at 2.3%. The space to cut remains open as real rates look optically higher and RBI’s intent to support growth was clearly visible last policy.

Domestic Liquidity -

- Liquidity surplus improved vs October end but by end of November moderated back to 1.7 trn amid continued RBI intervention and lower than expected government spending.

- Accordingly, the weighted average overnight rates rose by 4 bps week on week basis to ~5.41%.

- Going into this week, we expect liquidity surplus to improve amid government spending and as the last leg of the CRR cut impact plays out. Notably, the continued pressure on INR and the consequent FX intervention could continue to impact durable liquidity.

A Shift in US Monetary Dynamics –

- FED in October-25 policy delivered a rate cut and also mentioned end of quantitative tightening.

- Fed governor himself highlighted pressures on overnight rates on selected dates on use of standing repo facility (SRF).

- Secondly, labour market conditions in US have weakened in 2025 and FED is noticing.

- Such symptoms of tightening liquidity and growth uncertainty should be seen as the major mover for future rate cuts and quantitative easing.

Domestic Monetary Policy –

- Since the August-25 policy, when the monetary policy committee (MPC) pointed to a limited room for supporting growth, policymakers now in October-25 MPC signal available policy space to aid growth.

- RBI’s forward guidance on space for rate cuts gives us confidence on growth supported future policy expectations.

Elevated spreads and yields –

- Valuation of securities is at reasonably attractive point wherein spreads of 10-year benchmark vs the overnight rate and SDLs/ Long g-sec versus the 10yr benchmark have reached the higher end of the trading range.

- The investors could benefit from further easing of rates in months ahead.

INR took the hit

- INR depreciation has resulted in INR valuation being closer to fair level and provides an attractive entry point from foreign investors in fixed income markets.

- Elevated rates and depreciated INR has supported foreign flows into domestic debt markets.

At last, the opportunity –

- Positive real rates of ~250 bps (1yr T-bill vs FY26 inflation), post RBI rate cut of 100 bps provides a fundamentally attractive case for remaining invested in fixed income assets.

- Benign inflation forecast of 2.6%, below RBI threshold of 4% for FY 26 and maintaining GDP forecast at 6.8% indicates a continuity of pro-growth-oriented policy mindset.

- Multiyear high spread between benchmarks and long end G-sec is expected to provide ample opportunity, with stable to lower rate view and comfortable macros.

Source- RBI Bulletin November 2025, Bloomberg, MOSPI

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.

Disclaimers for Market Outlook - Equity: The views and investment tips expressed by experts are their own and are meant for informational purposes only and should not be

construed as investment advice. Investors should check with their financial advisors before taking any investment decisions.

The material contained herein has been obtained from publicly available information, internally developed data and other sources believed to be reliable, but Baroda BNP

Paribas Asset Management India Private Limited (BBNPP), makes no representation that it is accurate or complete. BBNPP has no obligation to tell the recipient when opinions

or information given herein change. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This information is

meant for general reading purposes only and is not meant to serve as a professional guide for the readers. Except for the historical information contained herein, statements in

this publication, which contain words or phrases such as ‘will’, ‘would’, etc., and similar expressions or variations of such expressions may constitute forward-looking statements.

These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the

forward-looking statements. BBNPP undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date thereof. Words like believe/

belief are independent perception of the Fund Manager and do not construe as opinion or advice. This information is not intended to be an offer to see or a solicitation for the

purchase or sale of any financial product or instrument. The investment strategy stated above is for illustration purposes only and may or may not be suitable for all investors.