Despite the news around US imposing sanctions on Russian oil and India to reduce its dependency on Russian oil imports, Indian markets were up led by the recent rate cut by the RBI, strong inflows by FPI and relatively better earnings result.

While both mid and small cap index were up during the month, Nifty Midcap 150 Index (+4.8%) outperformed the broader index and Nifty Small Cap 250 Index (+3.7%) underperformed the broader market. Sector-wise majority of the sectors were in green with BSE Realty rallying the most by 9.2%, BSE OIL (+6.4%), BSE Bank and BSE Metals (+5.6% each), BSE IT (+5.5%), BSE Consumer Durables (+5%), BSE Healthcare (+3.4%) and BSE Discretionary (+1.9%).

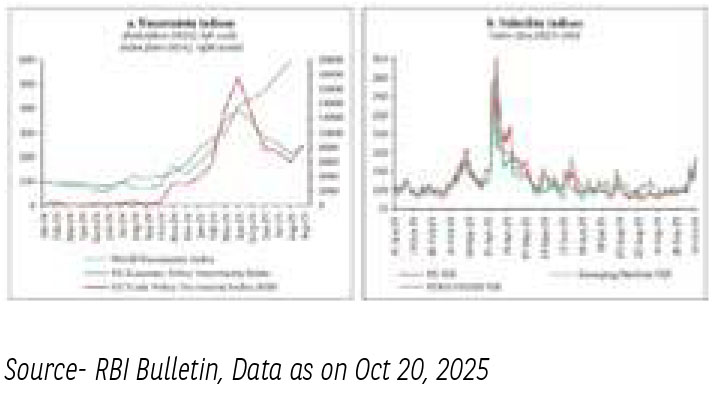

FPIs although continued to be net sellers for CY2025 to the tune of USD 15.1bn, they turned positive after three consecutive months of outflows, with net inflows of USD 2.4bn in October. With regards to certain emerging economies, most of the economies saw net outflow during the month. South Korea saw the highest inflow to the tune of USD 3.1bn, followed by Indonesia with USD 714mn inflows. Taiwan saw the most outflow to the tune of USD 1.8bn, followed by Vietnam (-USD 780mn), Malaysia (-USD 565mn), Brazil (-USD 395mn), Thailand (-USD 119mn) and Philippines (-USD 100mn).

The US Federal Reserve in its latest meeting cut rates by 25bps to the 3.75-4% range. The fed also announced that it will end Quantitative Tightening (QT) from 1st December 2025 to ease money-market liquidity pressures. The US national debt increased to a record high of USD 37.8tn, rising by USD 400bn in past one month and annual interest payments exceeding USD 1.2tn, surpassing its defence spending and debt-to-GDP inching to 124%.

Recently President Trump met Chinese leader Xi Jinping in Korea, with US indicating a cut in current tariff of 57% to 47%. President Trump also had discussions over semiconductors, with Nvidia set to engage with China on potential chip export. Post the US-China Summit, the US agreed to suspend restrictions on Chinese firms accessing American technology for a year, in exchange for China agreeing to delay its rare earth export curbs for the period.

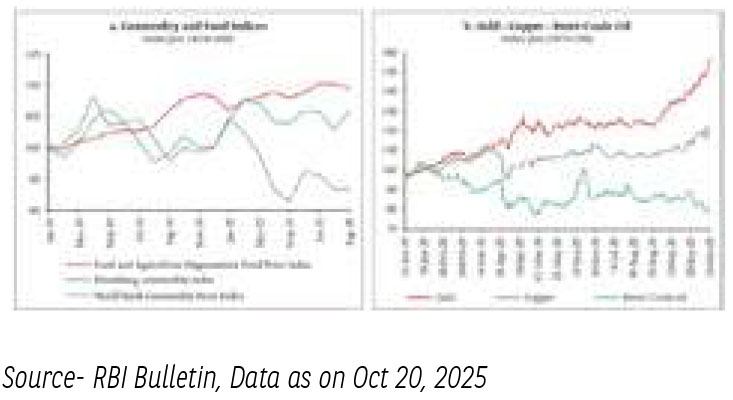

The US has put sanctions on two large Russian companies, Rosneft and Lukoil. With addition of these companies, total sanctions on Russian oil exports now stands at 75%. With this, India is also likely to reduce its crude oil imports from Russia.

Locally, festive sales came in strong with Diwali sales surging to INR 25.4tn in goods, an increase of 25% and service sales coming in at INR 650mn, as per the Confederation of All India Traders (CAIT). Post GST rate cut auto segment also saw healthy growth, with October month witnessing broad recovery across automobile industry. The early impact is visible in robust festive demand, with passenger vehicles sales up 20% YoY and two-wheelers up 40% YoY.

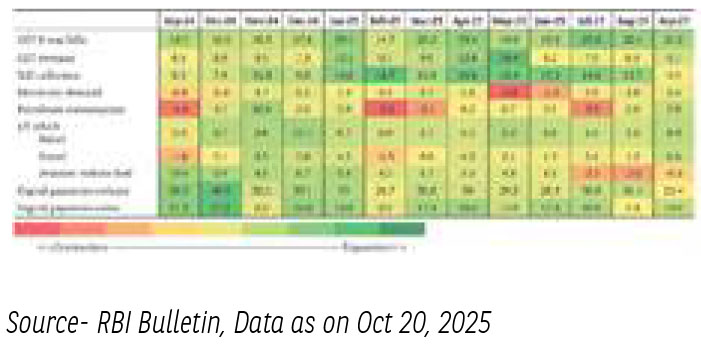

CPI inflation eased to 1.5% as against 2.07% in August on account of favourable base effect and moderation in food prices. Core inflation was higher at 4.5% driven by higher gold prices, while core inflation excluding gold stood at 3.2%. After recording a new high of 59.3 in August, India Manufacturing PMI (Purchasing Managers’ Index) eased to 57.7. Services PMI too eased to 60.9 in September vs 62.9 in August.

Corporate India started reporting its quarterly numbers. Q2FY26 earnings have largely been in-line with intensity of earnings cut coming down. Private banks and PSU’s have seen healthy results with private banks reporting healthy uptick in credit growth. I7T companies have largely met expectations, with order books inching up; commentary though was balanced given Uncertain global macro.

Indian market valuations trade at its long-term average of 21x and with expectations of accelerated growth from 2HFY26 onwards, valuations can see re-rating. While Indian markets have been underperforming global peers over one year period on weak earnings growth, recent favourable government policies and improvement in earnings, risk reward seems favourable.

Source: BnK/360One, Kotak Securities, Elara Securities . Data as of October 31, 2025. Kindly refer to the last page of the factsheet of Baroda BNP Paribas Mutual fund for the month ending October 2025 for disclaimers.

The month of October saw major asset classes, gold, equities and bond yields all climb together, a rare convergence fueled by different forces but bound by the same thread of geopolitical uncertainties and global developments. Given this backdrop, Global growth projections in the latest World Economic Outlook (WEO) are revised upwards relative to the April 2025 WEO but continue to mark a downward revision relative to the pre-policy-shift forecasts. Global growth is projected to slow from 3.3% in 2024 to 3.2% in 2025 and 3.1% in 2026. The risks to the above forecast remain on the downside led by prolonged uncertainty, more protectionism, labor supply shocks, fiscal vulnerabilities, potential financial market corrections, and erosion of institutions. This could threaten stability and add to bigger global problems.

On the global monetary front, the federal reserve cut the federal fund rate by 25bps to 3.75-4.00%, as expected, and announced it will end Quantitative Tightening (QT) from 1st Dec’25 to ease money-market liquidity pressures. The key communication from FED was a non-committal language on December cut. The FED clearly stated that there was no guarantee of rate cut in December-2025 policy, contrarian to overall market view. As a result, US treasury yields inched higher, 2-year yield inched 8bps and 10-year yields increased by 7bps. Looking closely at the Interest rates on reserve balance (IORB), which averaged around 4.4% in September and 4.15% in October, considering the FED fund rate is at 4-4.25% the narrow spread highlights the tightness in the liquidity conditions in the US money market. Also, as the governor himself highlighted pressures on selected dates on use of standing repo facility (SRF),such symptoms of tightening liquidity should be seen as the major mover for future rate cuts and quantitative easing.

On the other side of the world, Bank of Japan kept the interest rates on hold and the language reflected any expectations to have transferred next year as the outlook on inflation appeared stable.

Prices of precious metals like gold, silver etc, however, strengthened due to safe-haven demand. Crude oil prices moderated, supported by the ceasefire in the Middle East, and forecasts of a supply glut in 2026.

Domestic Economy-

The Indian economy displayed resilience amidst broader global uncertainty and weak external demand. Post the GST cut, high frequency indicators have displayed a revival in urban demand and robust rural demand. Auto registrations zoomed 27% y/y (comparable six week festive period last year), with 2W registrations growing 30%, and passenger vehicle registrations grew 21% y/y in October-2025. Commercial vehicles and 3Ws also grew by 17% and 9% respectively.

IIP growth remained steady at 4% y/y in Sep-25 vs. 4.1% in Aug-25 (revised up from 4%). IIP growth was above expectations on account of manufacturing, up 4.8%y/y in Sep-25 vs.3.8% in Aug-25.

On the fiscal front, Center’s total receipts grew 5.7% y/y in H1 FY26. Direct tax growth was at 2.9% (43% of FY2026BE) due to personal income tax growth at 4.3% and corporate tax growth at 1.1%. CGST revenue growth remained tepid at 5.8% in H1 FY26 (46% of FY2026BE). Center’s total expenditure growth at 9.1%, in H1 FY26 was driven by frontloaded capex spending growing at 40%. while revenue expenditure grew by 1.5%.

Domestic Inflation –

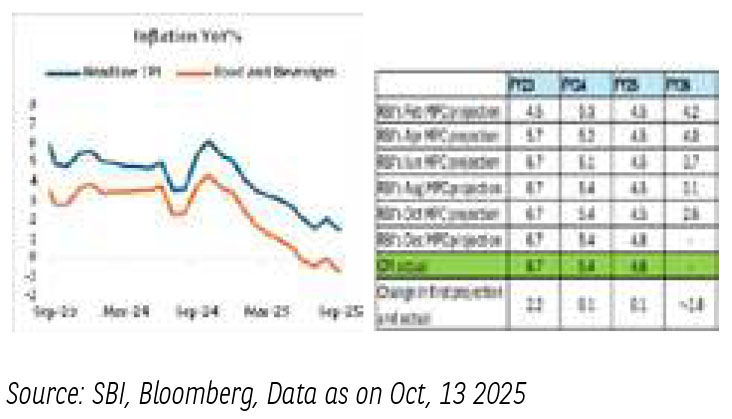

- Headlineinflation moderated to 1.54% y/y in Sep-25 vs. 2.1% y/y in Aug-25 led by muted food inflation and a favourable base.

- On a sequential basis, headline CPI rose marginally by 0.1% m/m.

- CPI inflation is expected to remain benign led by 1) Lower crude oil prices keeps input cost inflation under check 2) High-frequency food prices indicate a broad-based moderation in Oct-25, therefore highlighting a continued moderation in food prices.3) The remainder of the transient impact of the GST cuts is likely to be visible from October-25.

- The space to cut remains open as headline inflation is expected around 2.4-2.6% y/y in FY26, bringing the real rates around 250bps.

Domestic Liquidity -

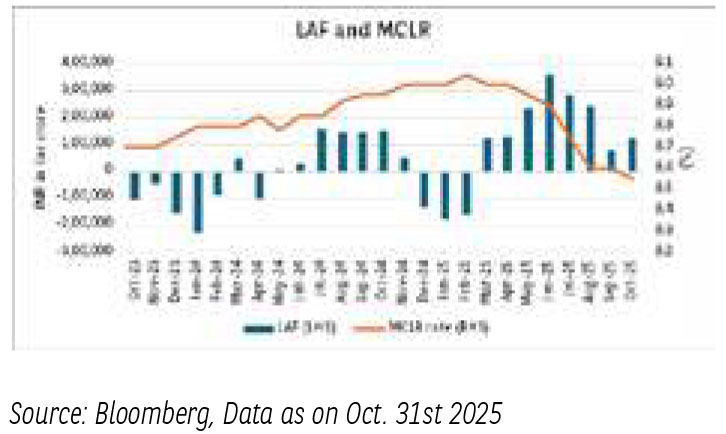

- Liquidity conditions moved to surplus zone towards the end of the month led by month end government spending.

- The RBI continued with Variable repo rate(VRR) auctions to manage overnight rates.

- Tracking the benchmark rates and liquidity MCLR rate softened further by 5bps in Oct-25.

- We expect liquidity surplus to remain comfortable supported by (1) G-sec redemption of ~Rs1 tn, (2) third tranche of CRR rate cut and (3) continued government spending.

US Monetary Shift – FED in October-25 policy delivered a rate cut and also mentioned end of quantitative tightening. The uncertainty on future cuts is contrary to our view of more cuts and quantitative easing soon to follow. The reason is that in the current Fedmeeting, the governor highlighted rates inching up in the money market. Looking closely at the Interest rates on reserve balance (IORB), which averaged around 4.4% in September and 4.15% in October, considering the FED fund rate is at 4-4.25% the narrow spread highlights the tightness in the liquidity conditions in the US money market. Also, as the governor himself highlighted pressures on selected dates on use of standing repo facility (SRF). Such symptoms of tightening liquidity should be seen as the major mover for future rate cuts and quantitative easing.

Changing Domestic Policy Dynamics from August to October-25 - Since the August-25 policy, when the monetary policy committee (MPC) pointed to a limited room for supporting growth, policymakers now in October-25 MPC signal available policy space to aid growth. RBI’s forward guidance on space for rate cuts gives us confidence on growth supported future policy expectations.

Elevated spreads and yields - We believe the recent sell off started since August-25 has created another opportunity for investors as it has resulted in valuation of securities to a reasonably attractive point wherein spreads of 10-year benchmark vs the overnight rate and SDLs/Long gsec versus the 10yr benchmark have reached the higher end of the trading range. The investors could benefit from further easing of rates in months ahead.

Fiscal concerns added to the woes But! – Fiscal concerns aided further rise in yields, but we do not expect GST rate cuts to be fiscally negative as we expect Government to benefit from higher volumes at lower GST rates along with other avenues to manage the deficit, if any.

INR took the hit - INR depreciation has resulted in INR valuation being closer to fair level and provides an attractive entry point from foreign investors in fixed income markets.

At last, the opportunity - Positive real rates of ~200 bps (1yr T-bill vs FY26 inflation), post RBI rate cut of 100 bps provides a fundamentally attractive case for remaining invested in fixed income assets. Benign inflation forecast of 2.6%, below RBI threshold of 4% for FY 26 and maintaining GDP forecast at 6.8% indicates a continuity of progrowth- oriented policy mindset. Multiyear high spread between benchmarks and long end G-sec is expected to provide ample opportunity, with stable to lower rate view and comfortable macros.

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.

Disclaimers for Market Outlook - Equity: The views and investment tips expressed by experts are their own and are meant for informational purposes only and should not be

construed as investment advice. Investors should check with their financial advisors before taking any investment decisions.

The material contained herein has been obtained from publicly available information, internally developed data and other sources believed to be reliable, but Baroda BNP

Paribas Asset Management India Private Limited (BBNPP), makes no representation that it is accurate or complete. BBNPP has no obligation to tell the recipient when opinions

or information given herein change. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This information is

meant for general reading purposes only and is not meant to serve as a professional guide for the readers. Except for the historical information contained herein, statements in

this publication, which contain words or phrases such as ‘will’, ‘would’, etc., and similar expressions or variations of such expressions may constitute forward-looking statements.

These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the

forward-looking statements. BBNPP undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date thereof. Words like believe/

belief are independent perception of the Fund Manager and do not construe as opinion or advice. This information is not intended to be an offer to see or a solicitation for the

purchase or sale of any financial product or instrument. The investment strategy stated above is for illustration purposes only and may or may not be suitable for all investors.