Indian markets started the month on a positive note led by GST announcement, Fitch Ratings revising India’s GDP growth upwards and likely progress on trade talks with the US. However, Changes in the US H1B Visa regulations and announcement of 100% tariffs on patented and branded pharma products kept the markets under check.

The mid and small cap index outperformed the broader market with Nifty Small Cap 250 Index rallying by 1.1% and Nifty Midcap 150 Index by 1.4% for the month. Sector-wise BSE Metals rallying the most by 9.4% in September, followed by BSE PSU (+7.8%), Auto (+5.9%), BSE OIL (+5.4%), Cap Goods (+4.4%), BSE Bank (+2.5%) and BSE Discretionary (+1%), while Durables saw sharp fall of 4.9% followed by IT (-3.6%), BSE Teck (-3.1%), FMCG (-2.4) and healthcare (-1.3%).

FPIs continued to be net sellers to the tune of USD 17bn for CY2025 and USD 1.7bn for the month of September as Indian markets remain expensive compared to some of the Asian economies, weak corporate earnings and geopolitical uncertainty. With regards to certain emerging economies, Brazil and Taiwan FPI remain net buyers to the tune of USD 4.7bn and USD 7.4bn respectively for CY2025. Taiwan saw the highest inflow of USD 7.3bn in September, followed by South Korea (+5.1bn). Vietnam and Thailand saw net outflow of USD 937mn and USD 257mn respectively in September.

In the latest meeting the US Federal Reserve lowered its interest rates by 25bps in-line with street expectation to the 4-4.25% range. It also signalled two more rate cuts amounting to 50bps by end of CY2025. The US Consumer Price Index (CPI) raises to 2.9% in August from 2.74% in July led by higher shelter, food and energy prices. US GDP for Q2 was revised upwards to 3.8% from 3.3% led by stronger consumer spending. In Asia, Japan’s inflation is showing signs of slowing down with CPI rising to 2.5% in September as against 3% in August and lower than expectation of 2.8%.

Locally, the GST council announced structural reforms in the GST regime, simplifying rates and process. It has also made reforms to address challenges faced regarding inverted duty structure and made processes business friendly. The council has rationalized GST rates in majority of the mass consumption at lower rates of 5% and 18% and select luxury and sin goods at 40% effective from 22nd September. GST along with tax cuts offered during the budget should drive consumption over the next few months.

On the tariff front, recently US President Trump made two announcements. US has proposed to introduce a one-time fee of USD100,000 on new H1B applications effective from the new lottery system (i.e. April 2026). The US Department of Homeland Services have also announced that the lottery service will favour applicants in the higher wage categories. While this will not have a major near-term impact, in the medium to long term IT companies will see some impact on profitability. Secondly, Trump administration announced 100% tariff on branded and patented products unless a company is building manufacturing plants in the US. Given that majority of Indian pharma companies export generic products to the US, the impact is likely to be minimal.

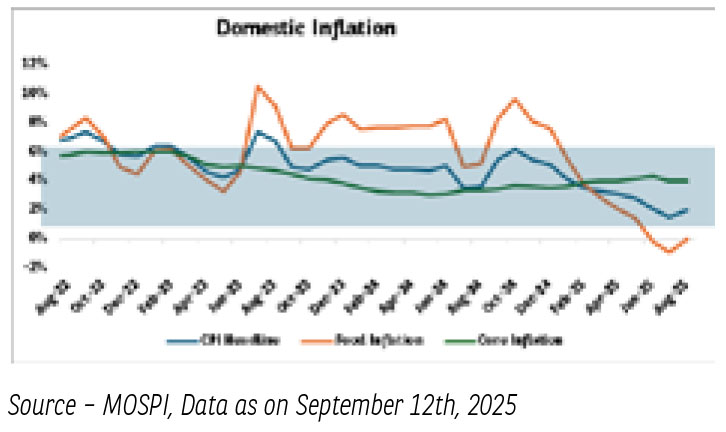

CPI inflation rose to 2.07% in August from 8 year low of 1.55% in July due to seasonal rise in food and beverage inflation. India Manufacturing PMI (Purchasing Managers Index) hit another new high in August, led by rapid expansion in production, to 59.3 up from 59.1 in July. Services PMI further inched up to a fifteen year high to 62.9 in August from 60.5 in July on back of surging new orders.

Indian markets continue to underperform global peers over one year period on weak earnings growth and geopolitical tensions. Valuation of Indian market at 19.1x FY27E remains attractive compared to some of the developed and emerging economies. With earnings growth expected to pick up 2HFY26 onwards, supported by some of the key announcements by RBI and Government of India on monetary and fiscal policies, we continue to remain cautiously optimistic.

Source: Bloomberg, Kotak Securities, B&K Securities. Data as of September 30, 2025. Kindly refer to the last page of the factsheet of Baroda BNP Paribas Mutual fund for the month ending September 2025 for disclaimers.

The global economy remains clouded by growing uncertainty, driven by a combination of geopolitical tensions and protectionist policies. The imposition of tariffs by the United States has disrupted global trade flows, straining relationships with key partners and contributing to market volatility. Ongoing wars, particularly in strategically significant regions like Russia and Israel, have further destabilized global supply chains and investor confidence. What is increasingly concerning is the emerging trend of geopolitics directly influencing trade, as nations begin to link economic decisions with wartime allegiances and security concerns. This convergence of war and trade has created a complex and uncertain environment, posing challenges to global economic activity and stability across asset classes.

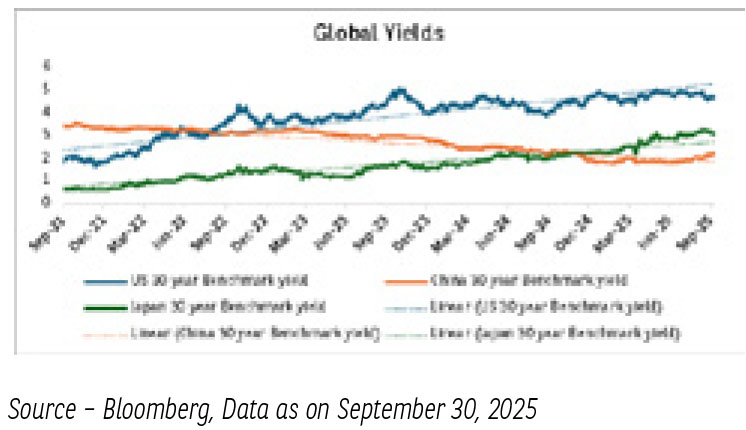

Global Bond markets in advanced economies have witnessed a substantial increase in long-dated borrowing costs, which also touched multi-year for some of the economies like Japan, amidst renewed concerns about the fiscal health and inflationary dynamics. Towards the end of September, yields softened in the US following rising expectations of Fed easing. In September-2025 Fed’s communication on shifting balance of economic risks further led to decline in yields followed by the rate cut.

Keeping global inflation under check, crude oil prices weakened in September due to supply glut in global markets on announcement of increased production by OPEC plus. Nevertheless, high-frequency commodity price indicators showed a sharp pick-up in select commodity prices from the second half of August-2025, gold prices topping the chart with ~45% increase CYTD basis.

Domestic Economy-

India’s growth story remains resilient, with both S&P and OECD highlighting the strength of domestic demand and policy support. S&P retained its GDP growth forecast for FY26 at 6.5% in its latest update (Sep-25), after raising it from 6.3% in June-2025, while the OECD revised its projection higher to 6.7% for FY26. Concerns do loom over the impact of fresh U.S. tariffs but domestic reforms and consumption is expected to offset some of the impact.

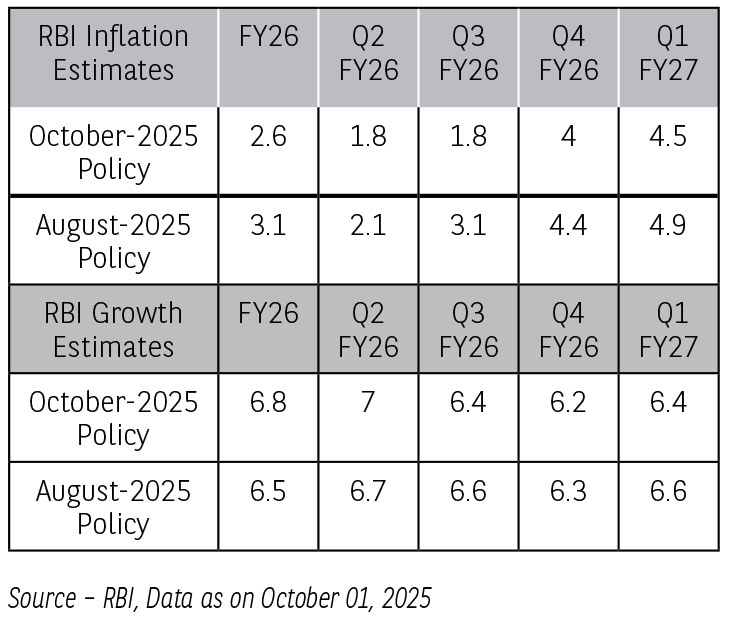

RBI MPC in October-25 policy voted in favor of keeping the Repo rate unchanged at 5.50% . The stance was retained at neutral, though two external members voted for a change of stance to ‘accommodative’ to signal dovish intentions ahead. The RBI’s decision to keep the repo rate unchanged at 5.5% signals a cautious and data-dependent stance amidst global and domestic uncertainties. RBI appeared to be reluctant to exhaust its rate-cutting options prematurely, especially without seeing the full impact of the recent GST cuts on festive season demand.

While the changes in projections were broadly in line with expectations, concerns on growth have taken a front seat while inflation smoothly gears the balance. The real clarity on the scope for further easing is likely to emerge in the December-25 and February-26 policy meetings, once the effects of US tariffs, global economic conditions, and domestic fiscal measures become more evident.

Domestic demand conditions remain robust characterised by strong rural remand in a low inflation environment. Rural demand stood strong with robust retail tractor sales and recovery in two-wheeler sales aided by a favourable monsoon and easing inflation. Household demand for employment under the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) declined in August-25, reflecting the availability of alternative avenues of employment due to higher kharif sowing and government’s infrastructure push. Urban demand continued to show some weakness as indicated by a modest uptick in automobile sales and subdued domestic air passenger traffic.

INR and FX reserves

INR continues to swing around the delays in the US-India trade deal, while grappling with additional risks brewing in the services sector. INR hit a fresh low of 88.80 in September-2025, with mild support from the RBI attempting to cap volatility. FPI flows during the week also remained weak, with net outflows of ~US$2.1 bn(equity: (-) US$1.9 bn, debt: (-)US$0.3 bn).

Domestic Inflation-

- India’s headline inflation is expected to undershoot RBI’s target of 3.1% in FY26 led by softer commodity prices, lesser food shocks and GST rate rationalization.

- Inflation trajectory in India remains favorable keeping real rates around 250bps proving space for another rate cut.

Domestic Liquidity -

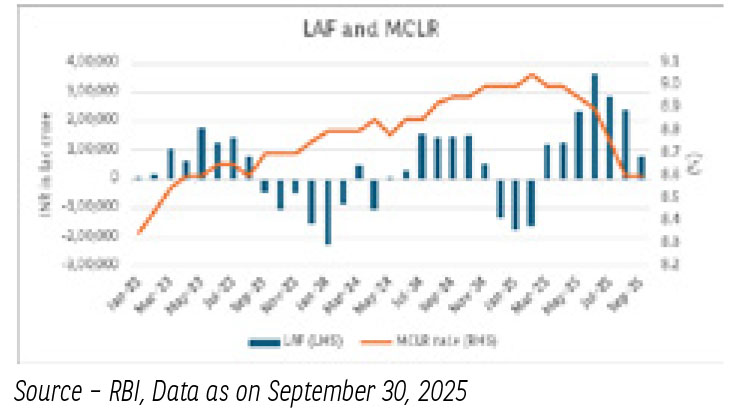

- System liquidity fell into deficit mode in the early part of last week on the back of GST related outflows, whereas heavy G-Sec redemptions provided some comfort even as additional government spending remained tepid.

- The weighted average overnight rates rose to around 5.49%. Overall RBI intervened with Variable reverse repo (VRR) auctions regularly to manage overnight rates.

- Going ahead, we expect liquidity surplus to improve driven by month end government spending, partially offset by CIC leakage and month-end RBI forward maturities.

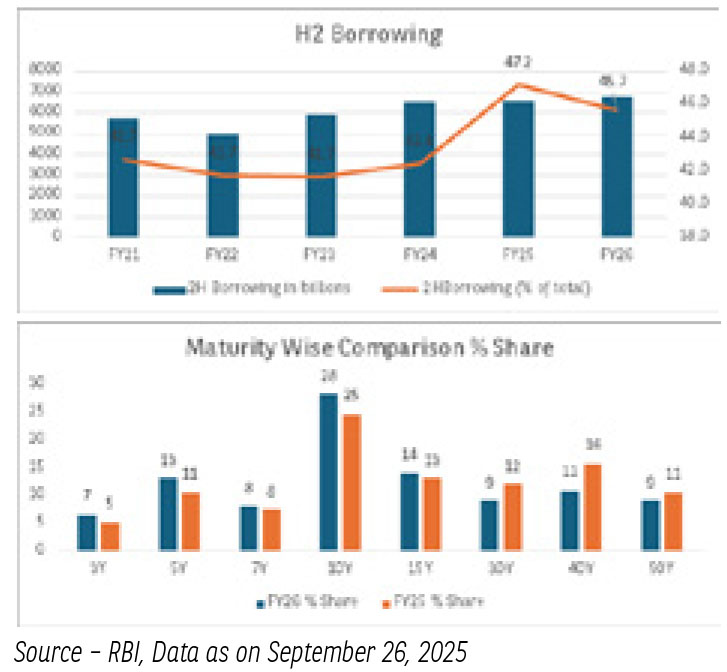

- The central government announced its H2 FY26 borrowing program of Rs 6.77 tn, (45.8% of total), bringing the fullyear FY26 borrowing to Rs14.72 tn (FY2026BE: Rs14.82 tn).

- Although, borrowing in H2 FY26 is above the historical average, it is still below the 47.2% of total seen in H2 FY25.

- With a steepening yield curve, the government has cut borrowing above 10-year tenor to 43.6% in H2 FY26 from 51.8% in H2 FY25.

- Borrowing above 30-year stands at 29.4% in H2 FY26, down from 38.2% in H2 FY25.

- The yield curve could flatten marginally, given supply shifting lower from the far end of the curve.

Fixed Income outlook -

- Changing Policy Dynamics from August to October-25 - Since the August-25 policy, where the monetary policy committee (MPC) pointed to a limited room for supporting growth, policymakers now in October-25 monetary policy signal available policy space to aid growth. RBI’s forward guidance on space for rate cuts gives us confidence on growth supported future policy expectations.

- Elevated spreads and yields - We believe the recent sell off started since August-25 has created another opportunity for investors as it has resulted in valuation of securities to a reasonably attractive point wherein spreads of 10-year benchmark vs the overnight rate and SDLs/Long gsec versus the 10yr benchmark have reached the higher end of the trading range. The investors could benefit from further easing of rates in months ahead.

- Fiscal concerns added to the woes But! – Fiscal concerns aided further rise in yields but we do not expect GST rate cuts to be fiscally negative as we expect Government to benefit from higher volumes at lower GST rates along with other avenues to manage the deficit, if any.

- INR took the hit - INR depreciation has resulted in INR valuation being closer to fair level and provides an attractive entry point from foreign investors in fixed income markets

- At last the opportunity - Positive real rates of ~200 bps (1yr Tbill vs FY26 inflation), post RBI rate cut of 100 bps provides a fundamentally attractive case for remaining invested in fixed income assets. Benign inflation forecast of 2.6%, below RBI threshold of 4% for FY 26 and maintaining GDP forecast at 6.8% indicates a continuity of pro-growth-oriented policy mindset. Multiyear high spread between benchmarks and long end G-sec is expected to provide ample opportunity, with stable to lower rate view and comfortable macros.

The material contained herein has been obtained from publicly available information, believed to be reliable, but Baroda BNP Paribas Asset Management India Private Limited (BBNPPAMIPL) makes no representation that it is accurate or complete. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. This information is not intended to be an offer to see or a solicitation for the purchase or sale of any financial product or instrument. Past Performance may or may not be sustained in future and is not a guarantee of future returns.

Disclaimers for Market Outlook - Equity: The views and investment tips expressed by experts are their own and are meant for informational purposes only and should not be

construed as investment advice. Investors should check with their financial advisors before taking any investment decisions.

The material contained herein has been obtained from publicly available information, internally developed data and other sources believed to be reliable, but Baroda BNP

Paribas Asset Management India Private Limited (BBNPP), makes no representation that it is accurate or complete. BBNPP has no obligation to tell the recipient when opinions

or information given herein change. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This information is

meant for general reading purposes only and is not meant to serve as a professional guide for the readers. Except for the historical information contained herein, statements in

this publication, which contain words or phrases such as ‘will’, ‘would’, etc., and similar expressions or variations of such expressions may constitute forward-looking statements.

These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the

forward-looking statements. BBNPP undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date thereof. Words like believe/

belief are independent perception of the Fund Manager and do not construe as opinion or advice. This information is not intended to be an offer to see or a solicitation for the

purchase or sale of any financial product or instrument. The investment strategy stated above is for illustration purposes only and may or may not be suitable for all investors.