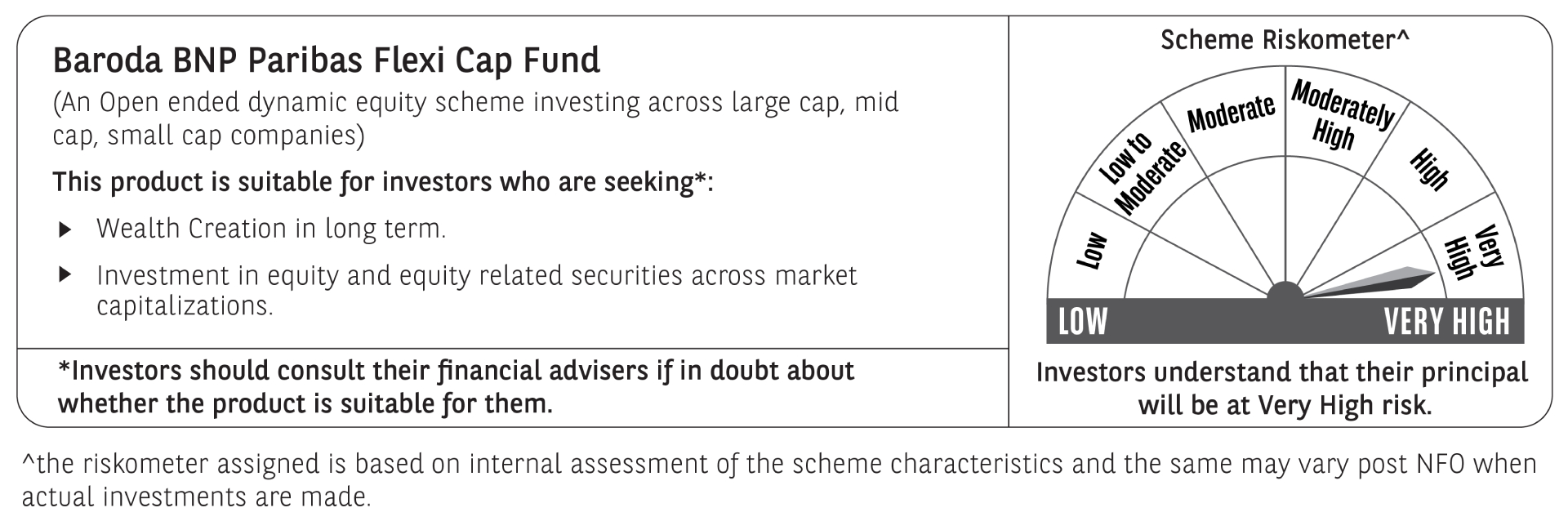

The Scheme seeks to generate long term capital appreciation by investing in a dynamic mix of equity and equity related instruments across market capitalizations. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns.