Baroda BNP Paribas Nifty Bank ETF

Passive investing or index investing as it is commonly understood, is a long term investment strategy that tracks / replicates a specified underlying market index. The index can range from a broad market index like Nifty 50, Sensex to a sector specific index like Nifty Bank.

ETFs or Exchange Traded Funds are mutual fund schemes that seek to replicate/track the performance of an underlying index or commodity. They are listed on stock exchanges and can be traded freely like shares.

Passive investing, especially ETFs have seen increasing interest / AUM growth in India in the last few years, especially post the pandemic.

Easy: Passive funds have an easy-to-understand investment strategy, namely tracking / replicating a pre-specified benchmark / index, as closely as possible.

Rule-based investing: An index is a rule-based portfolio with stock / company selection based on pre-defined rules and free from any individual biases.

Efficient: Portfolio reflects the collective wisdom of the market with index performance subject to tracking error and fees.

Economical: Generally, passive funds have a lower expense ratio than an active mutual fund due to no active decision by fund manager.

In addition to the above advantages, ETFs have some distinct advantages which are as follows:

1. Convenient execution: ETFs allow investors the flexibility to quickly enter and exit, especially intraday whereas traditional mutual fund schemes can be bought or sold only at the end of day.

2. Diversification: ETFs hold a basket of securities allowing for easy diversification in a single instrument.

3. Small Ticket Size: ETF units are priced at a fraction of the index or commodity that they hold. For e.g. if the Nifty Bank index is trading at 48,000, the ETFs will be priced at 48 or 480. This allows investors exposure to a basket of securities at a fraction of the cost.

4. Used for margining purpose: ETFs are traded and treated like shares and can be used for margining purposes with brokers and exchanges.

1. Exposure to a large, high impact sector that is closely linked to the state of Indian economy.

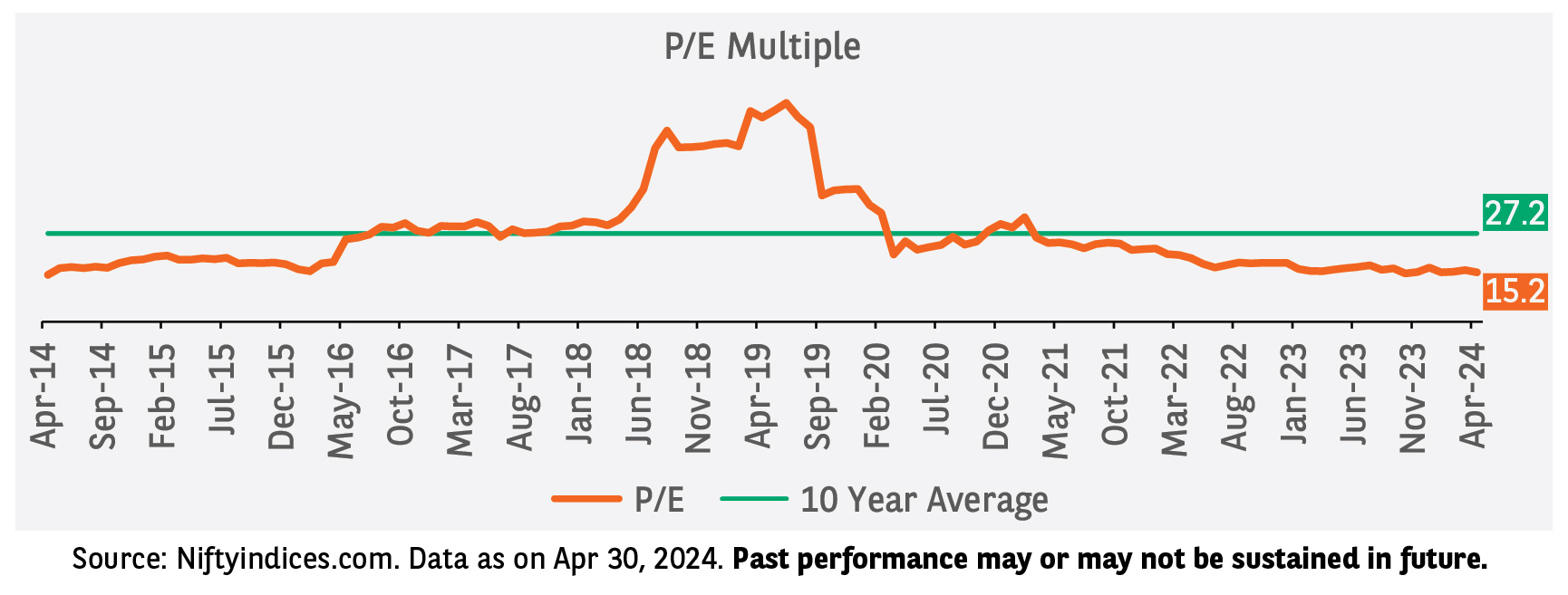

2. Valuations have corrected and are below long-term average:

3. An investor investing for a random 7-year holding period in the last 24 years could have achieved greater than 10% CAGR returns, 97% of the time with no negative returns.

| Nifty Bank TRI | 7 Year Rolling Returns |

|---|---|

| Average | 19.4% |

| Median | 16.0% |

| Minimum | 4.8% |

| Maximum | Maximum |

| Returns Range | % of Observations |

| Negative | 0% |

| 0% to 10% | 3% |

| >10% to 15% | 37% |

| >15% to 20% | 28% |

| >20% | 31% |

Source: Niftyindices.com, MFI explorer. Data as on Apr 30, 2024. Daily Rolling Returns calculated from Jan 31, 2001 onwards. Above returns are CAGR returns. The above data is provided for information purposes only and should not be construed as investment advice or used to develop an investment strategy. Past performance may or may not be sustained in future.

Baroda BNP Paribas Nifty Bank ETF is an exchange traded fund investing primarily in equity and equity related securities comprising the Nifty Bank Total Returns index. Units will be issued in dematerialized form and will be available for trading on NSE and BSE.

| NFO Date | 31-05-2024 to 14-06-2024 |

| Minimum application amount | During NFO: Lumpsum investment: Rs. 5,000 and in multiples of Re. 1 thereafter. There is no upper limit. Ongoing basis: The Units of the Scheme will be listed on the Capital Market Segment of the National Stock exchange of India Ltd. (NSE) and/ or BSE Limited (BSE) and/or on any other recognized Stock exchange(s) as may be decided by AMC from time to time. All investors including Authorized Participants and Large Investors can subscribe (buy) / redeem (sell) Units on a continuous basis on the NSE and/ or BSE on which the Units are listed during the trading hours on all the trading days The AMC reserves the right to change the minimum application amount from time to time. |

| Load Structure | Entry Load: Not Applicable Exit Load: Nil |

| Plans & Options | No plans or options |

| Benchmark | Nifty Bank Total Returns Index |

| Fund Manager | Neeraj Saxena |

Risk factors: The risks associated with investments in equities include fluctuations in prices, as stock markets can be volatile and decline in response to political, regulatory, economic, market and stock-specific development etc. Please refer to scheme information document for detailed risk factors, asset allocation, investment strategy etc.

Further, to the extent the scheme invests in fixed income securities, the Scheme shall be subject to various risks associated with investments in Fixed Income Securities such as Credit and Counterparty risk, Liquidity risk, Market risk, Interest Rate risk & Re-investment risk etc., Further, the Scheme may use various permitted derivative instruments and techniques which may increase the volatility of scheme’s performance. Also, the risks associated with the use of derivatives are different from or possibly greater than, the risks associated with investing directly in securities and other traditional investments. Investor should consider their risk appetite at the time of investing in index funds.

Please refer to Scheme Information Document available on our website (www.barodabnpparibasmf.in) for detailed Risk Factors, assets allocation, investment strategy etc.

NSE Disclaimer: It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full text of the Disclaimer Clause of NSE.

BSE Disclaimer: It is to be distinctly understood that the permission given by BSE Limited should not in any way be deemed or construed that the SID has been cleared or approved by BSE Limited nor does it certify the correctness or completeness of any of the contents of the SID. The investors are advised to refer to the SID for the full text of the Disclaimer Clause of the BSE Limited.

KIM and Editable Application Form

Click HereSID

Click HereProduct Presentation

Click HereProduct one pager

Click Here

^The riskometer assigned is based on internal assessment of the scheme characteristics and the same may vary post NFO when actual investments are made

Baroda BNP Paribas Nifty Bank ETF