Baroda BNP Paribas ESG Best-in-Class Strategy Fund

In today’s world, challenges such a climate change, social inequality, and weak governance are reshaping how investors think about risk and opportunity. While these risks may not always be visible in a company’s current financials, their long-term impact – through supply chain disruptions, regulatory action, or operational challenges can significantly affect business performance.

An investment approach that combines ESG factors with traditional financial analysis can help investors navigate these risks more effectively. Baroda BNP Paribas ESG Best-in-Class Strategy Fund seeks to offer investors this approach – supporting sustainable business practices while aiming for competitive long-term returns.

This Scheme is an investment solution designed to align financial growth with ESG principles. We believe that companies with strong ESG practices are better positioned for long-term success. By applying Best-in-Class ESG filter to our investment process, we aim to reduce risk through responsible governance, and capture opportunities in companies growing sustainably.

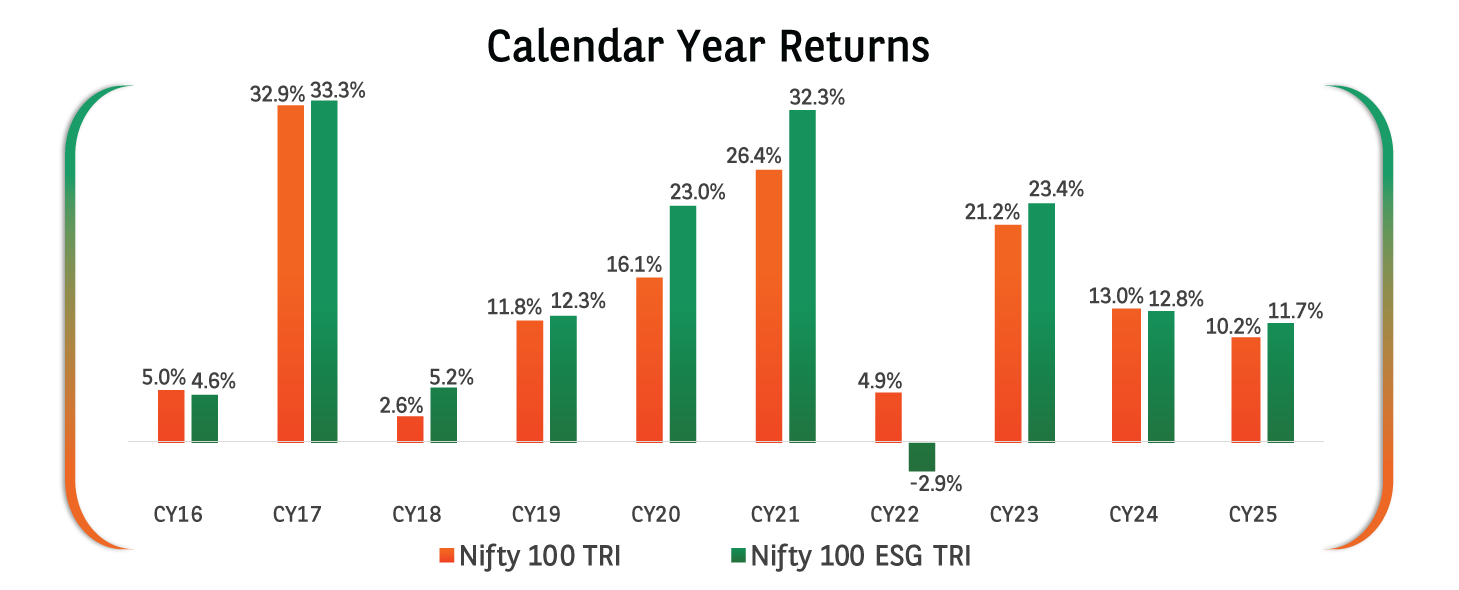

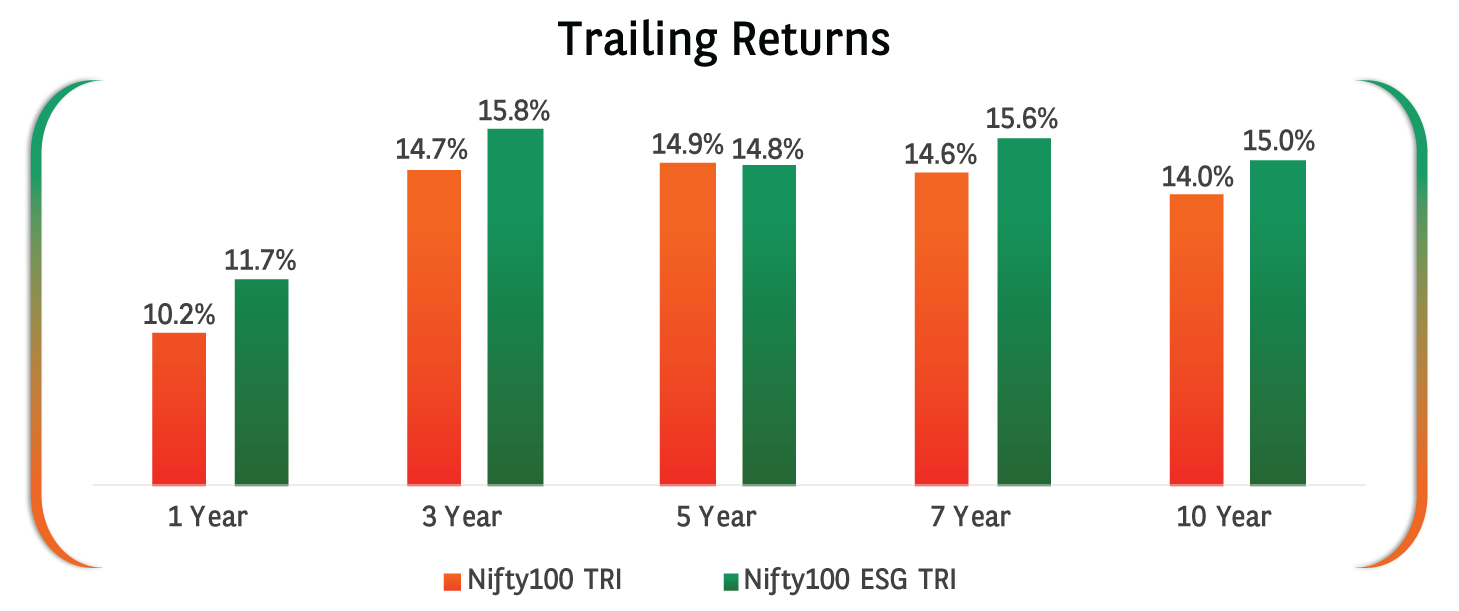

Source: Nifty Indices, Data as on December 31, 2025. Returns are Compounded Annualized. Past performance may or may not be sustained in future and is not a guarantee of any future returns. The information should not be construed as an investment advice, and investors are requested to consult their investment advisor and arrive at an informed investment decision before making any investments

Investments in equity and equity related securities of companies in India, based on ESG criteria following Best-in-Class Strategy.

Under Best-in-Class Strategy, the aim is to invest in companies and issuers that perform better than sector peers on ESG factors.

Companies in each sector group will be ranked basis ESG assessment. Those companies with ESG score equal to or above the sector median will form the portfolio’s investible universe.

After applying the ESG filter, portfolio construction will focus on factors like financial strength, management reputation, long-term growth prospects, and other drivers of future performance.

Companies involved in alcohol, tobacco, gambling, and high adverse environmental impact would be excluded from the investment universe of the Scheme.

#Please consult your financial advisor before investing. Please refer to the SID for further details of the investment strategy and asset allocation. Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments.

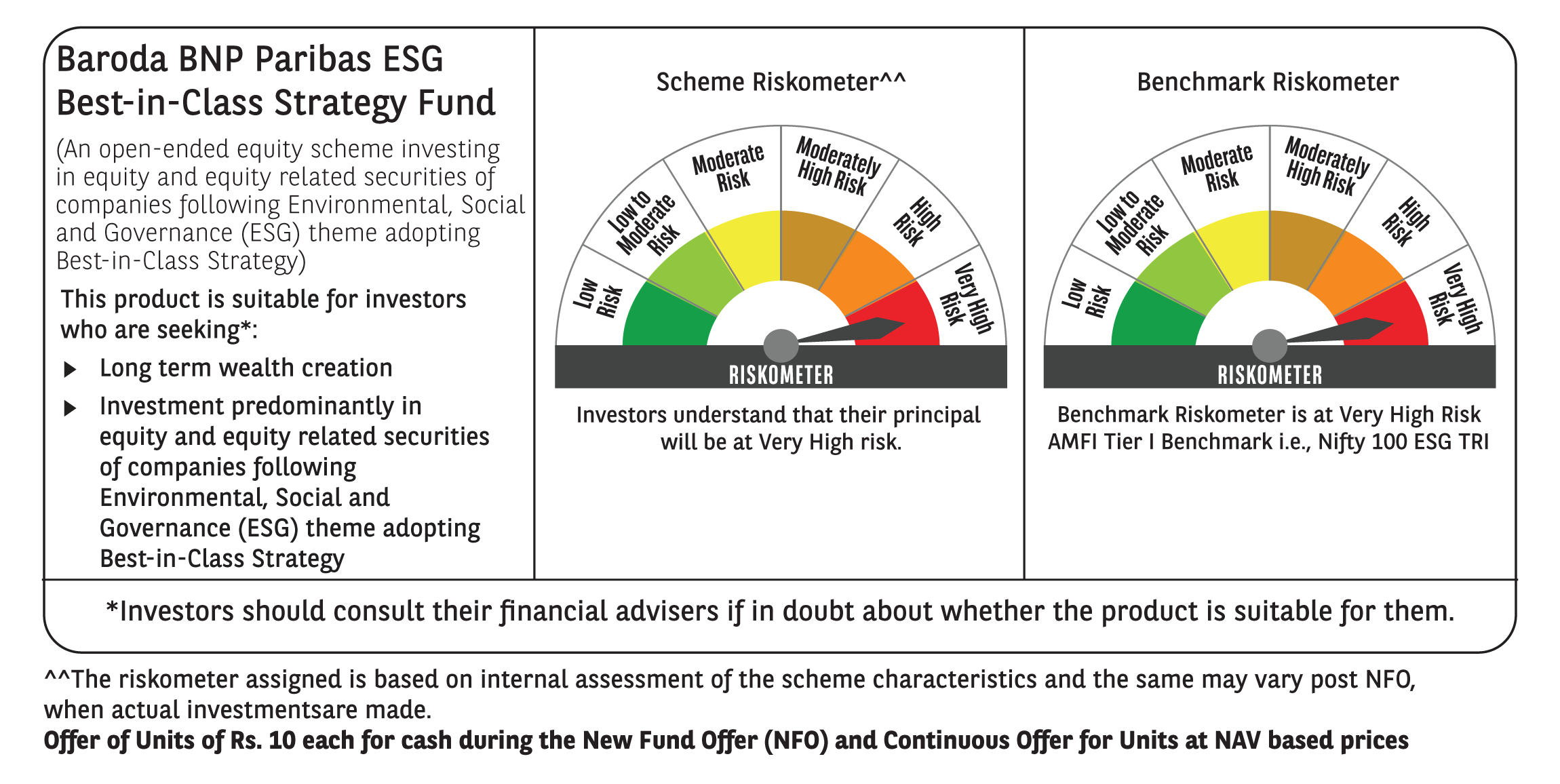

| Scheme Name | Baroda BNP Paribas ESG Best-in-Class Strategy Fund |

| Type of the Scheme | An open-ended equity scheme investing in equity and equity related securities of companies following Environmental, Social and Governance (ESG) theme adopting Best-in-Class Strategy |

| Category | Thematic fund – ESG Theme |

| Investment Objective | The investment objective of the scheme is to achieve long term capital appreciation by actively managed investments in equity and equity related securities of companies in India, based on Environmental, Social and Governance (“ESG”) criteria following Best-in-Class Strategy. The Scheme does not guarantee/indicate any returns. However, there can be no assurance that the investment objective of the Scheme will be realized. |

| Benchmark | Nifty 100 ESG TRI (AMFI Tier I Benchmark) |

| Fund Manager | Mr. Jitendra Sriram and Mr. Kushant Arora |

| Load Structure |

Exit Load:

|

| Minimum Amount for Application during the NFO & Ongoing Offer | Minimum Amount for Application during the NFO & Ongoing: A minimum of Rs1,000 per application and in multiples of Rs1 Minimum Additional Application Amount: Rs1,000 and in multiples of Rs1 thereafter. |

| SIP Details: Minimum Application Amount |

(i) Daily, Weekly, Monthly SIP: Rs500/- and in multiples of Rs1/- thereafter; |

#Please refer to the Scheme Information Document of the scheme before investing for details including investment objective, asset allocation pattern, investment strategy, risk factors and taxation.

KIM and Editable Application Form

Click HereSID

Click HereProduct Presentation

Click Hereone pager

Click Here

In the preparation of this document, Baroda BNP Paribas Asset Management India Ltd. (“AMC”) has used information that is publicly available and developed in-house. The AMC, however, does not warrant the accuracy, reasonableness and/or completeness of any information. This document may contain statements/opinions/ recommendations, which contain words, such as “expect”, “believe” and similar expressions or variations that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our investments, the monetary and interest policies of India, inflation, defiation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices, etc. The AMC (including its affiliates), Baroda BNP Paribas Mutual Fund (“Mutual Fund”), its sponsor / trustee and any of its officers, directors, employees, shall not liable for any loss, damage of any nature, including direct, indirect, punitive, exemplary, consequential, or loss of profit arising from use of this document. The recipient alone shall be fully responsible for decision taken based on this document. All data given in this document is dated and may or may not be relevant at a future date. Investors are advised to consult their legal/tax/financial advisors to determine possible tax, legal and other financial implication or consequences of investing into the scheme. Past performance may or may not be sustained in the future and is not a guarantee of any future returns. The information should not be construed as an investment advice, and investors are requested to consult their investment advisor and arrive at an informed investment decision before making any investments.

Baroda BNP Paribas ESG Best-in-Class Strategy Fund