Gujarat International Finance Tec-City (GIFT City) is a Special Economic Zone (SEZ) established as India’s first International Financial Services Centre (IFSC). It is located in Gandhinagar and next to Ahmedabad in the state of Gujarat The objective of the SEZ is to help India realize its potential in the international financial services industry. GIFT City IFSC provides a strategic location to develop an efficient platform for all inbound and outbound foreign currency transactions. GIFT City provides financial services to both- Indian and foreign entities in foreign currencies and a tax efficient manner.

The International Financial Services Centre (IFSC) is envisaged as a jurisdiction that provides financial services to non-residents and residents (Institutions), in foreign currencies. IFSC is set-up to undertake financial services transactions that are currently carried on outside India by overseas financial institutions and overseas branches/ subsidiaries of Indian financial institutions. The IFSC is approved and regulated by the Government of India under the Special Economic Zones Act, 2005. The launch of the IFSC at GIFT City is expected to be the first step towards bringing financial services transactions relatable to India, back to Indian shores. The IFSC unit is treated as a non-resident under extant Foreign Exchange Management regulations.

Baroda BNP Paribas Asset Management India Private Limited (BBNPP AM) is an Asset Management Company, having its Registered Office at 201(A) 2nd Floor, A wing, Crescenzo, C38 & 39, G Block, Bandra-Kurla Complex, Mumbai, -400051 Maharashtra, India. 50.1% of the paid–up equity share capital of the AMC is held by Bank of Baroda and 49.9% of the paid–up equity share capital of the AMC is held by BNP Paribas Asset Management Asia Limited. Baroda BNP Paribas Asset Management India Private Limited has been appointed as Asset Management Company of Baroda BNP Paribas Mutual Fund.

BBNPP AM set up its branch in GIFT City in 2024 and has subsequently registered with International Financial Services Centre Authority (IFSCA) as Retail Fund Management Entity (FME) bearing registration number: IFSCA/FME/III/2023-24/099. Gift city funds, advisory services and mandates are managed by the Offshore team.

BBNPP AM plans to develop its presence in the GIFT City by offering investment management solutions and services to resident and Foreign National investors across asset classes

We advocate for long-term equity investments as we recognize the potential for substantial value creation over time, acknowledging the limitations of market efficiency. Through diligent research and investment strategies, we aim to achieve superior performance by gaining a deep understanding of equity markets.

Our investment approach focuses on growth, targeting companies with the potential for sustained long-term growth. Utilizing our proprietary BMV framework (Business - Management - Valuation), we identify such companies with strong growth prospects.

Valuation is a pivotal aspect of our strategy, as we seek growth companies with reasonable valuations. We prioritize companies that leverage insights into future trends and effectively incorporate them into their business models, facilitating above-average growth rates.

Management quality is paramount in our evaluation of growth companies. We emphasize management's ability to consistently perform across market cycles and uphold best-in-class corporate governance standards.

We strive for consistent investment performance across various market conditions, achieved through rigorous risk management and a disciplined investment process. Recognizing market volatility, our philosophy prioritizes downside protection while aiming for superior risk-adjusted returns over the long term.

As active managers, our goal is to consistently deliver superior performance by blending macro research with precise security selection, all while adhering to portfolio discipline and stringent risk controls.

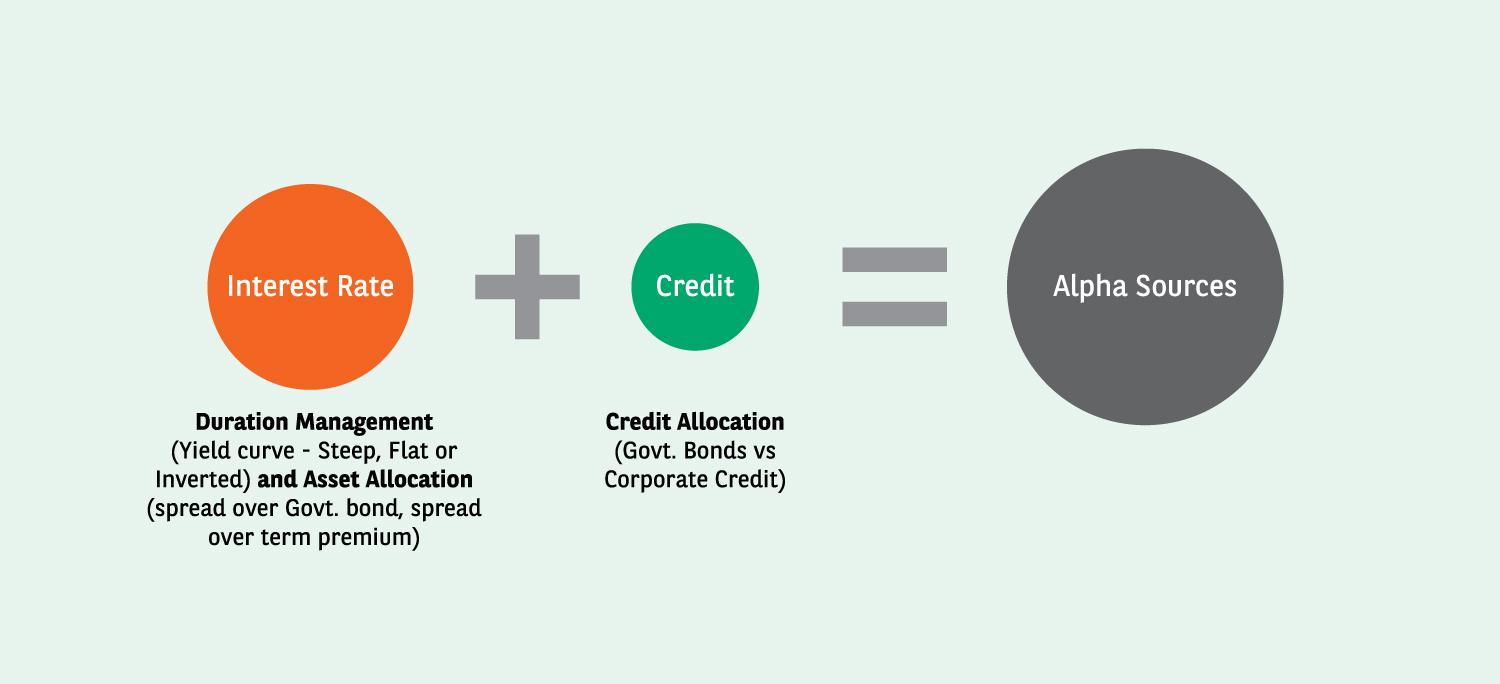

In fixed income investing, safety, liquidity, and returns are fundamental priorities, with safety taking precedence. Our approach emphasizes prudent decision-making, avoiding overly aggressive positions, and recognizing the outsized impact of risks on returns.

Know more about the prolific Offshore Investment Team at Baroda BNP Paribas Asset Management

Jayesh Gandhi

Head - Offshore Advisory & AIF

Mr. Gandhi brings with him over 20 years of experience managing Indian equities,

across market-caps, with the track record of delivering above average/benchmark

returns for over a decade. Currently, he is Head - Offshore Advisory & AIF at Baroda

BNP Paribas Asset Management India Private Limited.

Prior to this he worked with

Aditya Birla Sun Life Asset Management Company (ABSL AMC). He was Lead

Portfolio Manager for the India Multi-Cap/Mid Cap Equity strategies managing an

AUM of over USD 700 million. He has also worked as Lead Portfolio Manager for the

India Multi-Cap strategies, part of the India Onshore leadership team at Morgan

Stanley Investment Management (MSIM). In 2018 Mr. Gandhi was ranked amongst

Top Equity Fund Managers by Business Outlook publication & the ET Wealth. As a

volunteer, Mr. Gandhi has served as the President of the CFA Society India from

2013-18 and was a Board member for 10 years (2008-18).

Mr. Gandhi is graduated with CA from the Institute of Chartered Accountants of India,

CFA (US) and Master of International Management from Thunderbird, US.

Shrinarayan Mishra

Fund Manager & Research Analyst, Equities

Shrinarayan brings with him over 6 years of experience spread across Asset & Wealth Management, Equity Research, Valuations and Audit.

He joined Baroda BNP Paribas Asset Management in June 2024. He has previously worked with Nrups Consultants, a Family Office, as an Associate Fund Manager – Equities where he played a key role in managing equity investments. He has also worked with Equirus Securities, a sell side research firm, as a Research Associate covering capital goods sector, providing in-depth analysis and insights. Prior to that he worked at KPMG where his key role involved developing financial models, earnings presentation, identifying and tracking revenue drivers, variance analysis and contributing to other management/shareholder reports.

Shrinarayan is a Chartered Accountant and has completed all levels of the CFA (USA) program. He holds a Bachelor of Commerce degree.

Darshil Shah

Investment Specialist - Indian Equities

Darshil brings with him over 6 years of experience spread across Asset & Wealth Management and Credit Ratings & Research.

He has previously worked with JP Morgan & Co. as an Investment Specialist, where he played a key role in crafting informative publications and presentations, delineating insights on their suite of global multi-asset products to clients. He has also worked with CRISIL, India’s largest credit rating agency, as a Credit Analyst, where he used to work on comprehensive rating reports, sector analysis, ESG research and other media publications.

Darshil has completed his Masters in Management Studies from N.L. Dalmia Institute of Management Studies & Research, Mumbai, India. He is a CFA Charterholder, USA. He has completed his CFA certification in ESG investing.

Goldy Admane

ESG Research Analyst

Goldy is a dedicated ESG professional with experience across asset management, management consulting, and water infrastructure sector. As an ESG Research Analyst, he focuses on ESG integration and stewardship. Additionally, he is involved with BNP Paribas Asset Management’s Global Sustainability Center. Prior to his current role, Goldy worked at Deloitte India Consulting and VA Tech Wabag. He holds an MBA from IIM Ahmedabad and has completed his undergraduate studies at NIT Warangal. He has completed his CFA certification in ESG investing, and is a GARP Sustainability and Climate Risk certificate holder. He has successfully completed Level 1 of the CFA program.

Pankaj Sonkar

Trader and Investment Support

Pankaj joined in October 2022 as a Trader & Investment Support. He has an overall work experience of 7 years. His previous job stints were at Canara HSBC OBC Life Insurance, SBI General Insurance Co. Ltd, Reliance Nippon life Insurance & ICICI Bank Ltd. Academically, Pankaj has completed his M.Com from Mumbai University.

Baroda BNP Paribas Gift US Small Cap Fund (A non-Retail Category – III AIF)

Delivering alpha through focus in high quality high conviction portfolio if US Small Cap Companies.

Baroda BNP Paribas Asset Management India Pvt Ltd. – GIFT City Branch

Name of the Contact Person: Pramod Saini

Address: Unit No 801, 8th Floor, Brigade International Financial Centre, Building No 14 A, Zone 1, Gift City, Gift SEZ, Gandhinagar, Gujarat. 382355, India.

Tel no: 07969477901

Email: gift.service@barodabnpparibasmf.in

Complaint Redressal Officer (CRO): Pramod Saini

Email id: pramod.saini@barodabnpparibasmf.in

Complaint Redressal Appellate Officer (CROA): Shrinarayan Mishra

Email id: shrinarayan.mishra@barodabnpparibasmf.in