Gujarat International Finance Tec-City (GIFT City) is a Special Economic Zone (SEZ) established as India’s first International Financial Services Centre (IFSC). The objective of the SEZ is to help India realize its potential in the international financial services industry. GIFT City IFSC provides a strategic location to develop an efficient platform for all inbound and outbound foreign currency transactions. GIFT City provides financial services to both- Indian and foreign entities in foreign currencies and a tax efficient manner.

Further, it is a global financial and technology hub that offers single-window clearances and approvals under one umbrella. It is an efficient way to invest in India with stable regulatory regime at par with global jurisdictions , simplified registration process for FM and FME (Fund Management Entity), favourable carve out in tax laws, multi-currency exibility and Global benchmarking.

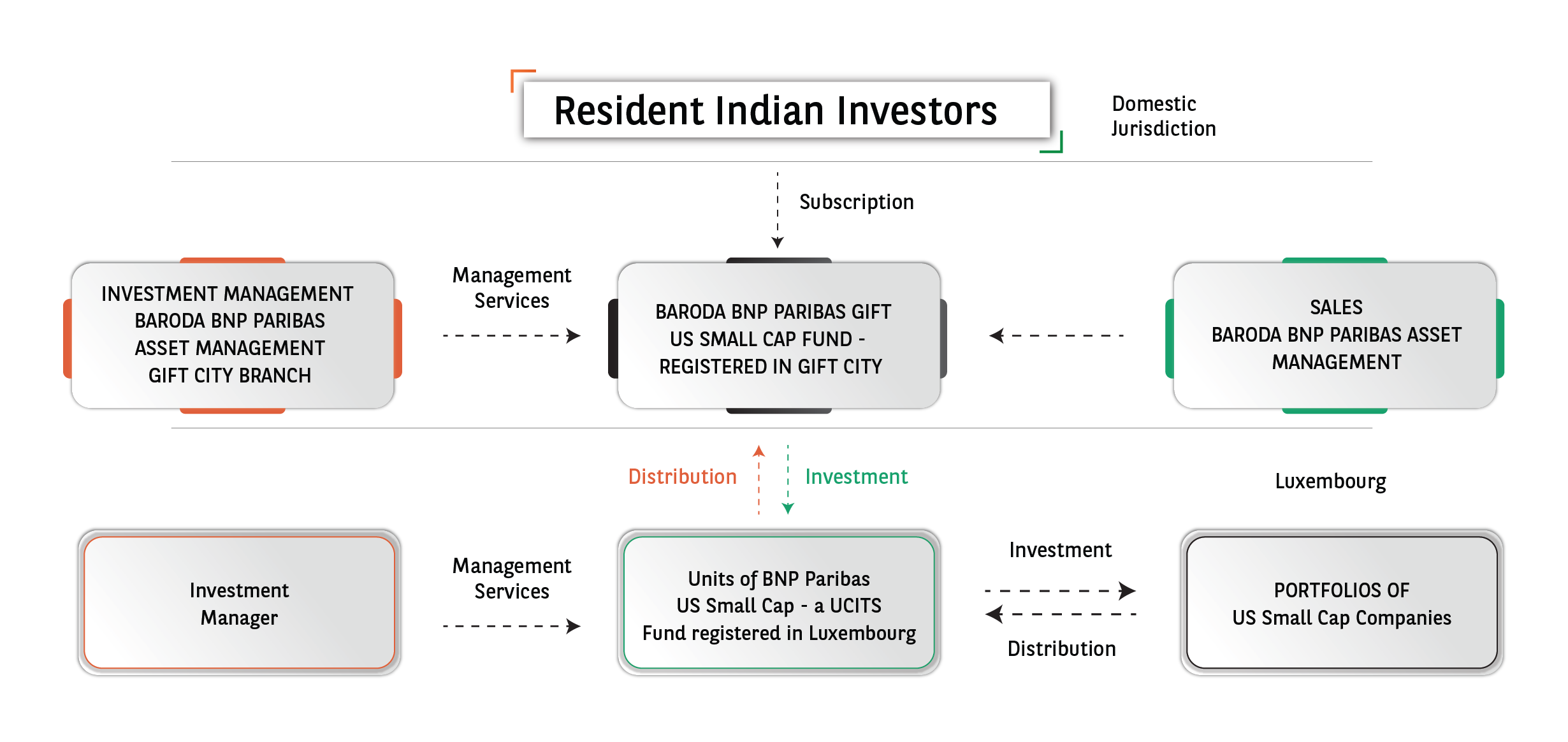

A Restricted Scheme classified as an open-ended Category III AIF under the IFSCA Regulations, that predominantly seeks to invest in BNP PARIBAS US SMALL CAP, a UCITS fund registered in Luxembourg (“Underlying Fund”). The Underlying Fund invests in US Small Cap companies with a view to provide long term capital appreciation for the Contributors in accordance with Applicable Laws and the Trust Documents.

| Share Class | Minimum Application Amount | Lock In | Exit Load | Management Fees |

|---|---|---|---|---|

| U | USD 1,50,000 | 2 Years (i.e. No Luxembourg Investment Distribution Exit Load PORTFOLIOS OF US Small Cap Companies redemptions allowed for first 2 years) | NIL | 1.75% per annum |

| T | USD 1,75,000 | NIL | 1% for 1 Year | 1.65% per annum |

| I | USD 2,50,000 | NIL | NIL | 0.75% per annum |

About Baroda BNP Paribas Asset Management India Private Ltd - GIFT City Branch (BBNPP - Gift)

BBNPP – Gift set up its branch in GIFT City in 2024 and has subsequently registered with International Financial Services Centre Authority (IFSCA) as retail Fund Management Entity (FME) bearing registration number: IFSCA/FME/III/2023-24/099.

BBNP-Gift is the investment manager for the Fund and will manage the Fund from Gift city.

| Entity | Tax Applicability |

|---|---|

| Resident Investors | Any Income from AIF exempt from tax |

| Baroda BNP Gift US Small Cap Fund | AIF pays out redemption proceeds after deducting capital gains tax for individual investors |

U.S. equity markets continuing to show resilience and leadership in a volatile global landscape, we see a compelling case for broadening exposure beyond the mega-cap names that have driven recent gains. U.S. small caps offer an attractive opportunity at this stage of the cycle – benefiting from a potential Fed pivot, relative valuation discounts to large caps, and increased domestic orientation as geopolitical risks persist.

Diversification beyond big tech: Small caps offer broader exposure to the U.S. economy beyond the tech-heavy S&P 500, allowing investors to tap into the underappreciated and under-researched part of the U.S. growth engine. Small cap has greater sector diversification and less name concentration than large cap (weight of top 10 constituents in Russell 2000 vs S&P500 is 3.7% vs 38.2%)

Attractive valuation opportunity: Rusell 2000 vs. S&P 500 relative forward P/E way below long-term average; Small caps trading at significant discount to large caps at near 20-year high and the gap starts to narrow.

Strong earnings rebound ahead: Despite trade war disruption, U.S. small cap earnings expected to recover in 2H 2025 and through to 2026 according to forecasts – domestic reshoring and increased lending by banks and private credit are two trends supporting the forecast

Supportive policy environment: U.S. domestic growth policies and reshoring trends benefit smaller, domestically focused companies, with over 70% small cap companies focused on domestic businesses.

M&A potential: Small caps are common acquisition targets, with increased deal flow expected as rates decline.

Performance:

| Cumulated Performance at 29.08.2025 (%) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| YTD | 1 Month | 3 Months | 6 Months | 1 Year | 2 Years | 3 Years | 4 Years | 5 Years | |

| Fund | 7.45 | 5.71 | 11.07 | 7.41 | 9.61 | 31.28 | 38.89 | 18.45 | 66.98 |

| Benchmark | 7.06 | 7.14 | 14.93 | 7.45 | 8.17 | 28.15 | 34.11 | 10.12 | 61.97 |

Holdings: & of Portfolio

| By Holdings (%) | By Sector (%) | Against Benchmark | ||

|---|---|---|---|---|

| Casella Waste Syst Inc A | 1.89 | Financials | 19.46 | +0.36 |

| Watts Water Technologies Inc A | 1.86 | Health care | 16.37 | +0.89 |

| MSA Safety INC | 1.76 | Information Technology | 15.96 | +1.47 |

| Radian Group INC | 1.74 | Industrials | 15.67 | -1.82 |

| Commercial Metals | 1.73 | Consumer Discretionary | 7.98 | -2.40 |

| Advanced Energy Industries INC | 1.69 | Real Estate | 6.11 | +0.01 |

| Hexcel Corp | 1.64 | Materials | 5.64 | +1.53 |

| HERC Holdings INC | 1.63 | Energy | 3.08 | -1.67 |

| JFROG LTD | 1.63 | Utilities | 2.98 | -0.17 |

| Axcelis Technologies INC | 1.62 | Consumer Staples | 1.98 | -0.28 |

| No. of Holdings in Portfolio | 80 | Forex contracts | -0.02 | -0.02 |

| Source of date: BNP Paribas Asset Management, as at 29.08.2025

The above mentioned securities are for illustrative pupose only and do not

constitute any investment recommendation. The data as shown in the factsheet are based on official accounting data and are based on trade date. |

Other | 1.36 | -1.35 | |

| Cash | 3.44 | +3.44 | ||

| Total | 100.00 | |||

Dated: August 29, 2025 , it is the latest available data. Past performance may or may not be sustained in future and is not a guarantee of any future returns. Returns do not consider the load and taxes, if any.

High conviction, quality focus:

Collaboration at its core: The Boston based U.S. Equity team manages six strategies with total of over $12B AUM. Having a strategic overweight in smaller caps across all strategies has been a key alpha driver for over a decade, including this Fund with $1.4B AUM since the team manages it in May 2013.

Proven track record: Outperformed benchmark in 10 of the last 12 years, mainly through stock picking. Over the last 10 years, the Fund has achieved an annualized net return was +9.88% and cumulative excess net return was +22.37% over benchmark (Russell 2000).Furthermore, the fund has outperformed benchmark in 10 out of the last 12 calendar years with excess returns driven mainly by stock selection, including the outperformance against benchmark in difficult years like 2022; Majority of outperformance have been driven by stock selection as we adopt sector-neutral approach.

Disclaimer : Source – Gift Gujarat, Bloomberg, Participation in the Fund is subject to substantial risks, including the risk that the entire amount invested may be lost. There is no guarantee that any investor will realize any particular rate of return or will receive the return of its invested capital. Returns are dependent on prevalent market factors, liquidity and other conditions. Investors may consult their nancial or tax advisor while making investments decisions.

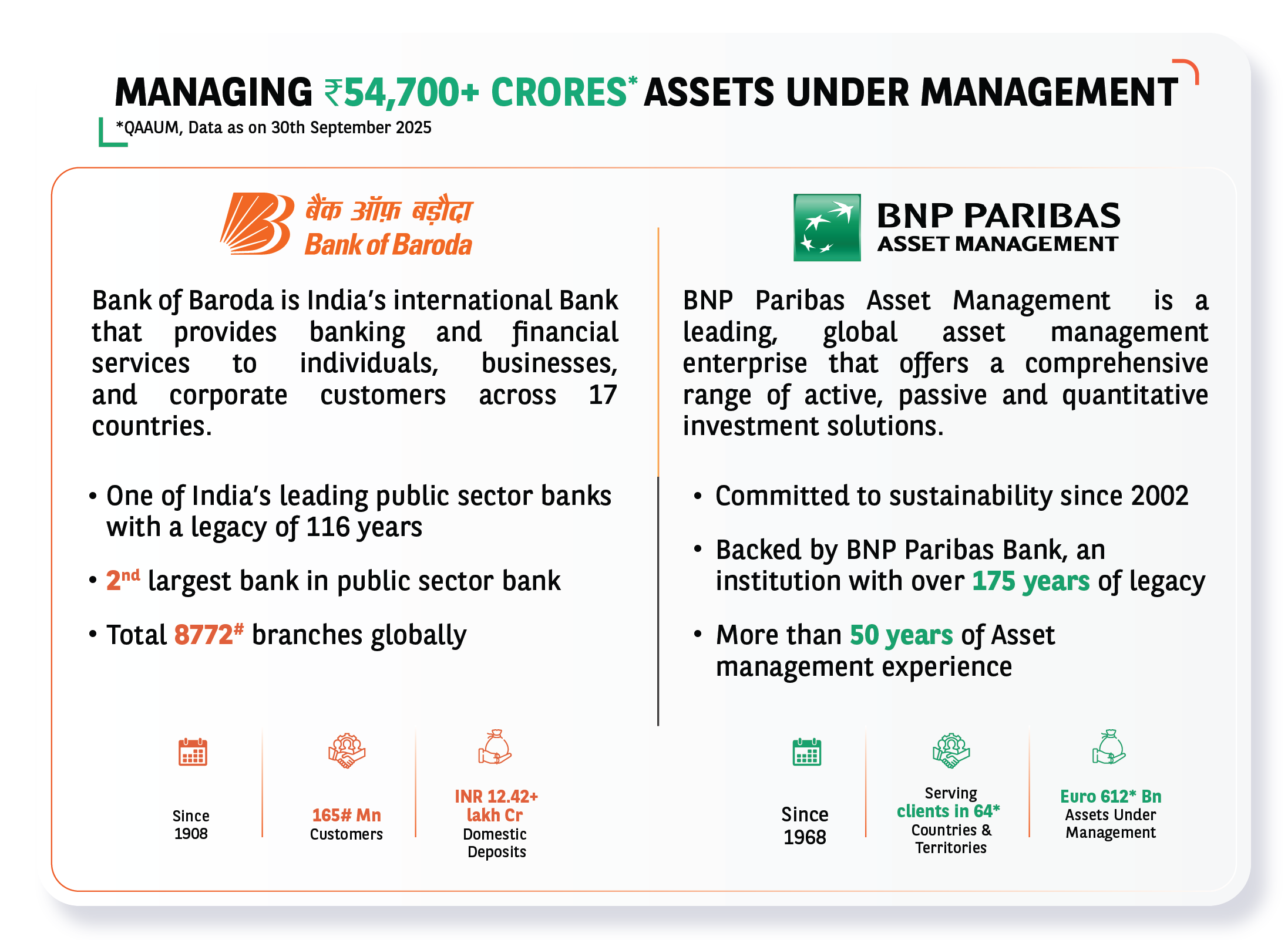

#Data as on 30th Jun 2025

Source: Website and Bank of Baroda Annual Report as of 31st Mar 2025

*Data as of 30th Jun 2025

Source: BNP Paribas Group