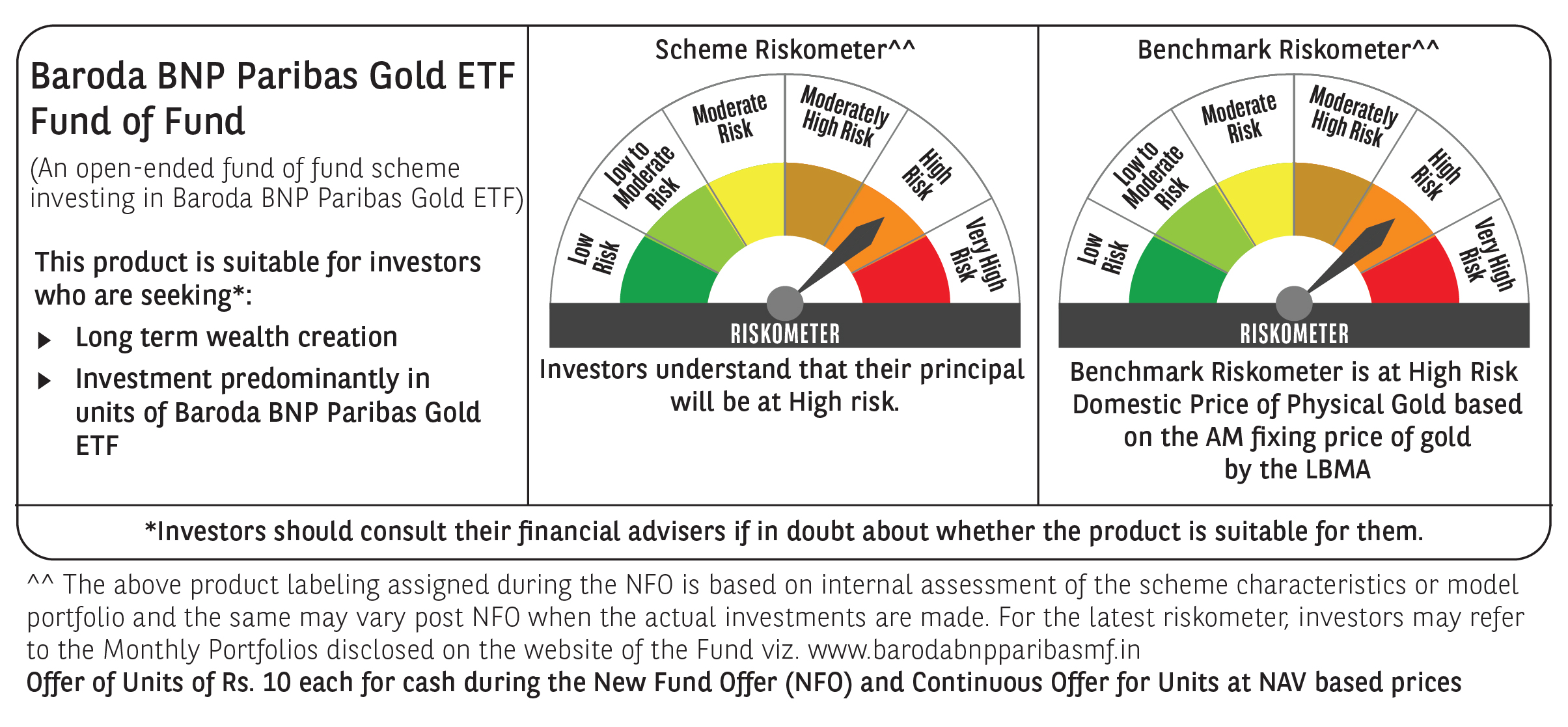

Investors may please note that they will be bearing the expenses of the relevant fund of fund scheme in addition to the expenses of the underlying schemes in

which the fund of fund scheme makes investment in. The Scheme will invest predominantly in Baroda BNP Paribas Gold Exchange Traded Fund of Baroda BNP

Paribas Mutual Fund. Hence the Scheme’s performance will depend upon the performance of the underlying mutual fund scheme. Any change in the investment

policies or the fundamental attributes of the underlying scheme could affect the performance of the Scheme. Investments by Baroda BNP Paribas Gold ETF are

subject to availability of gold. If favorable investment opportunities do not exist or opportunities have noticeably diminished, Baroda BNP Paribas Gold ETF may

suspend accepting fresh subscriptions. This may also affect acceptance of subscription by the Fund of Fund Scheme. The investors of the Scheme will bear dual

recurring expenses and possibly dual loads, viz, those of the Scheme and those of the underlying Schemes. Hence the investor under the Scheme may receive

lower pre-tax returns than what they could have received if they had invested directly in the underlying Schemes in the same proportions. The Portfolio

disclosure of the Scheme will be limited to providing the particulars of the underlying schemes where the Scheme has invested and will not include the

investments made by the underlying Schemes. However, as the scheme proposes to invest only in Baroda BNP Paribas Gold ETF, the underlying assets will by and

large be physical gold. The changes in asset allocation may result in higher transaction costs. The value (price) of gold may fluctuate for several reasons and all

such fluctuations will result in changes in the NAV of units under the scheme. The factors that may effect the price of gold, among other things, include demand

and supply for gold in India and in the global market, Indian and Foreign exchange rates, Interest rates, Inflation trends, trading in gold as commodity, legal

restrictions on the movement/ trade of gold that may be imposed by RBI, Government of India or countries that supply or purchase gold to/from India, trends

and restrictions on import/export of golden jewellery in and out of India, etc. The Scheme assets are predominantly invested in Baroda BNP Paribas Gold ETF and

valued at the market price of the said units on the principal exchange. The same may be at a variance to the underlying NAV of the fund, due to market expectations, demand supply of the units, etc. To that extent the performance of scheme shall be at variance with that of the underlying scheme/s.

The endeavour would always be to get cash on redemptions from the underlying Scheme. However, in case the underlying fund is unable to sell for any reason,

and delivers physical gold, there could be delay in payment of redemptions proceeds pending such realization. The Scheme will subscribe according to the value

equivalent to unit creation size as applicable for each of the underlying scheme. When subscriptions received are not adequate enough to invest in creation unit

size, the subscriptions may be deployed in debt and money market instruments which will have a different return profile compared to gold returns profile. The

liquidity of the Scheme’s investments may be inherently restricted by trading volumes, settlement periods and transfer procedures. In the event of an inordinately large number of redemption requests, or of a re-structuring of the Scheme’s investment portfolio, these periods may become significant. Although, the

objective of the Scheme is to generate optimal returns, the objective may or may not be achieved. The NAV of the scheme to the extent invested in Money market

securities are likely to be affected by changes in the prevailing rates of interest and are likely to affect the value of the Scheme’s holdings and thus the value of

the Scheme’s Units. While securities that are listed on the stock exchange carry lower liquidity risk, the ability to sell these investments is limited by the overall

trading volume on the stock exchanges. Money market securities, while liquid, lack a well-developed secondary market, which may restrict the selling ability of

the Scheme and may lead to the Scheme incurring losses till the security is finally sold. Investment decisions made by the AMC may not always be profitable,

even though it is intended to generate capital appreciation and maximize the returns. The tax benefits available under the Scheme are as available under the

present taxation laws and are available only to certain specified categories of investors and that is subject to fulfilment of the relevant conditions. The information given is included for general purposes only and is based on advice that the AMC has received regarding the law and the practice that is currently in force in

India and the investors and the Unitholders should be aware that the relevant fiscal rules and their interpretation may change. As is the case with any

investment, there can be no guarantee that the tax position or the proposed tax position prevailing at the time of investment in the Scheme will endure indefinitely. In view of the individual nature of tax consequences, each Investor/Unitholder is advised to consult his/her own professional tax advisor

All risks associated with the underlying scheme, including performance of underlying physical gold, asset class risk, passive investment risk, indirect taxation

risk etc. will be applicable to this scheme. Investors who intent to invest in this scheme are required to and deemed to have understood the risk factors of the

underlying scheme.

Disclaimers: The material contained herein has been obtained from publicly available information, internally developed data and other sources believed to be

reliable, but Baroda BNP Paribas Asset Management India Private Limited (AMC) makes no representation that it is accurate or complete. The AMC has no

obligation to tell the recipient when opinions or information given herein change. It has been prepared without regard to the individual financial circumstances

and objectives of persons who receive it. This information is meant for general reading purpose only and is not meant to serve as a professional guide for the

readers. Except for the historical information contained herein, statements in this publication, which contain words or phrases such as 'will', 'would', etc., and

similar expressions or variations of such expressions may constitute 'forward-looking statements'. These forward-looking statements involve a number of risks,

uncertainties and other factors that could cause actual results to differ materially from those suggested by the forward-looking statements. The AMC undertakes

no obligation to update forward-looking statements to reflect events or circumstances after the date thereof. The words like believe/belief are independent

perception of the Fund Manager and do not construe as opinion or advise. This information is not intended to be an offer to sell or a solicitation for the purchase

or sale of any financial product or instrument. The information should not be construed as an investment advice and investors are requested to consult their

investment advisor and arrive at an informed investment decision before making any investments. The sector(s) mentioned in this document do not constitute

any recommendation of the same and Baroda BNP Paribas Mutual Fund may or may not have any future position in these sector(s). The Trustee, AMC, Mutual

Fund, their directors, officers or their employees shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary

damages arising out of the information contained in this document. Past performance may or may not be sustained in future and is not guarantee of any future

returns.