Baroda BNP Paribas Income Plus Arbitrage Active Fund of Funds

A fund of funds scheme means a mutual fund scheme that invests primarily in other schemes of the same mutual fund or other mutual funds.

These funds offer diversication across various asset classes. The fund can strategically allocate assets to achieve varying investment objectives, such as focusing on risk management. This structure provides you with a convenient way to access a diversied investment portfolio through a single fund.

Tax benefit for long term investors – LTCG of 12.5% and no tax impact on investors on rebalancing.

| Holding | Debt Funds | Fund of Funds |

|---|---|---|

| Up-to 24 months | Investor Slab Rate | 30% |

| More than 24 months | Investor Slab Rate | 12.5% |

Surcharge as applicable + Health and Education Cess applicable at 4% on aggregate of base tax + surcharge. Investors are requested to take professional advice while making investment decisions. As announced in the Union Budget 2024

Portfolio Diversication and Fund Selection – Investments in multiple underlying schemes across asset classes depending on the asset allocation of the scheme.

Ease of Handling – Single NAV for mutual fund investments

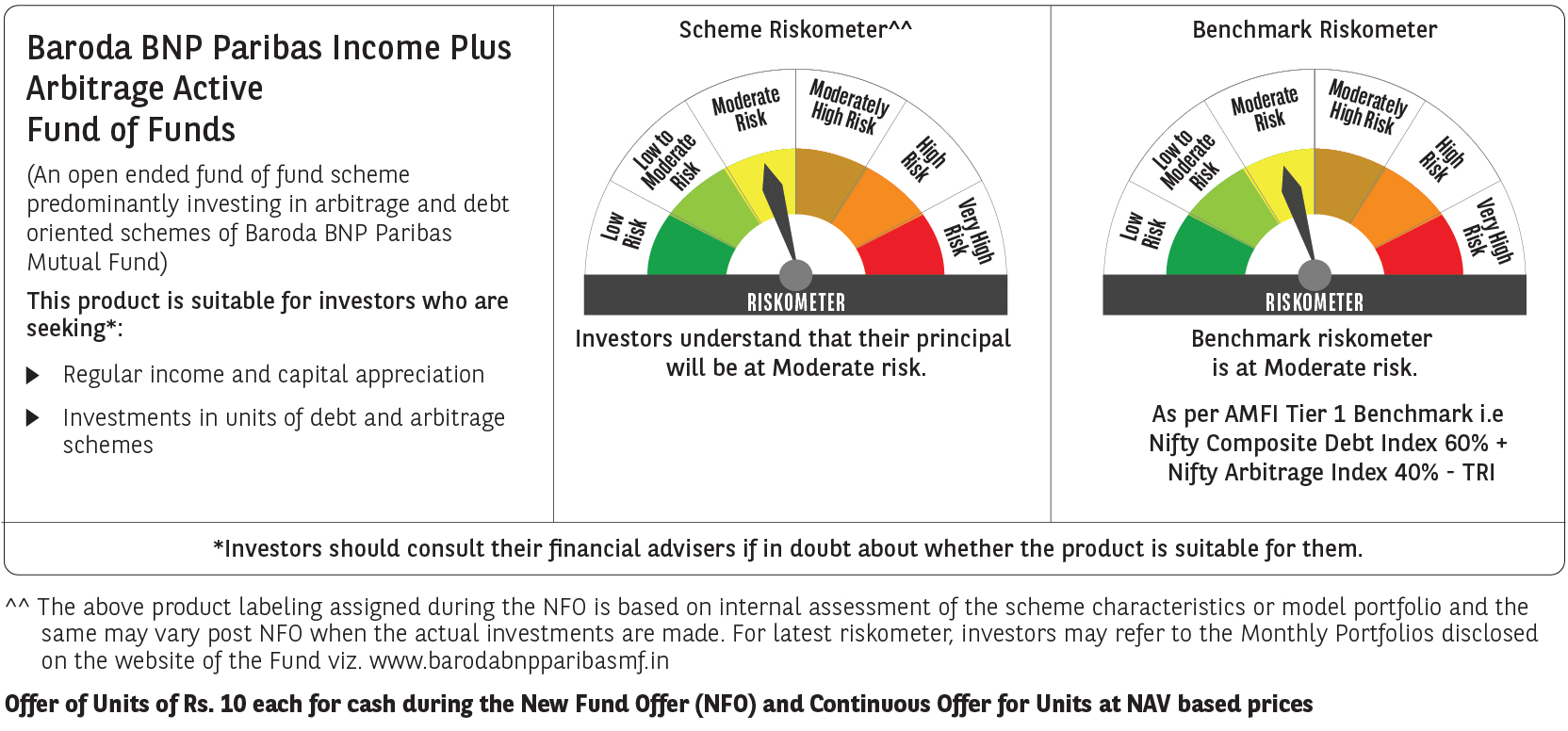

The primary objective of the Scheme is to offer regular income and capital appreciation through diversication of investments across debt and arbitrage schemes. The Scheme does not guarantee / indicate any returns. There is no assurance that the investment objective of the Scheme will be achieved.

The Scheme seeks to invest in a portfolio of xed income and arbitrage schemes. The portfolio of Scheme seeks to build a risk prole similar to lower risk xed income schemes. The Scheme would invest in Baroda BNP Paribas Arbitrage Fund for its arbitrage allocation. The portfolio manager would select a xed income scheme or multiple xed income schemes with differential weights based on their views on macro-economic variables, interest rates, credit environment, etc.

The Scheme intends to predominantly invest in debt schemes, thus providing investors a low-risk investment option.

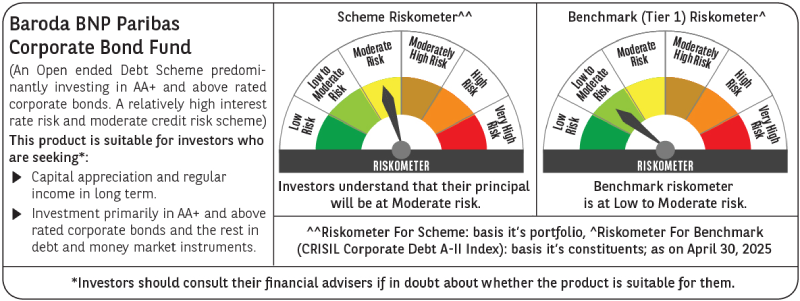

Baroda BNP Paribas Corporate Bond Fund*

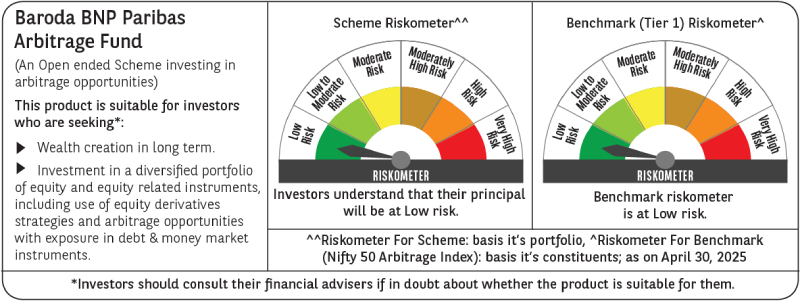

Baroda BNP Paribas Arbitrage Fund*

#Please refer to the Scheme Information Document of the scheme before investing for details including investment objective, asset allocation pattern, investment strategy, risk factors and taxation.

| Scheme Name | Baroda BNP Paribas Income Plus Arbitrage Active Fund of Funds | ||||||||||||

| Type of Scheme | An open-ended fund of fund scheme predominantly investing in arbitrage and debt-oriented schemes of Baroda BNP Paribas Mutual Fund | ||||||||||||

| Category | Hybrid Fund of Fund (FoF) - Income plus Arbitrage FoF | ||||||||||||

| Investment Objective | The primary objective of the Scheme is to offer regular income and capital appreciation through diversication of investments across debt and arbitrage schemes. The Scheme does not guarantee / indicate any returns. There is no assurance that the investment objective of the Scheme will be achieved. | ||||||||||||

| Asset Allocation |

For complete details, please refer to SID available on our website (www.barodabnpparibasmf.in). |

||||||||||||

| Fund Manager~ | Mr. Prashant Pimple (Total Experience 25 years), Mr. Neeraj Saxena (Total Experience 21 years) | ||||||||||||

| Benchmark | Nifty Composite Debt Index 60% + Nifty Arbitrage Index 40% TRI | ||||||||||||

| Load Structure & Expenses |

Exit Load: Nil Maximum Total Expense Ratio (TER) -2% - Permissible under Regulation 52. Investors are requested to note that they will be bearing the recurring expenses of the fund of funds scheme in addition to the expenses of the underlying fund(s) in which the fund of funds scheme makes investment. |

*The portfolio manager would select a xed income scheme or multiple xed income schemes with differential weights based on their views on macro-economic variables, interest rates, credit environment, etc. Considering the current market conditions, the scheme intends to invest in the Baroda BNP Paribas Corporate Bond Fund. The Fund Manager may at its discretion invest in any other debt-oriented schemes of Baroda BNP Paribas Mutual Fund, based on market conditions, interest rate scenario and other related factors .

^Money Market instruments include commercial papers, commercial bills, treasury bills, Government securities having an unexpired maturity up to one year, call or notice money, certicate of deposit, usance bills, cash & cash equivalents and any other like instruments as specied by the Reserve Bank of India from time to time. To know in detail about the other multiple underlying debt schemes, please refer the Scheme Information Document

KIM and Editable Application Form

Click HereSID

Click HereProduct Presentation

Click HereProduct one pager

Click Here

Trading volumes and settlement periods may restrict liquidity in debt investments. Investment in Debt is subject to price, credit, and interest rate risk. The NAV of the Scheme may be affected, inter alia, by changes in the market conditions, interest rates, trading volumes, settlement periods and transfer procedures. The NAV may also be subjected to risk associated with tracking error. Past performance may or may not be sustained in future and is not a guarantee of any future returns. In the preparation of the material contained in this document, Baroda BNP Paribas Asset Management India Ltd. (“AMC”) has used information that is publicly available, including information developed in-house. The AMC, however, does not warrant the accuracy, reasonableness and/or completeness of any information. This document may contain statements/opinions/ recommendations, which contain words, or phrases such as “expect”, “believe” and similar expressions or variations of such expressions that are “forward looking statements”. Actual results may di er materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices, etc. The AMC (including its a liates), Baroda BNP Paribas Mutual Fund (“Mutual Fund”), its sponsor / trustee find any of its o cers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of pro t in any way arising from the use of this document in any manner. The recipient alone shall be fully responsible / liable for any decision taken based on this document. All gures and other data given in this document are dated and may or may not be relevant at a future date. Prospective investors are therefore advised to consult their own legal, tax and nancial advisors to determine possible tax, legal and other nancial implication or consequence of subscribing to the units of the schemes of Baroda BNP Paribas Mutual Fund . Past performance may or may not be sustained in the future. Please refer to the Scheme Information Document of the schemes before investing for details of the scheme including investment objective, asset allocation pattern, investment strategy, risk factors and taxation.

Baroda BNP Paribas Income Plus Arbitrage Active Fund of Funds