An equity fund is a mutual fund scheme that invests predominantly in equity stocks.

In the Indian context, as per current SEBI Mutual Fund Regulations, an equity mutual fund scheme must invest at least 65% of the scheme's assets in equities and equity related instruments

Under the tax regime in India, equity funds enjoy certain tax advantages (such as, there is no incidence of long term capital gains tax on equity shares or equity funds which are held for at least 12 months from the date of acquisition). As per current Income Tax rules, an "Equity Oriented Fund" means a Mutual Fund Scheme where the investible funds are invested in equity shares in domestic companies to the extent of more than 65% of the total proceeds of such fund.

Before understanding the various types of equity funds, it is important to understand the classification of stocks based on their market capitalisation.

Types of equity oriented Mutual funds as per SEBI (Mutual Funds) Regulations, 1996:

Multi-Cap Funds: These funds can choose to invest in companies across market capitalisations. This means that depending on the scheme's investment mandate it can invest in small-cap, mid-cap and large-cap stocks. The minimum allocation in equity and equity-related instruments is 65% of total assets for these funds.

Large-Cap Funds: These funds predominantly invest in large-cap stocks. The minimum allocation in equity and equity-related instruments belonging to the large-cap category should be 80% of total assets for these funds.

Large and Mid-Cap Funds: These funds can invest in mid-cap and large-cap stocks. The minimum allocation in equity and equity-related instruments of mid-cap and large-cap stocks is 35% of total assets each, for these funds.

Mid-Cap Funds: These funds predominantly invest in mid-cap stocks. The minimum allocation in equity and equity-related instruments belonging to the mid-cap category should be 65% of total assets for these funds.

Small-Cap Funds: These funds predominantly invest in small-cap stocks. The minimum allocation in equity and equity-related instruments belonging to the small-cap category should be 65% of total assets for these funds.

Dividend Yield Funds: These funds predominantly invest in stocks that have historically yielded high dividends. The minimum allocation in equity and equity-related instruments is 65% of total assets for these funds. However, this needs to be in dividend yielding stocks.

Value Funds: These equity schemes follow a value investment strategy and seek to invest in stocks that are deemed to be undervalued in price based on fundamental characteristics. The minimum allocation in equity and equity-related instruments is 65% of total assets for these funds.

Contra Funds: These schemes follow the contrarian investment strategy and invest in stocks that are compelling in nature but may not be attractive to a majority of the investors. The minimum allocation in equity and equity-related instruments is 65% of total assets for these funds.

Focused Funds: These schemes can invest across market capitalisations, but cannot hold more than 30 stocks in the portfolio. The minimum allocation in equity and equity-related instruments is 65% of total assets for these funds.

Sectoral/Thematic Funds: These schemes can invest in stocks belonging to a particular sector or adhering to a particular theme only. The minimum allocation in equity and equity-related instruments from the particular sector or theme is 80% of total assets for these funds.

Equity Linked Savings Schemes (ELSS): These are tax-saving schemes that come with a lock-in period of 3 years. They predominantly invest in equity and equity related instruments. The minimum allocation in equity and equity-related instruments is 80% of total assets for these funds. Investors can claim tax deduction under section 80C of the Income Tax Act, 1961 by investing in ELSS.

Risk in Equity Oriented Mutual Funds

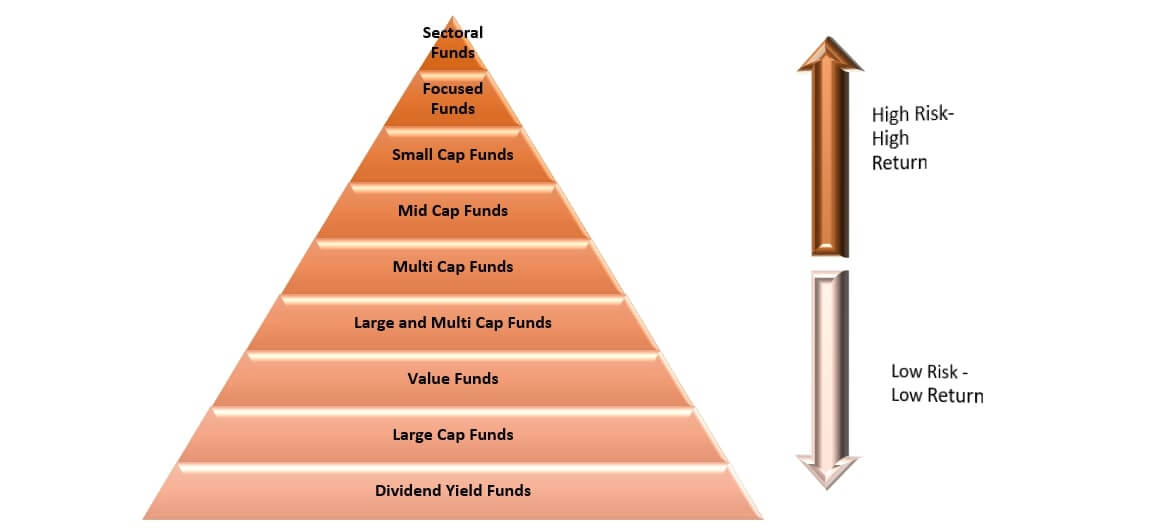

Not all investors have the same risk-taking capacity and the above-mentioned funds will have different risk-return characteristics. The following diagram will provide you with information regarding the risk associated with the above mentioned funds.

Investors should invest in equity funds as per their risk profile. It is always advisable to connect with a financial adviser before making any decisions.

^As per the Finance Act, 2005, read with notifications dated 3rd November 2005 and 13th December, 2005 issued by ministry of finance, subscription to the extent of Rs.150,000 in Baroda BNP Paribas Long Term Equity Fund(ELSS) by Individuals and HUFs should be eligible for deduction under section 80C of the Income Tax Act, 1961. Investors are requested to consult their tax advisor in this regard. The investments in the scheme shall be locked-in for a period of 3 years from the date of allotment.

It is mandatory for all mutual fund investors to undergo a one-time KYC (Know Your Customer) process. For more info on KYC specifically on: the procedure for completing KYC, for changing address details, for changing contact details.

For changing bank details, visit bnpparibasmf.in/investor-centre/information-on-kyc

For more info on submitting a complaint or a grievance, visit https://www.bnpparibasmf.in/contact-us

Further, investors should ensure that they transact ONLY with SEBI Registered Mutual Funds listed under Intermediaries/Market Infrastructure Institutions on the SEBI website https://www.sebi.gov.in/intermediaries.html

An Investor Awareness Initiative.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.