Happy Investing!

When you are chasing a dream, you need a systematic and planned approach for your investments to help achieve it.

A Systematic Investment Plan (SIP), is a method that allows you to invest a fixed sum, regularly, in a mutual fund scheme.

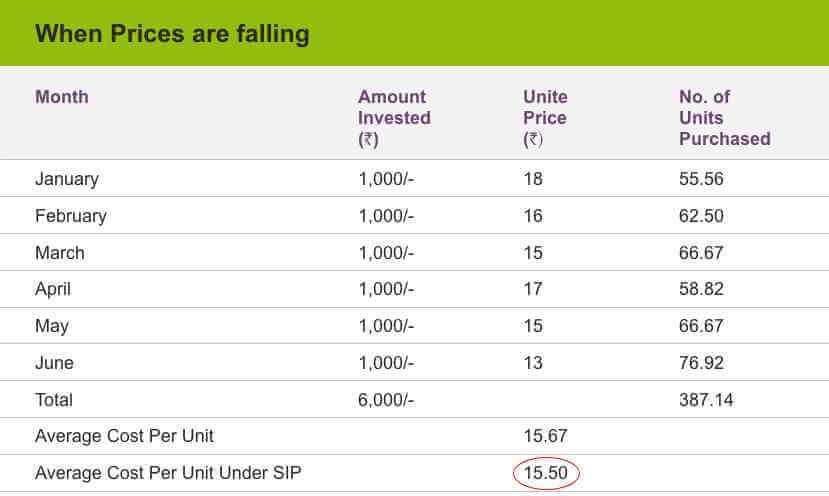

A SIP is designed to allow you to buy units on a given date every month/quarter, thus allowing you to implement an investment / saving plan for yourself. You can even begin with as low as Rs 500 every month. It eliminates the desire to try and time the market, and also inculcates a disciplined approach to investing which can prove to be better alternative as is demonstrated in the illustration below:

Rupee Cost Averaging – Eliminates the need for timing the market

SIPs are designed to try and cushion you from market volatility. It buys you more number of units when the NAVs are down and less units when NAVs are high. Thus helping you keep average purchase price lower.

A disciplined and systematic investment approach can go a long way in helping you realize your dreams. As always, it is advisable to seek professional services of an advisor to help you identify your financial goals and work out on an optimum plan.

Once you have decided upon the fund to invest in, the amount you want to invest and the frequency, you can either issue post-dated cheques or a NECS instruction. And, your systematic investments will be taken care of automatically.

Happy Investing!

It is mandatory for all mutual fund investors to undergo a one-time KYC (Know Your Customer) process. For more info on KYC specifically on: the procedure for completing KYC, for changing address details, for changing contact details.

For changing bank details, visit bnpparibasmf.in/investor-centre/information-on-kyc

For more info on submitting a complaint or a grievance, visit https://www.bnpparibasmf.in/contact-us

Further, investors should ensure that they transact ONLY with SEBI Registered Mutual Funds listed under Intermediaries/Market Infrastructure Institutions on the SEBI website https://www.sebi.gov.in/intermediaries.html

An Investor Awareness Initiative.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.