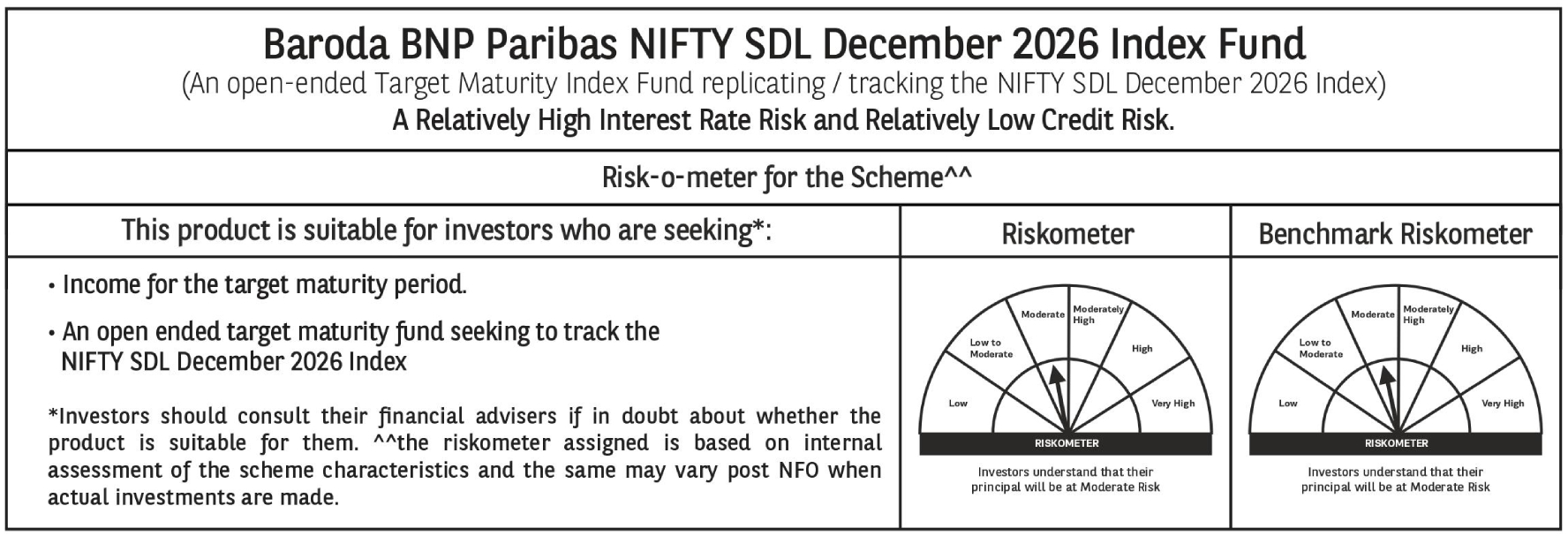

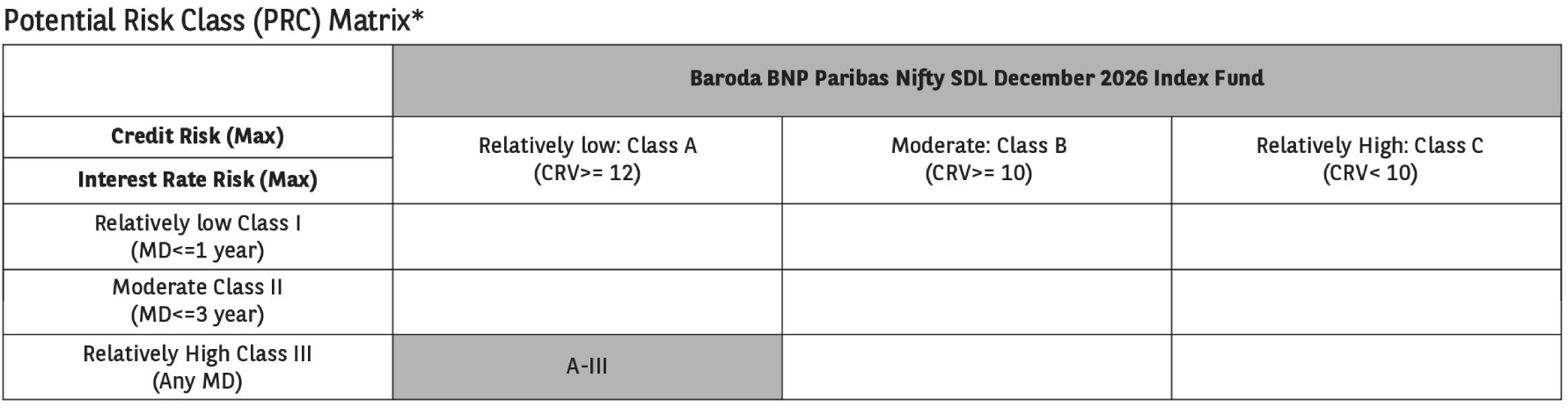

Baroda BNP Paribas NIFTY SDL December 2026 Index Fund

(An open-ended Target Maturity Index Fund replicating / tracking the NIFTY SDL December 2026 Index)

A Relatively High Interest Rate Risk and Relatively Low Credit Risk.

By entering your details, you hereby authorize Baroda BNP Paribas Asset Management India Pvt. Ltd. to contact you, which will override any NDNC registration made by you.

The fund is passively managed employing an investment strategy that seeks to offer returns that are in line with the returns offered by Nifty SDL December 2026 Index by replicating its portfolio & investing in its constituents in an identical proportion.

Invest in the fund which aims to avail relative predictable returns as the fund helps you to enter or invest at a current rate

The fund invests in top SDL, increasing the quality of your investments maturing on 31st December 2026

The open-ended nature of the fund offers the flexibility to invest and withdraw at any time during the investment tenure

Investing for 3+ years will help you qualify for long term capital gains along with indexation benefit

Being a passive fund, the expense ratio is comparatively lower than active funds

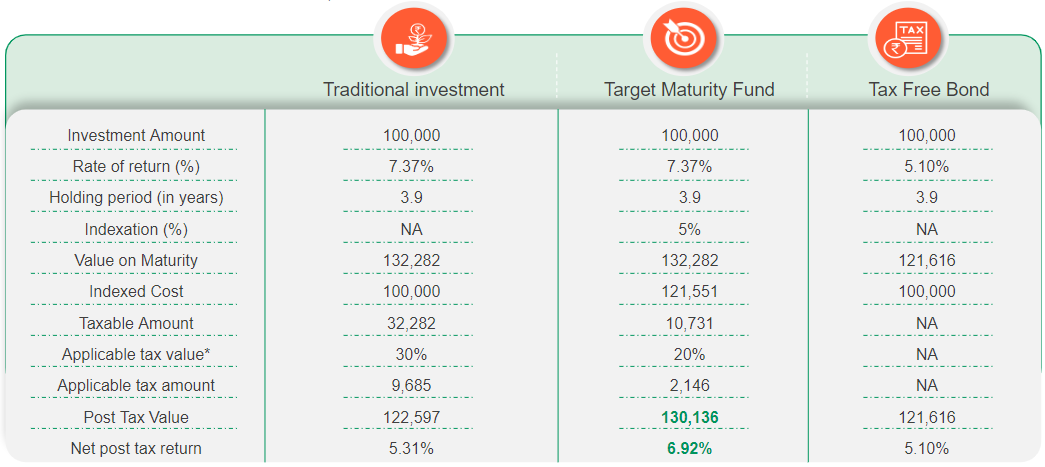

Target Maturity Funds may offer better post tax returns in comparison with traditional investments.

Here is an illustration to demonstrate:

Source: NSE indices *Traditional Investment taxed at 30% and Target Maturity Fund taxed at 20% post indexation exclusive of applicable surcharges & cess. Rate of return

for traditional investment is assumed to be same as the yield of the Benchmark Index. Rate of return for Target Maturity Fund is the yield of the index as on December 30,

2022, and does not include scheme expenses, impact cost, etc. (Source: NSE Index methodology document). Rate of indexation is assumed to be 5%. Rate of tax-free

bonds is the average yield of tax-free bonds traded on NSE. Investors are advised to consult their tax advisors for taxation related matters. To be used for illustrative

purposes only illustration to explain the concept of indexations and its benefits and actual dates and figures would vary. Actual tax implications may differ basis prevailing tax

laws. The Scheme is not providing any assured or guaranteed returns, neither forecasting any returns. This is not an indicative yield as well of the product. Traditional Saving

Schemes such as Fixed Deposits and Target Maturity Funds are not comparable. The comparison is limited to tax efficiency, which is subject to changes in prevailing tax

laws. Investments in FDs are insured by Deposit Insurance and Credit Guarantee Corporation (DICGC) upto a maximum of Rs. 1,00,000 (Rupees one lakh) for both

principal and interest amount.

Past Performance may or may not be sustained in future.

Nifty SDL Dec 2026 Index seeks to measure the performance of portfolio of 10 State Development Loans (SDLs) maturing during the six-month period ending December 31, 2026.

For every selected state/Union Territory, SDL with longest maturity maturing during the six-month period ending December 31, 2026, is selected to be a part of the index

Only one SDL per state/UT to be part of the index

Each state/Union Territory that is part of the index is given equal weight as on the base date of the index

Subsequently, the security level weights may drift due to price movement and will not get reset

On a semi-annual basis, index will be screened for compliance with the Norms for Debt Exchange Traded Funds (ETFs)/Index Funds.

Baroda BNP Paribas NIFTY SDL December 2026 Index Fund

(An open-ended Target Maturity Index Fund replicating / tracking the NIFTY SDL December 2026 Index)

A Relatively High Interest Rate Risk and Relatively Low Credit Risk.

Index Fund

The investment objective of the scheme is to provide investment returns closely corresponding to the total returns of the securities as represented by the Nifty SDL December 2026 Index before expenses, subject to tracking errors, fees and expenses. However, there is no assurance that the objective of the Scheme will be realised and the Scheme does not assure or guarantee any returns.

NIFTY SDL December 2026 Index

Entry Load: Nil.

Exit Load: Nil.

Mayank Prakash

| Type of Scheme | Min (% of Net Assets) | Min (% of Net Assets) | Risk Profile |

|---|---|---|---|

| Debt Instruments comprising of Nifty SDL December 2026 Index | 95 | 100 | Low to Medium |

| Cash & Money Market instruments and Units of liquid and debt mutual fund schemes | 0 | 5 | Low to Medium |

During normal circumstances, the Scheme’s exposure to money market instruments will be in line with the asset allocation table. However, in case of maturity of instruments in the Scheme portfolio, the reinvestment will be in line with the index methodology. The cumulative gross exposure through debt and money market instruments will not exceed 100% of the net assets of the scheme. The Scheme will not invest in equity and equity related securities and Foreign Securities. The Scheme will not indulge in short selling and securities lending and borrowing.

For complete details on asset allocation, please refer to SID available on our website (www.barodabnpparibasmf.in).

The scheme will have two Plans: Regular and Direct.

Each of the above Plans under the Scheme offers following options: Growth option and Income Distribution cum Capital Withdrawal (‘IDCW’) option.

The IDCW option offers Payout of Income Distribution cum capital withdrawal option

Lumpsum Details:

Minimum Application Amount: Rs. 5,000 and in multiples of Rs. 1 thereafter.

Minimum Additional Application Amount: Rs. 1,000 and in multiples of Rs. 1 thereafter.

SIP Details:

Minimum Application Amount -

(i) Daily, Weekly, Monthly SIP: Rs. 500/- and in multiples of

Rs. 1/- thereafter;

(ii) Quarterly SIP: Rs. 1500/- and in multiples of Rs. 1/- thereafter. Frequency Available: Daily, Weekly, Monthly & Quarterly

“The “Product” offered by “the issuer” is not sponsored, endorsed, sold or promoted by NSE INDICES LIMITED (formerly known as India Index Services & Products Limited (IISL)). NSE INDICES LIMITED does not make any representation or warranty, express or implied (including warranties of merchantability or fitness for particular purpose or use) and disclaims all liability to the owners of “the Product” or any member of the public regarding the advisability of investing in securities generally or in the “the Product” linked to NIFTY SDL December 2026 Index or particularly in the ability of the NIFTY SDL December 2026 Index to track general equity market performance in India. Please read the full Disclaimers in relation to the NIFTY SDL December 2026 Index in the in the Offer Document / Prospectus / Information Statement.”

Please refer to Scheme Information Document available on our website (www.barodabnpparibasmf.in) for detailed Risk Factors, assets allocation, investment strategy etc.