Baroda BNP Paribas Value Fund

By entering your details, you hereby authorize Baroda BNP Paribas Asset Management India Pvt. Ltd. to contact you, which will override any NDNC registration made by you.

Value investing is about identifying and investing in stocks that are under-priced to their intrinsic value.

The fund aims to invest in under-valued companies which aims to generate wealth in long term.

Catching Potential Gems - Value investing is all about looking for stocks with unrealised potential.

Holding for Long Term - Value investing involves selecting stocks and staying invested for long term till the value is realised.

Leveraging on market sentiments - Markets tend to move according to investors’ emotions fuelled by fear and greed. This creates value opportunities for research based rational value fund manager who aims to buy quality companies at low prices.

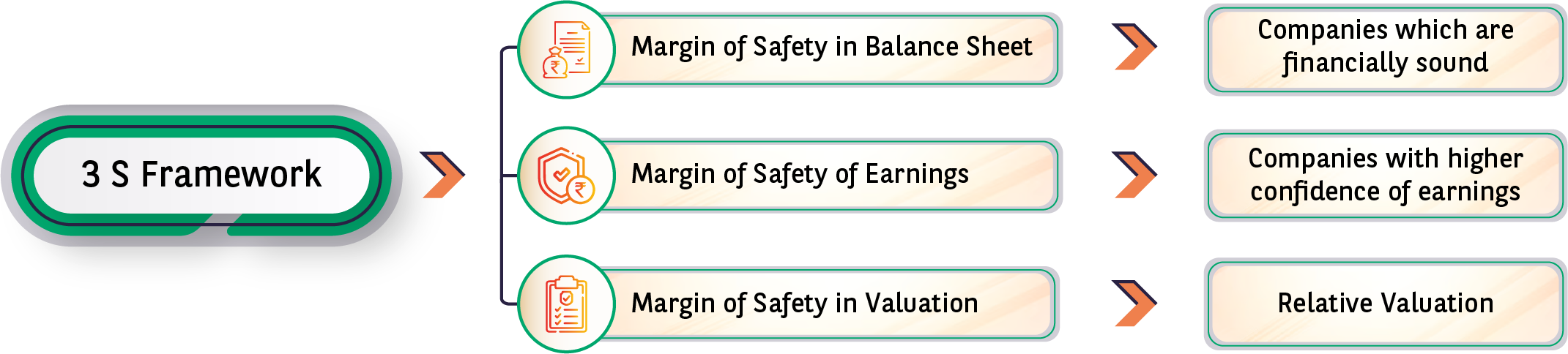

*Safety here does not mean safety market price. This is the investment strategy that the fund intends to follow. The Investment strategy being followed shall be in line with the investment strategy mentioned in the Scheme Information Document (SID). This does not in any manner indicate positive performance or safety of investments.

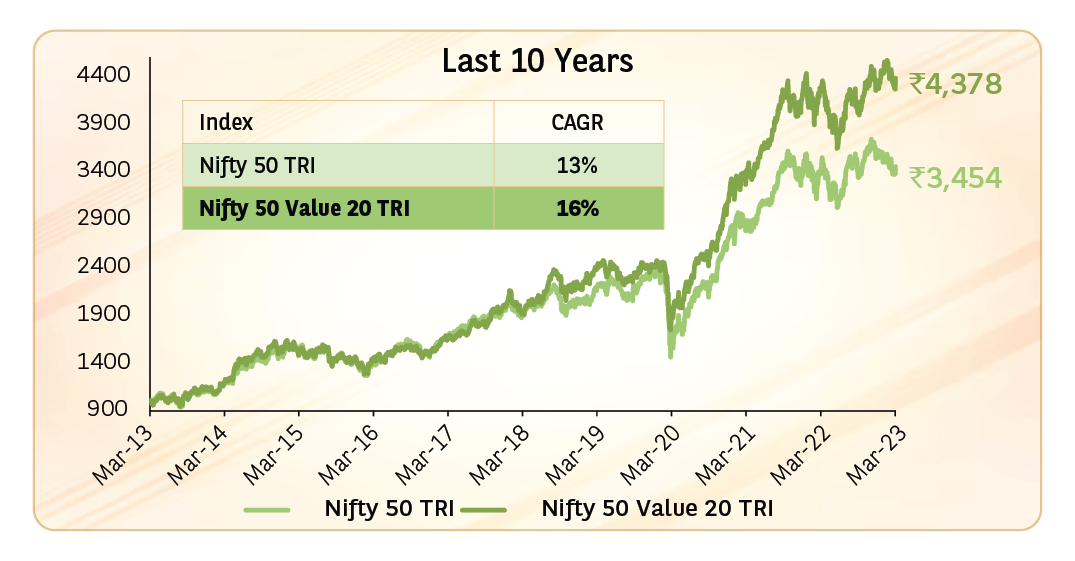

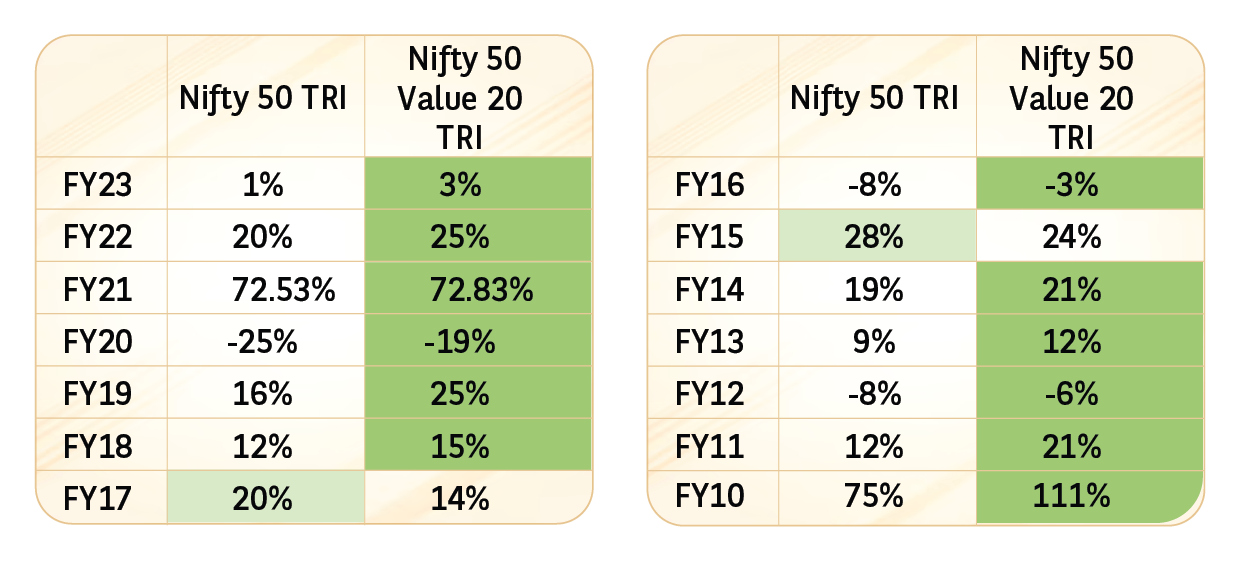

The value style of investing has outperformed the broad market benchmark in 12 out of 14 financial years.

Soure: Bloomberg and Internal. Data as on 31st March 2023

Disclaimer: Nifty 50 TRI is the proxy for broad market performance and Nifty 50 value 20 Index is a proxy of the value investment style. Neither of these indices are the benchmark of the scheme. Nifty 500 TRI is the benchmark for the scheme. The Nifty 50 value 20 Index does not represent the investment strategy for the scheme. For further details on asset allocation, investment strategy and risk factors of the Scheme please refer to SID available on our website (www.barodabnpparibasmf.in). Past performance, including such scenarios, is not an indication of future performance.

Patient Long Term Investors

Investors looking for diversification from growth-oriented portfolios

Investors looking for benefits

Baroda BNP Paribas Value Fund

An open ended equity scheme following a value Investment strategy

Value Funds

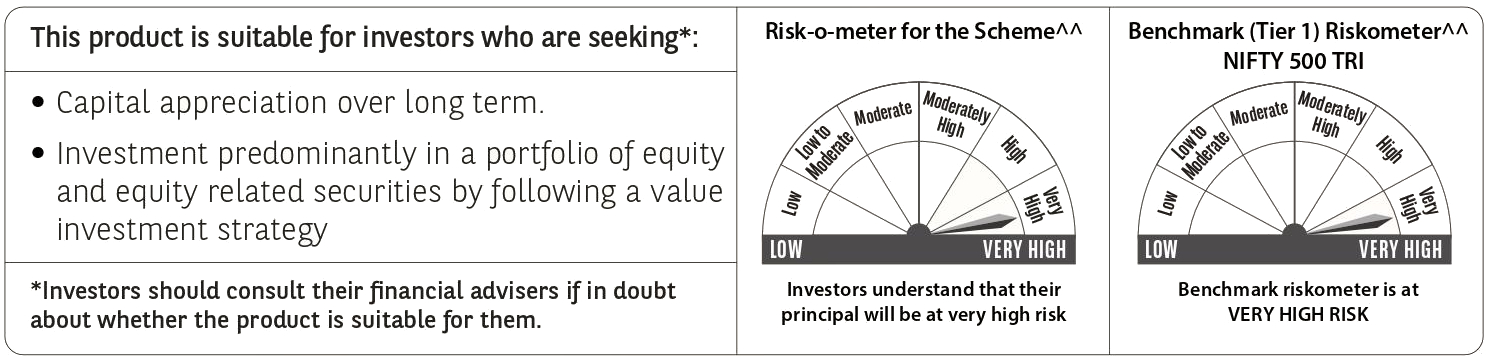

The Scheme seeks to generate long term capital appreciation from a diversified portfolio of predominantly equity and equity related instruments by following a value investment strategy.

However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns.

NIFTY 500 TRI

Entry Load : NA

Exit Load:

Mr. Shiv Chanani

| Min (% of Net Assets) | Min (% of Net Assets) | Risk Profile | |

|---|---|---|---|

| Equity & Equity related instruments | 65 | 100 | High |

| Debt & Money Market instruments | 0 | 35 | Low to Medium |

| Units issued by REITs & INvITs | 0 | 10 | Medium to High |

| Units of Mutual Fund Schemes | 0 | 10 | Medium to High |

*For complete Asset allocation and investment strategy of the scheme, investors are requested to refer to the Scheme Information Document of the Scheme.

The Scheme offers following two plans: Regular and Direct

Each plan offers Growth Option, and Income Distribution cum capital withdrawal (IDCW)* Option with payout and reinvestment options.

*Amounts can be distributed out of investors capital (equalization reserve), which is part of sale price that represents realized gains.

Lumpsum Details:

Minimum Application Amount: Rs. 5,000 and in multiples of Rs. 1 thereafter.

Minimum Additional Application Amount: Rs. 1,000 and in multiples of Rs. 1 thereafter.

SIP Details:

Minimum Application Amount -

(i) Daily, Weekly, Monthly SIP: Rs. 500/- and in multiples of Rs. 1/- thereafter;

(ii) Quarterly SIP: Rs. 1500/- and in multiples of Rs. 1/- thereafter Frequency Available: Daily, Weekly, Monthly & Quarterly

^^the riskometer assigned is based on internal assessment of the scheme characteristics and the same may vary post NFO when actual investments are made.

Offer of units of Rs. 10 each during the New Fund Offer period and continuous offer for units at NAV based prices.