Invest in Balanced Advantage Funds

Ever felt like life is off-balance? Sometimes you tend to lean more towards one side while taking a decision. The emotions drive you that way and later you realise, the repercussions are nothing but the missing core. If the conditions are out of balance, no matter what the preparations are, you will end up on the ground, but your investments don't have to be. Balanced Advantage Funds helps to adapt to market conditions, aiming that your portfolio is on track. With expert management and dynamically adjusting your investments in equity and debt you may ride market’s ups and downs with confidence and aim to achieve your long-term goals.

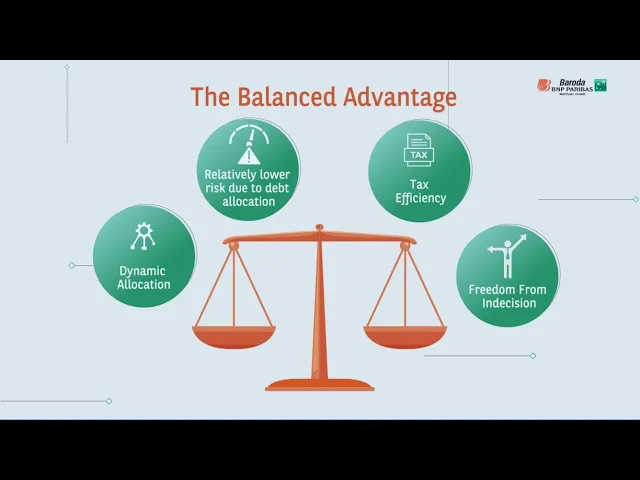

Benefits of Balanced Advantage Funds

✓ Avoid Market Timing: Eliminate the need to predict market highs and lows.

✓ Dynamic Asset Allocation: Adjusts portfolio based on market trends.

✓ Diversified Portfolio: Combines equity and debt for balanced growth and reduced risk.