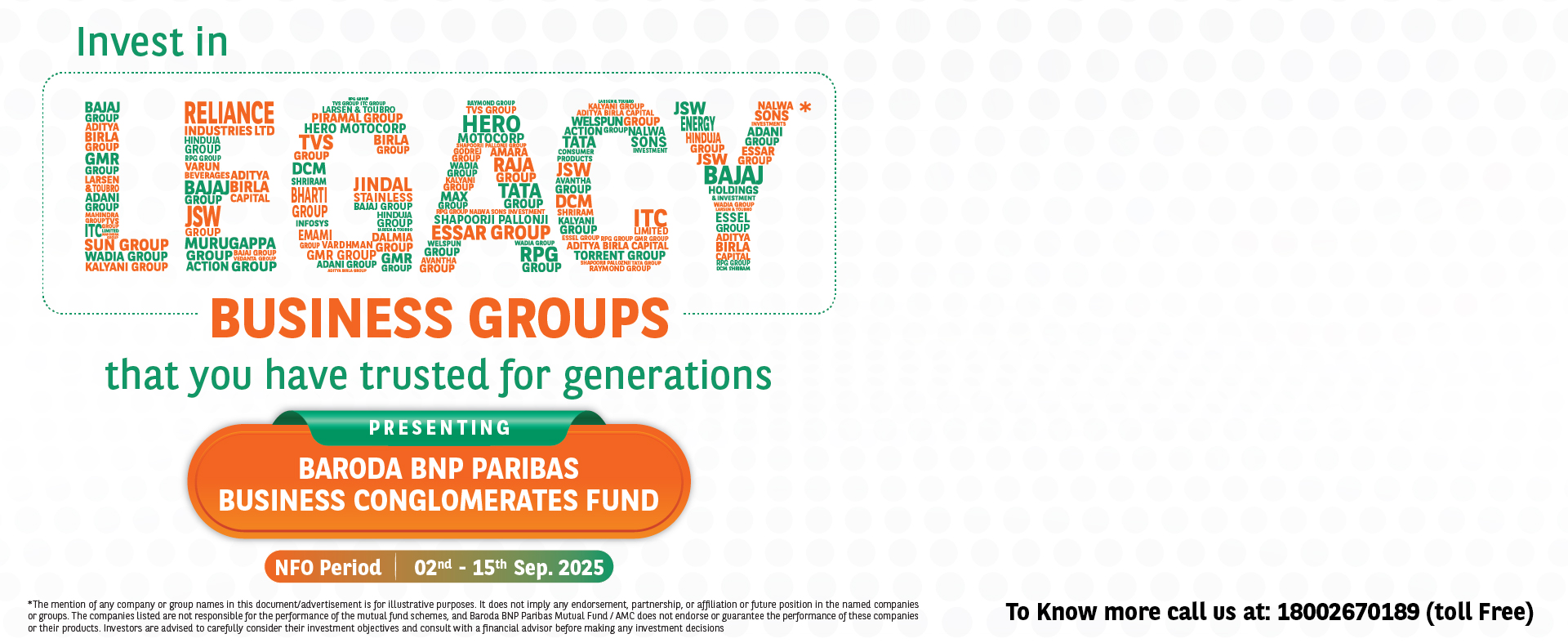

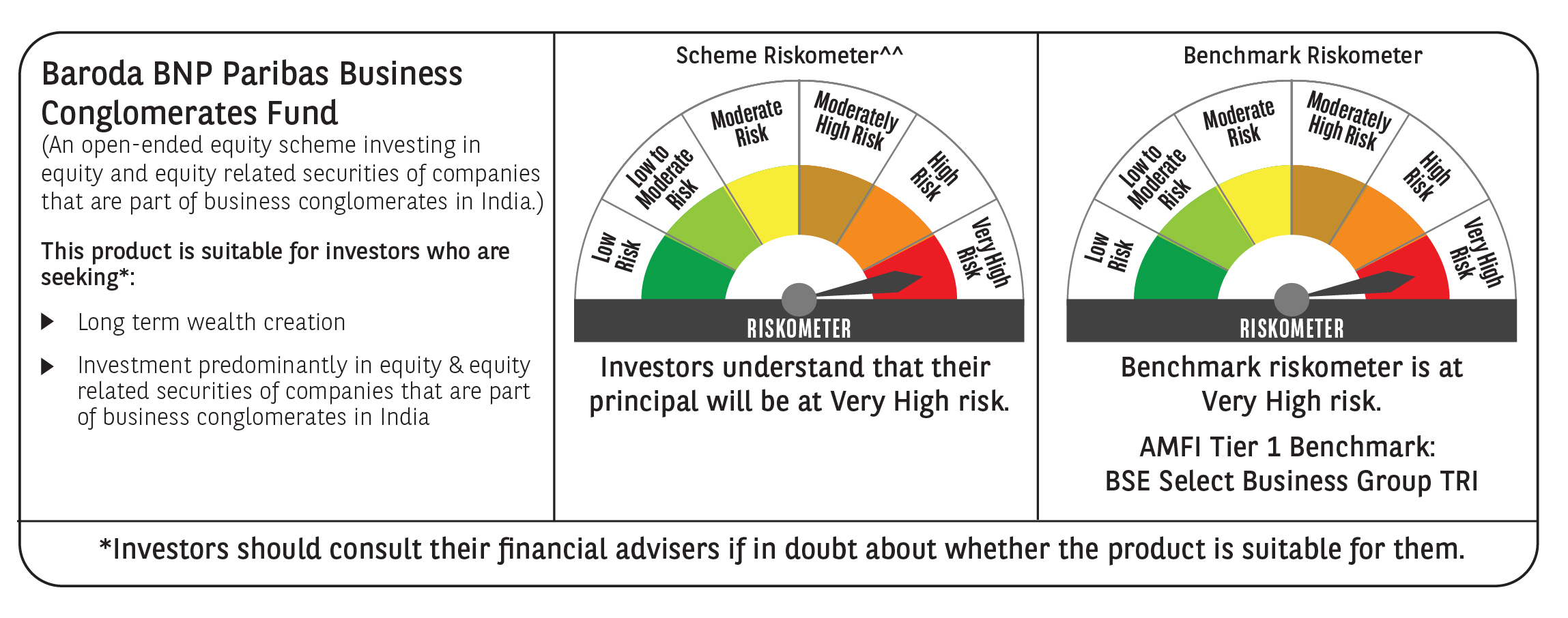

Baroda BNP Paribas Business Conglomerates Fund

Thematic funds are a type of open ended equity Scheme, investing in companies that are focused on a specific theme.

Conglomerates form the backbone of everyday India, with their deep-rooted presence across industries, from energy and infrastructure to consumer goods and technology, shaping the way the nation lives, works, and grows. This broad footprint not only aims to anchor India’s economic resilience but also positions conglomerates as key drivers of innovation, infrastructure, and inclusive growth. Invest in Baroda BNP Paribas Business Conglomerates Fund, designed to tap into multiple growth engines through a diversified investment strategy.

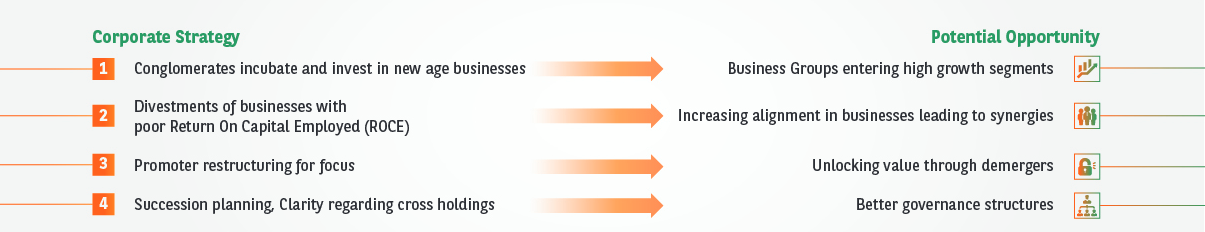

Diversified revenue streams mitigate risk: Presence of a conglomerate across multiple sectors diversifies risk, where potentially profitable mature businesses generate steady cash flows that can offset losses from experimental or high-risk ventures.

Leveraging Legacy: Conglomerates aim to leverage their strong brand reputation and goodwill to empower their subsidiaries, creating a combined effect of trust, credibility, and market access.

Financial firepower to invest in innovative ventures: Indian conglomerates are set to invest nearly $800 billion in growth over the next decade, almost triple their spending in the past ten years. Around 40% of this will flow into emerging sectors like clean energy, semiconductors, EVs, and data centres (S&P Global Report, Oct 2024, latest available data). With their legacy of resilience and long-term vision, conglomerates are uniquely positioned to back sunrise industries with meaningful capital and strategic commitment.

This scheme seeks to provide investors the opportunity to participate in India’s broad-based growth story through investments in companies which are part of conglomerates.

Focused on companies from leading diversified conglomerates.

Invests at least 80% of its net assets in companies that are part of business conglomerates in India. Conglomerates will be identified as groups based in India, led or controlled by promoters, and comprising at least two listed companies in different sectors or industries.

The Scheme will invest in at least four groups, with exposure limited to 25% of the net assets per group.

*The mention of any company or group names in this document/advertisement is for illustrative purposes. It does not imply any endorsement, partnership, or affiliation or future position in the named companies or groups. The companies listed are not responsible for the performance of the mutual fund schemes, and Baroda BNP Paribas Mutual Fund / AMC does not endorse or guarantee the performance of these companies or their products. Investors are advised to carefully consider their investment objectives and consult with a financial advisor before making any investment decisions

Please refer to the SID for details of the investment theme, asset allocation and strategy. This information alone is not sufficient and shouldn’t be used for the development or Implementation strategy.

*Please consult your financial advisor before investing. Kindly read the SID to know in detail. Past performance may or may not be sustained in future

| Scheme Name | Baroda BNP Paribas Business Conglomerates Fund |

| Type of the Scheme | An open-ended equity scheme investing in equity and equity related securities of companies that are part of business conglomerates in India |

| Category | Sectoral / Thematic Fund – Conglomerate Theme |

| Investment Objective | The investment objective of the Scheme is to achieve long term capital appreciation by investing in equity and equity related securities of companies that are part of business conglomerates in India. The Scheme does not guarantee/indicate any returns. However, there can be no assurance that the investment objective of the Scheme will be realized. |

| AMFI Tier 1 Benchmark | BSE Select Business Group TRI |

| Fund Manager | Mr. Jitendra Sriram and Mr. Kushant Arora |

| Load Structure |

The above load shall also be applicable for switches between the schemes of the Fund and all Systematic Investment Plans,

Systematic Transfer Plans, Systematic Withdrawal Plans. No load will be charged on units issued upon re-investment of amount

of distribution under same IDCW option and bonus units. |

| Minimum Application Amount/switch in |

Lumpsum investment: Rs. 1,000 and in multiples of Rs. 1 thereafter. Systematic Investment Plan: (i) Daily, Weekly, Monthly SIP: Rs. 500/- and in multiples of Re. 1/- thereafter (ii) Quarterly SIP: Rs. 1500/- and in multiples of Re. 1/- thereafter. There is no upper limit on the amount for application. The Trustee / AMC reserves the right to change the minimum amount for application and the additional amount for application from time to time in the Scheme and these could be different under different plan(s) / option(s). |

Disclaimers:

In the preparation of this document, Baroda BNP Paribas Asset Management India Ltd. (“AMC”) has used information that is publicly available and developed in-house. The AMC, however, does not warrant the accuracy, reasonableness

and/or completeness of the information. This document may contain statements/opinions/ recommendations, which contain words, such as “expect”, “believe” and similar expressions or variations that are “forward looking statements”.

Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and

political conditions in India and other countries globally, which have an impact on our investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity

prices or other rates or prices, etc. The AMC (including its affiliates), Baroda BNP Paribas Mutual Fund (“Mutual Fund”), its sponsor / trustee and any of its officers, directors, employees, shall not liable for any loss, damage of any nature,

including direct, indirect, punitive, exemplary, consequential, or loss of profit arising from use of this document. The recipient alone shall be fully responsible for decision taken based on this document. All data given in this document is

dated and may or may not be relevant at a future date. Investors are advised to consult their legal/tax/financial advisors to determine possible tax, legal and other financial implication or consequences of investing into the scheme.

Past performance may or may not be sustained in the future and is not a guarantee of future returns.

KIM and Editable Application Form

Click HereSID

Click HereProduct Presentation

Click Hereone pager

Click HereThematic funds are a type of open ended equity Scheme, investing in companies that are focused on a specific theme.

Baroda BNP Paribas Business Conglomerate Fund is an equity oriented thematic fund which invests predominantly in companies belonging to leading diversified conglomerates in India. The investment objective of the Scheme is to achieve long term capital appreciation by investing in equity and equity related securities of companies that are part of business conglomerates in India. The Scheme does not guarantee/indicate any returns. However, there can be no assurance that the investment objective of the Scheme will be realized.

| Stock Name | Weight (%) |

|---|---|

| Reliance Industries Ltd | 22.74 |

| Larsen & Toubro Ltd. | 13.81 |

| Mahindra & Mahindra Ltd. | 9.19 |

| Tata Consultancy services Ltd. | 6.14 |

| Ultratech Cement Ltd. | 4.69 |

| Grasim Industries Ltd. | 3.4 |

| Adani Ports and SEZ Ltd. | 3.28 |

| JSW Steel Ltd. | 3.25 |

| Hindalco Industries Ltd. | 3.19 |

| Tech Mahindra Ltd. | 3.03 |

Source: BSE Indices, Data as on July 31, 2025.

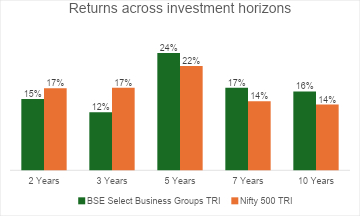

Source: BSE Indices, MFI Explorer, Data as of July 31, 2025. Returns are Compounded Annualized. Past performance may or may not be sustained in future and is not a guarantee of any future returns.

@ For further details, please refer to SID on our website www.barodabnpparibasmf.in

| Type of Instrument | Indicative Allocation (% of total assets) | |

|---|---|---|

| Minimum | Maximum | |

| Equity and equity related^ instruments of companies that are part of business conglomerates# in India | 80 | 100 |

| Equity and equity related^ instruments of companies other than above | 0 | 20 |

| Debt & Money Market instruments* | 0 | 20 |

| Units of Mutual Funds (Domestic Schemes) | 0 | 10 |

| Units issued by REITs & InvITs | 0 | 10 |

# Business conglomerates will be identified as groups based in India, led or controlled by promoters, and comprising at least two listed companies in different sectors or industries.

^The Scheme may invest up to 50% of equity assets in equity derivatives instruments as permitted under the SEBI (Mutual Funds) Regulations, 1996 from time to time. The Scheme may use equity derivatives for such purposes as maybe permitted under the SEBI (Mutual Funds) Regulations, 1996, including but not limited for the purpose of hedging and portfolio balancing, based on the opportunities available and subject to guidelines issued by SEBI from time to time.

*Debt instruments may include securitised debt up to 20% of the debt portfolio of the scheme. Money Market instruments include commercial papers, commercial bills, treasury bills, Government securities having an unexpired maturity up to one year, call or notice money, certificate of deposit, usance bills, and any other like instruments as specified by the Reserve Bank of India from time to time.

For detailed asset allocation, please refer to SID on our website www.barodabnpparibasmf.in

We suggest investors should consult their financial advisor before investing.

This Scheme is suitable for:

We suggest investors should consult their financial advisor before investing. Past performance may or may not be sustained in future and is not a guarantee of future returns.

Given that value creation by conglomerates is a long-term theme, it would be preferable for an investor to stay invested in the fund for upwards of 3 years and seek to reap benefits from the growth in this theme.

We suggest investors should consult their financial advisor before investing.

^^The riskometer assigned is based on internal assessment of the scheme characteristics and the same may vary post NFO, when actual investments are made.

Offer of Units of Rs. 10 each for cash during the New Fund Offer (NFO) and Continuous Offer for Units at NAV based prices

Baroda BNP Paribas Business Conglomerates Fund