As with every investment you make, discipline and regular reviews are critical to help your achieve your goals.

Happy Investing!

This age old proverb that most of us have grown up with has diversification of risk as the focal point.

Some of the most basic and fundamental principles of investing can often be learnt through simple, real life experiences.

Have you ever noticed that shops often sell seemingly unrelated products - such as umbrellas and sunglasses? They may seem odd - when would you buy both of these at the same time? Probably never. And that's the point. When it is raining, it is easier to sell umbrellas but harder to sell sunglasses. And when it's sunny, the reverse is true. By selling both of these, or by diversifying the product line - the shopkeeper reduces the risk of losing money.

Let's say you have a portfolio of Mutual Funds and all of them are tech funds. To some degree, they are all correlated. When the tech bubble blew up in March of 2000, every tech stock went down and so did the tech funds. So if you had that portfolio, your portfolio went down big. Let's say you have a portfolio that has some tech funds, some banking funds, some fast moving consumer goods (FMCG) funds, some real estate, some bond funds, and some cash in it. When the tech bubble bursts, you get hit, but your portfolio does not "blow up." That is the power of diversification at work.

If this approach makes sense, you would already appreciate the benefits of diversification and asset allocation.

Historical market data shows us that asset classes perform differently depending on economic conditions. However, it is very difficult to predict which among the various asset classes will perform in the future. Asset allocation involves dividing an investment portfolio among different asset classes such as mutual funds, stocks, gold, real estate, bonds and cash. The process of determining which mix of assets to hold in your portfolio is unique to each individual.

Asset allocation is the task of identifying how much of your portfolio will be invested in different asset classes and helping you balance the expected returns with a level of risk that is acceptable to you. It should be based on your financial goals, the time horizon in which you wish to achieve them and your risk tolerance level.

Time Horizon

If your goals are long term in nature, you may be comfortable investing in a riskier or more volatile asset class like equities because you can wait out slow economic cycles and the numerous ups and downs of markets. However, if your time horizon is short, you are likely to assume lower risk.

Generally, the younger you are, the more risk you can afford to take. As you grow older, you may be more interested in preserving your capital/savings since a large decline near your retirement may need you to compromise your lifestyle or even make it impossible to retire.

Risk Tolerance

Your ability and willingness to lose some of your principal/savings in the near term in exchange for greater potential returns is called risk tolerance and is a major factor in deciding your asset allocation.

Once you have decided your time horizon and the level of risk you are willing to take, the next step is to identify the investment options that are suitable for you.

The thumb rule used is to subtract your age from 100 to determine the percentage of your investments in equities. If you are 40, you may invest 60% in equities and the rest in bonds and cash.

A smarter way to achieve asset allocation objectives is to use mutual funds. All you have to do is invest in equity funds, bond funds and liquid funds in the desired ratios to achieve diversification among asset classes.

You can even take your asset allocation plan a step further by diversifying among each of the broad asset classes. Mutual funds can also help you here since you have several options within funds in every asset class

| Types of Equity Funds | Types of Debt Funds |

|---|---|

| Large Cap | Bond |

| Mid & Small Cap | Gilt |

| Growth | Balanced Funds |

| Value | Fixed Maturity Plans |

| International | Cash |

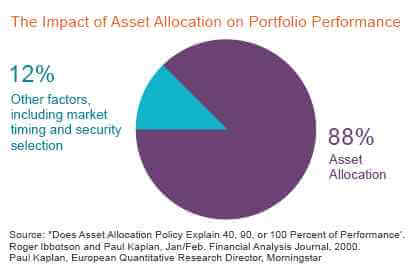

Many financial experts believe that determining your asset allocation is the most important decision that you need to make regarding your investments. Given that it is such an important decision, you may even consider taking professional advice to help you come up with an optimal asset allocation plan.

Research has proven that Asset Allocation is the single largest contributor to portfolio performance. 88% of the portfolio performance can be attributed to the right asset allocation decision.

As with every investment you make, discipline and regular reviews are critical to help your achieve your goals.

Happy Investing!

It is mandatory for all mutual fund investors to undergo a one-time KYC (Know Your Customer) process. For more info on KYC specifically on: the procedure for completing KYC, for changing address details, for changing contact details.

For changing bank details, visit barodabnpparibasmf.in/investor-centre/information-on-kyc

For more info on submitting a complaint or a grievance, visit https://www.barodabnpparibasmf.in/contact-us

Further, investors should ensure that they transact ONLY with SEBI Registered Mutual Funds listed under Intermediaries/Market Infrastructure Institutions on the SEBI website https://www.sebi.gov.in/intermediaries.html

An Investor Awareness Initiative.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.